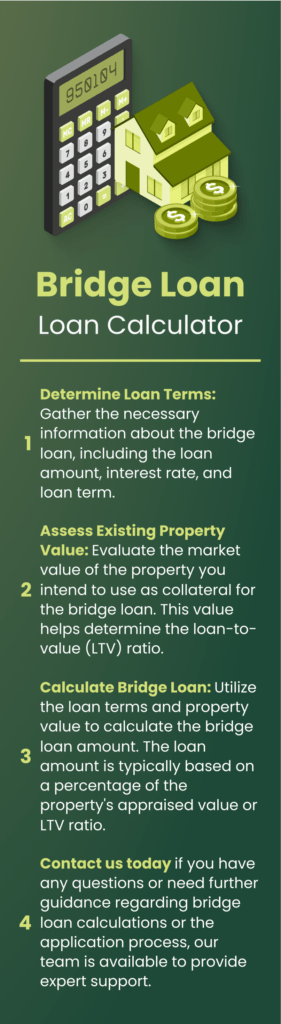

Calculate the bridge loan of your property

--

--

--

--

--

As far as real estate investment goes, bridge loans have emerged as a crucial financial tool for savvy investors seeking lucrative opportunities. It is a short-term financing option that bridges the gap between buying a new property and selling an existing one. Hence, investors can quickly secure funds, facilitate seamless transactions, and capitalize on time-sensitive investments.

Additionally, calculating the right bridge loan terms is paramount. Utilizing a bridge loan calculator allows investors to assess various loan scenarios, including interest rates, repayment periods, and potential costs. This empowers them to make informed decisions and execute successful real estate ventures with confidence.

Using a bridge loan calculator can help real estate investors analyze and optimize their financing options. As such, Fairmont Funding offers a tool to help you assess various aspects of bridge loan financing.

All you need to do is enter the required information about the bridge loan you are considering on the calculator. This involves the property’s purchase price, loan-to-value (LTV) ratio, interest rate, and loan term.

Fairmount Funding’s bridge loan calculator will automatically show how much you need to pay monthly, the cost of the balloon payment, and the total interest to pay. This should give you an insight into the financial implications of applying for a bridge loan.

Remember that while the bridge loan calculator can be a powerful tool, it is still best to consult with financial experts and real estate loan providers. That way, you can fully understand the terms and implications of the bridge loan you are considering.

The formula for computing bridge loans involves several components that determine the loan amount and the financing terms. The basic formula can be expressed as follows:

Bridge Loan Amount = Purchase Price * Loan-to-Value (LTV) Ratio

Let’s break down the components of the formula:

By considering these components and plugging in the relevant values, real estate investors can calculate the loan amount they can secure. They can also assess whether it aligns with their investment goals and financial capabilities.

However, you must keep in mind that each lender may have specific criteria, terms, and requirements for bridge loans. That is why seeking advice from real estate loan providers is essential to making well-informed decisions.

When a property investor applies for a bridge loan, it is essential to plan how to repay it thoroughly. This is where a bridge loan calculator can help them understand the payment structure and terms associated with the loan.

For one, the bridge loan calculator will likely indicate monthly interest payments. These payments are typically interest-only and do not include any principal repayment during the loan term.

This tool will also display the total interest cost incurred throughout the duration of the loan term. Understanding this figure will help investors assess the overall cost of borrowing and factor it into their financial projections. Using the calculator’s results, property investors can determine whether they have a viable repayment plan.

To repay the bridge loan in full, property investors must have a well-defined strategy to cover the principal amount. The most common approach is to use the sale proceeds of an existing property or secure long-term financing, such as a traditional mortgage.

Lastly, investors can experiment with different scenarios on the bridge loan calculator. They can adjust the variables, like the loan term or interest rate, to find the most suitable and manageable repayment plan.

A bridge loan calculator can provide several key results to help borrowers assess the feasibility of obtaining a bridge loan. This includes the estimated loan amount, monthly interest payments, total interest cost, and LTV ratio of the property.

Applying for a bridge loan is appropriate in various real estate scenarios, such as:

Bridge loans and hard money loans differ in various aspects: