For warehouse property financing, Fairmount provides several types of commercial real estate loans depending on your needs. These include conventional commercial mortgage loans, CMBS conduit loans, Small Business Administration (SBA) 7(a) loans or CDC/SBA 504 loans, commercial bridge loans, commercial hard money loans, and mezzanine loans.

We’ve got you completely covered, from funding to talent and more.

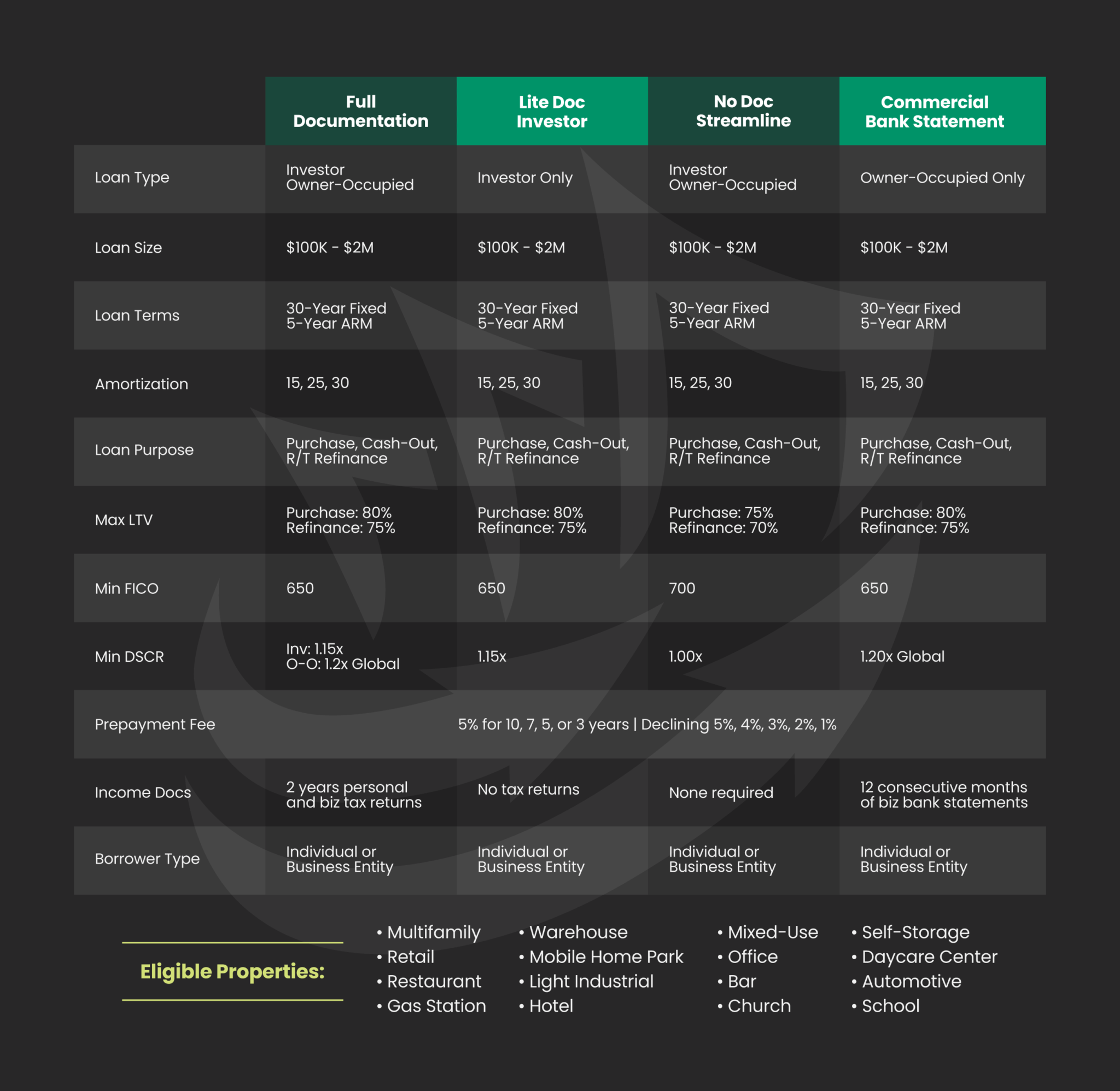

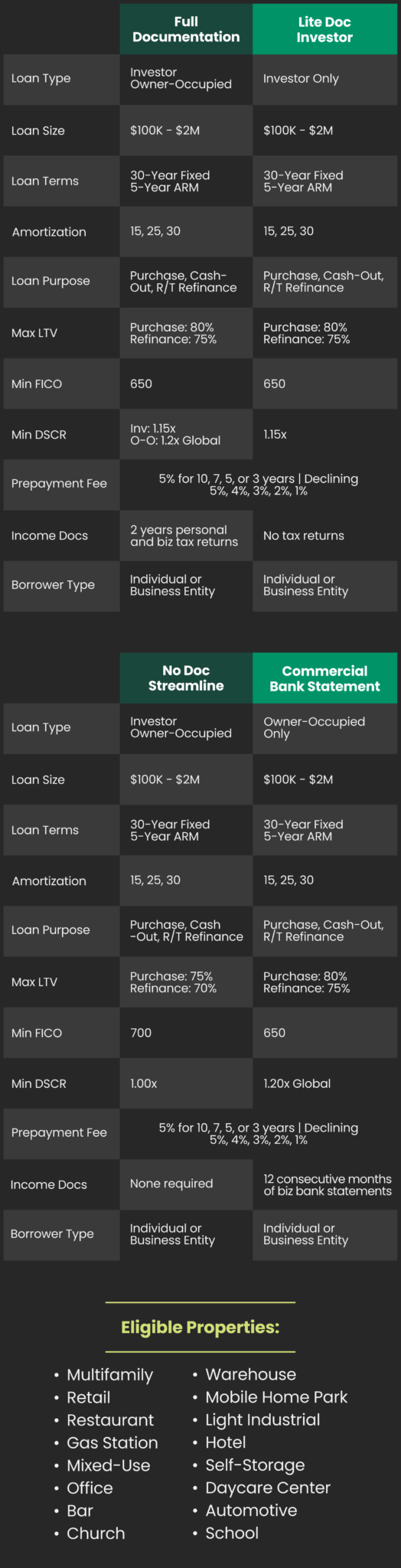

General loan terms for warehouses can be stated as follows, but may vary and depend on the individual case:

Loan Size: $100,000 – $2M

Loan Purpose: Purchase, Cash-Out, R/T Refinance

Loan Term: 5-year ARM, 30-year Fixed

Amortization: 15, 25 and 30-year options

Leverage: 70-80% Max LTV

DSCR: 1.00-1.20 minimum DSCR

Credit Score Requirement: 650 minimum

A commercial bridge loan is an effective financial tool for acquiring or renovating warehouse properties. This type of loan is a short-term financing solution designed to bridge the gap between the immediate need for capital and securing long-term funding. The loan amount is determined by loan-to-value ratios or loan-to-cost ratios, with the warehouse property itself typically serving as collateral.

Commercial bridge loans are particularly useful for purchasing immediate real estate opportunities, covering working capital needs during acquisitions, waiting to qualify for permanent financing, or investing in renovation projects. While traditional lenders such as banks and credit unions might offer competitive rates, their qualification criteria are often strict and funding timelines can be slow. Private lenders like Fairmount, who specialize in commercial real estate, can provide more flexible lending criteria and faster funding timelines.

For warehouse owners seeking a larger amount of commercial property financing, Commercial Real Estate Loans can arrange conduit loans, otherwise known as CMBS loans, for eligible projects. Our typical CMBS loans include:

Loan Size: $2,000,000 and up

Loan Term: 5, 7, or 10 year fixed-rate loans

Interest Rates: 4.9% (for 10 year fixed)

Amortization: 30 years

Leverage: 75% maximum LTV allowance

DSCR: 1.25 minimum

Recourse: Non-recourse (with standard carve-outs)

Another option is the Small Business Administration (SBA) 7(a) loans or CDC/SBA 504 loans, which are often used by small businesses that may not qualify for traditional bank loans. These loans have competitive rates and offer long repayment periods.

SBA 7(a) Loan Program: This is the SBA’s most popular loan program, offering up to $5 million to help small businesses purchase, construct, renovate, or refinance real estate, among other uses. The terms for SBA 7(a) loans can go up to 25 years for real estate. These loans are backed by the SBA, but they are issued by participating lenders, usually banks. The SBA guarantees a portion of the loan, reducing the risk for lenders and helping small businesses secure financing.

CDC/SBA 504 Loan Program: This program is specifically designed for major fixed asset purchases like real estate or machinery. It’s a powerful tool for small businesses looking to purchase, construct, or upgrade their own facilities (like a warehouse). The 504 loans are typically structured with 50% of the project costs provided by a private-sector lender, 40% by a Certified Development Company (CDC), and 10% equity from the small business. The maximum amount that the SBA can contribute is $5 million (or $5.5 million for manufacturing projects or those that meet certain energy efficiency or public policy goals).

Both SBA 7(a) and CDC/SBA 504 loans require that the business owner occupy at least 51% of the property being financed, among other eligibility requirements. They offer competitive interest rates and long repayment terms, making them a viable option for small businesses who may not qualify for traditional bank loans. Always be sure to consult with a professional loan advisor to understand the full details and implications of choosing any loan, and which are the best options available for your business.

Get Your Free Warehouse Loan Quote Today