Use our commercial mortgage calculator with attached amortization schedule to determine monthly payments. Just enter your loan amount and interest rate and our calculator will do the rest.

--

--

--

Amortization Schedule | This is an estimate only and should not be used for accounting purposes.

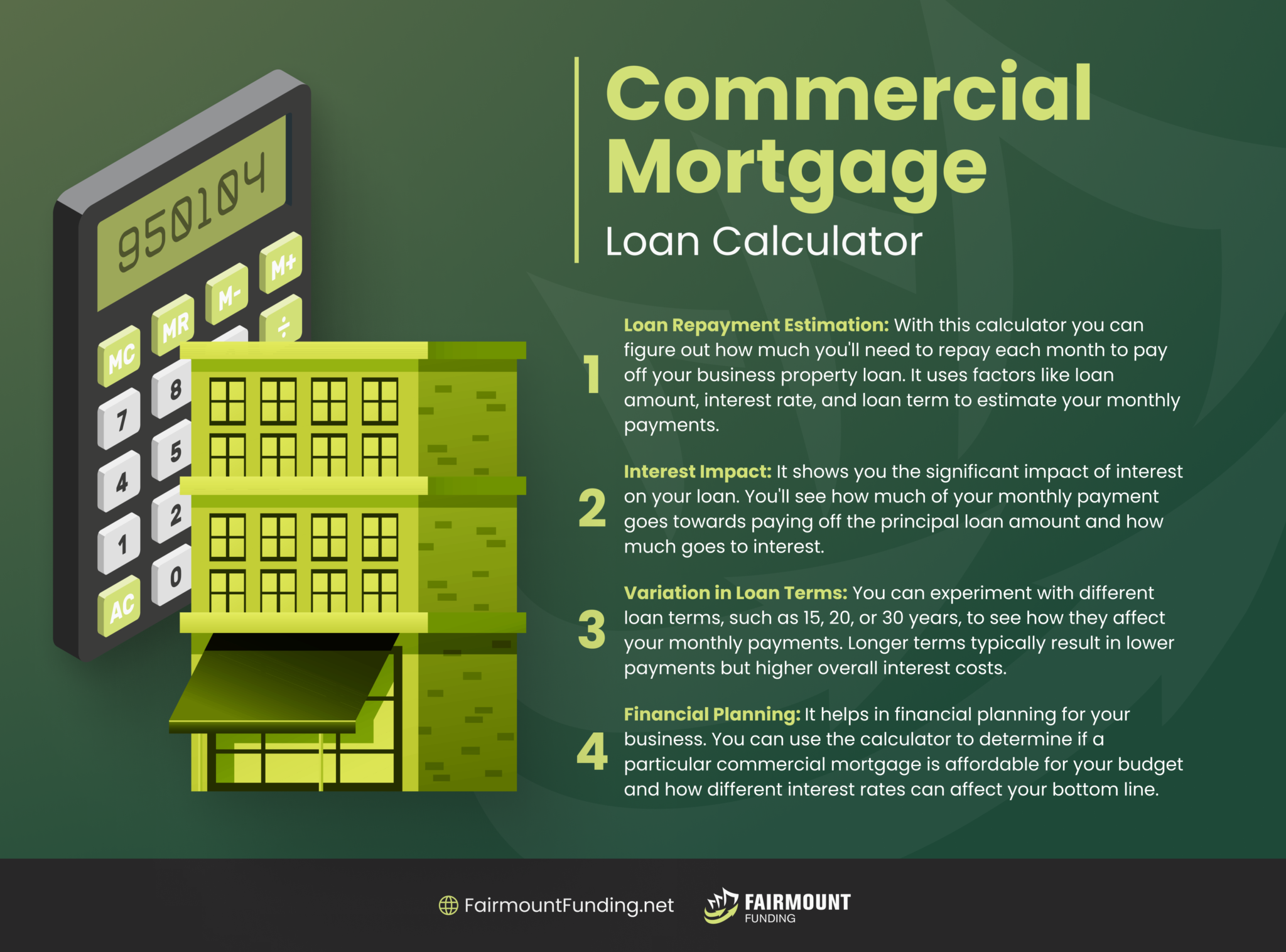

A commercial mortgage calculator is an invaluable tool for both seasoned real estate investors and those new to the commercial property market. Unlike residential mortgages, commercial property loans come with intricate variables, including varying interest rates, amortization periods, and additional criteria that can significantly impact monthly payments and the total cost over the life of the loan. This calculator is designed to navigate these complexities, offering users a clear glimpse into their potential financial commitments.

By inputting essential details like the loan amount, term, and interest rate into Fairmount’s commercial mortgage calculator, investors can obtain a comprehensive overview of their potential monthly payments and overall loan costs. This not only aids in budgeting and forecasting but also allows for comparison between different loan offers. For any investor looking to make informed decisions in the commercial real estate realm, this tool can be a game-changer in ensuring financial viability and success.

Owning a commercial property can be challenging if you need help to pay the mortgage. Fortunately, Fairmount Funding’s commercial mortgage calculator can take the guesswork out and help estimate how much you will need to pay monthly. Here is how it works:

When securing a commercial mortgage, it’s essential to understand that the monthly payment comprises more than just the principal and interest. Unlike residential mortgages, commercial loans often encompass a broader range of costs that can significantly influence the total amount due each month. These costs can vary based on the lender, the property type, and the terms of the agreement.

Speak with our team or fill out an application, we will get back to you ASAP.

A commercial mortgage loan calculator is an indispensable tool that offers potential borrowers a detailed perspective on their forthcoming financial obligations. By entering key variables like the loan amount, interest rate, term, and other associated costs, users gain insight into their monthly payments, allowing them to strategize effectively. Having this foresight enables borrowers to understand the direct impact of their decisions on monthly costs, which is vital for budgeting and financial planning.

One of the primary ways this tool aids in reducing payments is by facilitating scenario analysis. Borrowers can manipulate different parameters, such as down payment amounts or loan durations, to determine the most cost-effective approach for their unique situation. Moreover, by visualizing the direct consequences of various interest rates, borrowers are encouraged to negotiate more aggressively with lenders or to shop around for better terms. In essence, the calculator acts as a strategic guide, steering users towards decisions that optimize their financial outcomes in the commercial real estate sphere.

Speak with our team or fill out an application, we will get back to you ASAP.

A commercial mortgage calculator can help you compare different types of mortgages and loan terms. That way, you can decide which one works best for you. It can also help you figure out how much down payment you should make to afford the monthly payment.

A balloon payment is a large sum due at the end of a loan term, typically covering the remaining principal. It’s common in commercial real estate loans and allows for lower monthly payments during the loan, with a significant payment at the end. To avoid a balloon payment, borrowers can opt for a standard amortizing loan where each payment covers both interest and principal. Alternatively, refinancing the loan before the balloon payment is due can spread out the lump sum over a longer period. It’s also possible to negotiate with lenders or make additional principal payments to reduce or eliminate the balloon payment.

After using a commercial mortgage calculator to get an estimate of your potential monthly payments, it’s essential to consult with a mortgage broker or lender to discuss specific loan terms and get a more detailed quote. They can provide insights into additional costs, fees, and interest rate options that might affect your payment. Furthermore, gathering your financial documents and assessing the property’s value and profitability will better prepare you for the formal loan application process.