Are you looking to invest in a mobile home park but don’t have the necessary funds? Fairmount Funding is here to help you. With our flexible mobile home park financing options, you can now own a lucrative piece of real estate that promises steady cash flow and an excellent return on investment. We understand mobile home park investments and have tailored lending services to meet your specific needs.

We’ve got you completely covered, from funding to talent and more.

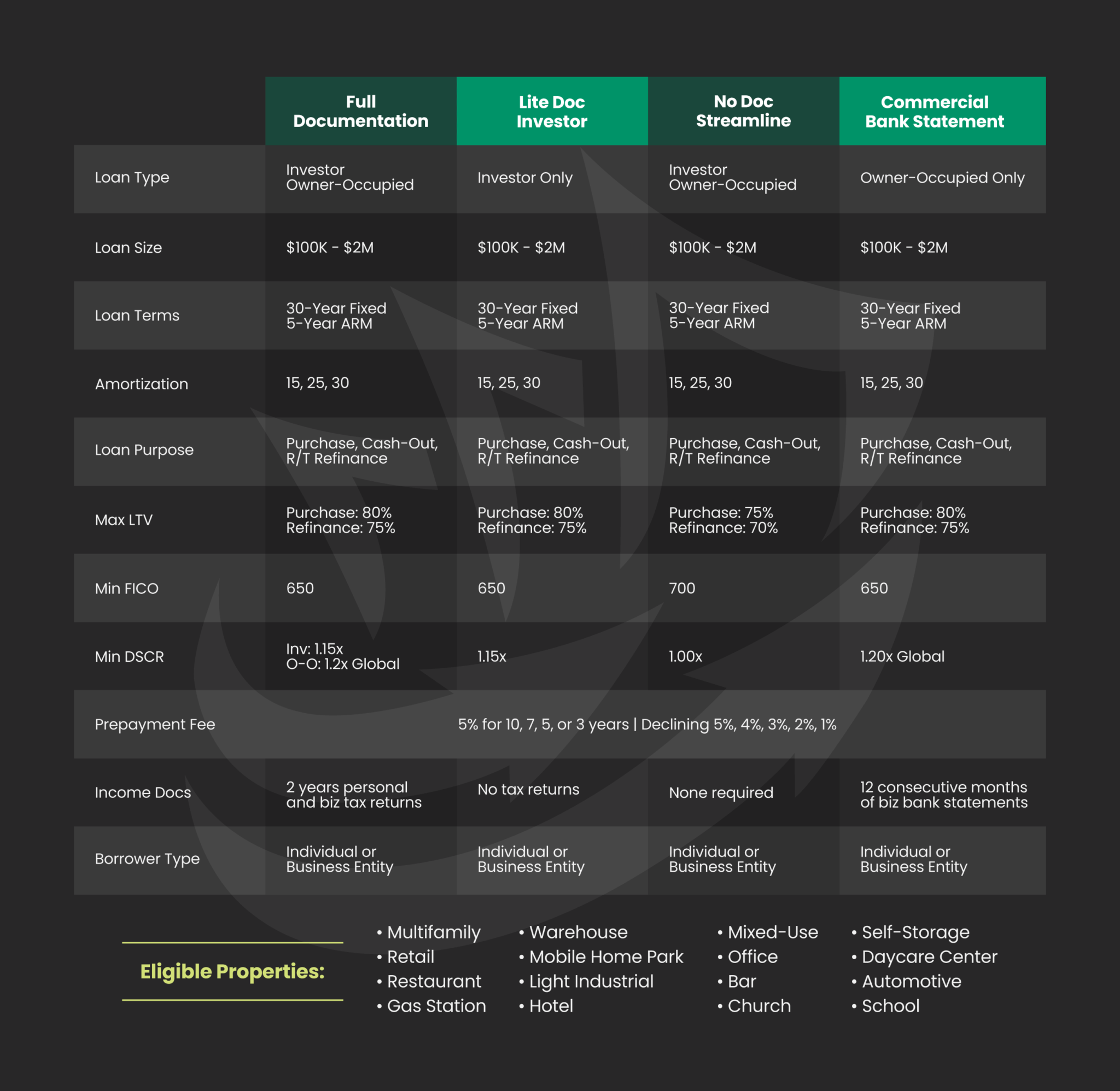

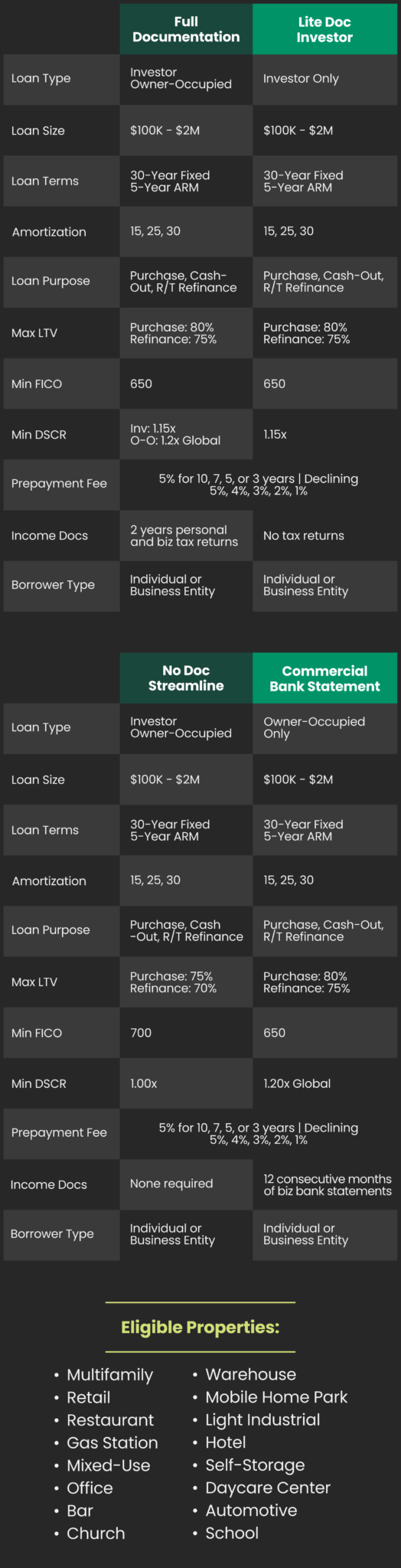

General loan terms for mobile home parks can be stated as follows, but may vary and depend on the individual case:

Loan Size: $100,000 – $2M

Loan Purpose: Purchase, Cash-Out, R/T Refinance

Loan Term: 5-year ARM, 30-year Fixed

Amortization: 15, 25 and 30-year options

Leverage: 70-80% Max LTV

DSCR: 1.00-1.20 minimum DSCR

Credit Score Requirement: 650 minimum

Investing in mobile home parks offers an avenue of consistent cash flow, lower risk, and increased demand. With an estimated 20 million Americans calling mobile parks home, the demand for affordable, community-oriented housing isn’t slowing down.

Customized Financing Solutions: We don’t believe in one-size-fits-all. That’s why we offer customized financing solutions that align with your financial situation and investment goals.

Competitive Interest Rates: Our interest rates are some of the most competitive in the market. You can rest assured that your investment won’t be burdened with exorbitant costs.

Expert Guidance: Our team of experienced professionals is here to guide you through every step of the process, ensuring a smooth and hassle-free experience.

Fast Approvals: Don’t let lengthy approval processes slow you down. With our quick and efficient service, you can get the financing you need in no time.

Mobile home parks offer a hedge against market downturns, keeping your investment safe even when other sectors falter. Moreover, the sector’s steady growth offers the potential for attractive returns, securing your financial future.

With our swift approval process, your dream of owning a mobile home park and earning passive income is just a step away. Whether you are a first-time homebuyer or a seasoned investor, our services have got you covered.

Investing in mobile home parks can be a lucrative business opportunity. However, securing financing requires meeting certain criteria. Here are some common requirements for mobile home park financing:

Credit Score: Lenders typically require a good credit score, often 680 or higher, to approve a loan. This score indicates your creditworthiness and ability to repay the loan.

Down Payment: You should be prepared to make a significant down payment, typically between 20% to 30% of the property’s purchase price. Some lenders may require more depending on the property and your financial situation.

Net Worth and Liquidity: Lenders usually require borrowers to have a net worth equal to or greater than the loan amount and post-closing liquidity (cash reserves) of about 10-20% of the loan amount.

Experience: Many lenders prefer borrowers with prior experience in owning or managing similar types of properties. This is not a hard and fast rule, but it can make obtaining financing easier.

Property Condition and Occupancy Rate: The condition of the mobile home park and its occupancy rates can significantly influence your financing options. Lenders tend to favor parks that are well-maintained and have high occupancy rates.

Loan Purpose: The loan’s purpose, whether it is for acquisition, refinance, or improvement, can impact the terms, rates, and approval process.

Financial Documentation: Be ready to provide financial documentation, such as personal and business tax returns, a detailed business plan, and a rent roll for the park.

Appraisal: An appraisal will likely be required to determine the property’s value and the loan amount that the lender is willing to offer.

We are committed to making your dream of owning a mobile home park a reality. With our expert guidance and tailored financing solutions, we empower you to invest in your future. Don’t wait to capitalize on this incredible opportunity.

Invest in mobile home parks today and open the door to a secure, prosperous future.