Yield maintenance plays a key role in determining the financial obligations associated with prepaying a commercial mortgage loan. It is a method that lenders use to compensate for potential losses incurred when a borrower pays off a loan before its scheduled maturity date.

Understanding this loan is essential for real estate investors, developers, and property owners. That is because it enables them to make informed decisions about refinancing or selling their assets.

One valuable tool that aids in comprehending the intricacies of this metric is the yield maintenance calculator. This online resource assists in estimating the potential costs and penalties associated with early loan repayment.

By inputting relevant loan details, the calculator provides users with an approximation of the amount required to maintain the lender’s expected yield. As such, it empowers real estate professionals to weigh the financial implications of different scenarios and make informed choices regarding their investment strategies.

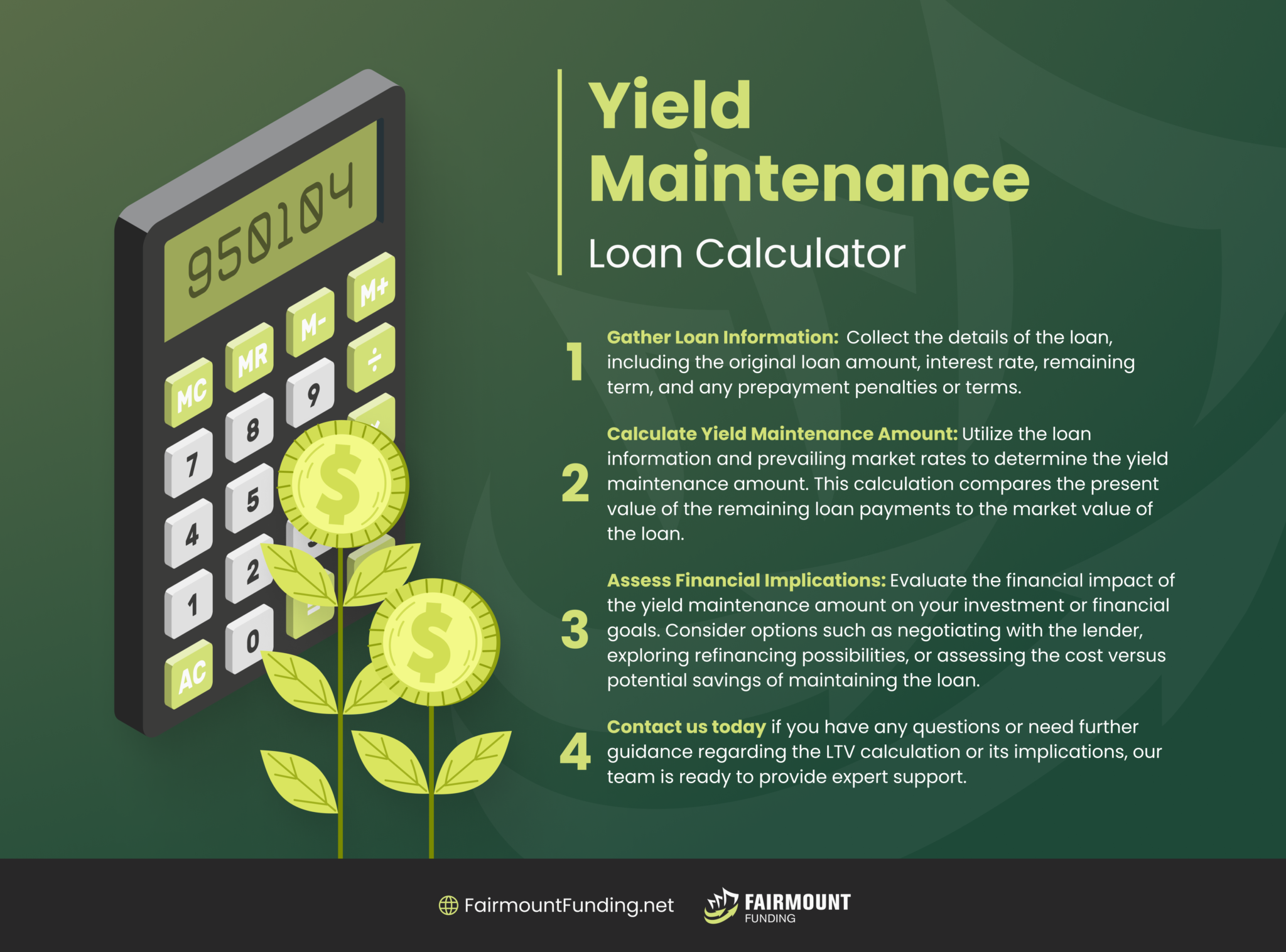

Mastering the concept of yield maintenance and utilizing tools like the yield maintenance calculator are crucial steps in navigating the complex landscape of real estate finance. You can follow these steps to use our yield maintenance calculator effectively:

With a firm grasp of yield maintenance principles, real estate professionals can make strategic decisions that align with their financial goals and optimize their investments. Relatively, the formula for computing yield maintenance in real estate finance is as follows:

Yield Maintenance Amount = Outstanding Loan Balance x (Yield Maintenance Percentage + Interest Rate Differential) x Remaining Term

Let’s break down the different components of the formula:

Yield maintenance is often used when borrowers consider the prepayment of a fixed-rate mortgage loan before its maturity date. However, you should note that this metric depends on various factors and specific circumstances. This includes debt refinancing, selling your property before the loan’s maturity date, and when making a financial analysis and decision-making process.

Meanwhile, using yield maintenance in real estate financing offers several advantages for borrowers, lenders, and investors:

Overall, incorporating yield maintenance calculations into your strategies lets you effectively navigate the complexities of real estate finance.

Using a yield maintenance calculator helps real estate investors and lenders assess the financial implications of prepaying a loan. This enables them to make informed decisions about refinancing or selling the property. That said, it is essential to consider the following factors before using a yield maintenance calculator:

Yield maintenance and defeasance are two methods used in commercial real estate financing to address the prepayment of loans. Yield maintenance deals with the borrower’s prepayment of a penalty to compensate the lender for the loss of expected interest income. Meanwhile, defeasance refers to substituting the original loan collateral with a portfolio of government securities (usually Treasury bonds) that generate cash flows similar to the original loan.

The typical yield maintenance period is equal to the remaining term of the loan. It represents the length of time until the loan reaches its scheduled maturity date.

Yield maintenance provisions are often included in loan agreements to protect lenders from the financial impact of early loan repayment during this remaining term. As the remaining term decreases, the yield maintenance costs typically decrease as well.

The tax implications of yield maintenance can vary depending on the specific jurisdiction and the nature of the transaction. Generally, the penalty or fee associated with yield maintenance may be considered a deductible expense for the borrower. That is because it represents a cost incurred in generating income from the property. However, it is vital to consult with tax professionals or advisors to understand the specific yield maintenance treatment in your jurisdiction.