The loan-to-value (LTV) ratio is a vital metric for real estate investors. That is because it measures the relationship between the amount of a loan and the appraised value of a property. Lenders commonly use the LTV ratio to assess the risk associated with a particular investment.

Understanding the LTV ratio is essential for real estate investors because it directly affects their borrowing power and the terms of their loans. To evaluate potential investments accurately, they often utilize an LTV calculator. This online tool lets them input the property value and loan amount to determine the LTV ratio quickly. Thus, they can assess the level of risk associated with a particular investment and make informed decisions regarding financing options.

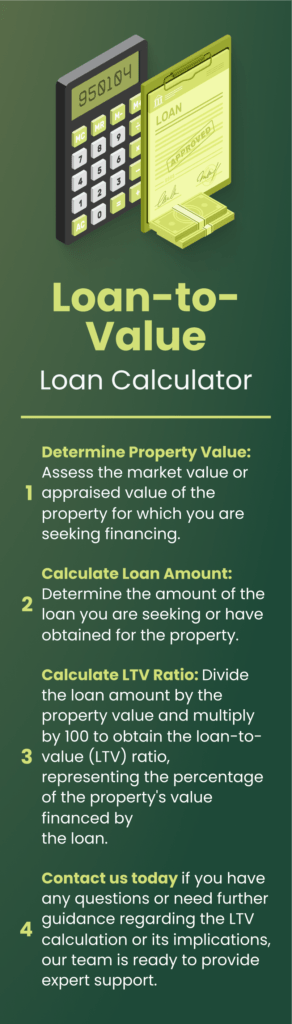

Using an LTV calculator is a simple process that allows real estate investors to quickly determine a property’s loan-to-value ratio.

You can start by plugging in the appraised value of the property into the relevant field in the calculator. The property value indicates the estimated worth of a real estate asset. It is essential to note that this should be the fair market value and not the purchase price or any other estimate.

Next, input the loan amount. This refers to the total amount of money you intend to borrow from a real estate money lender. It is common to apply for a loan when buying a property or refinancing an existing loan. That said, ensure to include any fees or closing costs associated with the loan in this figure.

Once you have entered both the appraised property value and the loan amount, the calculator will automatically calculate the real estate asset’s LTV ratio. The goal is to have an LTV ratio of 80% or less.

You can calculate a property investment’s LTV ratio by dividing the loan amount by its appraised value. The formula for computing the LTV ratio is as follows:

LTV Ratio = (Loan Amount / Appraised Value) * 100

Let’s break down the different components of the formula:

An LTV ratio of 80% means that the loan amount accounts for 80% of the property’s appraised value. A lower LTV ratio suggests a smaller loan amount relative to the property value, resulting in more favorable financing options and interest rates.

On the other hand, a higher LTV ratio implies a more significant loan amount than the property value. This can lead to higher interest rates and potentially stricter lending requirements.

Real estate investors and lenders interpret the result of an LTV ratio calculation to assess the risk associated with a particular investment. That way, they can make informed decisions regarding financing options. The interpretation of the LTV ratio depends on whether you are an investor or a lender:

Investors use the LTV ratio to evaluate the risk associated with a property. A lower LTV ratio implies a smaller loan amount relative to the property’s appraised value. This suggests that the investor has more equity in the property.

This also explains why a lower LTV ratio may result in more favorable financing options, lower interest rates, and potentially higher chances of loan approval. That is because it indicates a lower level of financial risk.

Conversely, a higher LTV ratio implies a larger loan amount compared to the property value. That is because it points out a higher level of leverage and a greater dependency on borrowed funds. This increases the overall risk associated with the investment, leading to higher interest rates, stricter lending requirements, and potentially more risk for the investor.

Lenders interpret the LTV ratio as a measure of risk when considering loan applications. A lower LTV ratio suggests that the borrower has a large equity in the property, reducing the lender’s risk of potential losses.

Lenders may deem borrowers with lower LTV ratios as more financially stable and creditworthy. Thus, they are more likely to offer a loan with favorable terms and lower interest rates.

On the other hand, a higher LTV ratio indicates a more considerable loan amount relative to the property’s appraised value. This suggests that the borrower has less equity in the property, potentially increasing the lender’s risk. Lenders may consider borrowers with higher LTV ratios as higher-risk borrowers. Hence, they may require additional collateral, impose stricter lending criteria, or charge higher interest rates to compensate for the increased risk.

The LTV ratio has a direct impact on mortgage rates. Generally, a higher LTV ratio indicates a higher risk for the lender, as the borrower has less equity in the property. This increased risk often translates into higher interest rates on the mortgage. Lenders may charge a premium to compensate for the additional risk associated with a higher LTV ratio.

A commonly observed threshold is 80%. If the LTV ratio exceeds 80%, it often triggers the requirement for private mortgage insurance (PMI) for conventional loans. This serves as a protection to the lender in case the borrower defaults. As such, borrowers often aim for an LTV ratio below 80% to avoid the additional cost of PMI and to access more favorable loan terms.

There are a few ways to decrease your LTV ratio: