Calculate Net Operating Income (NOI) using our calculator.

--

The higher the net operating income is compared to the property price, the easier it is to find financing.

Property investors can use net operating income (NOI) to make informed decisions and assess the financial viability of potential real estate opportunities. NOI is an important metric that represents the property’s revenue after subtracting operating expenses, debt service, and income taxes. It provides a clear picture of the property’s profitability and cash flow potential.

Investors can use an NOI calculator to simplify computing a property’s net operating income. It can also help them quickly and efficiently assess a property’s financial performance. This allows investors to compare and evaluate various investment opportunities, determine potential returns, and make well-informed decisions based on the property’s income-generating potential.

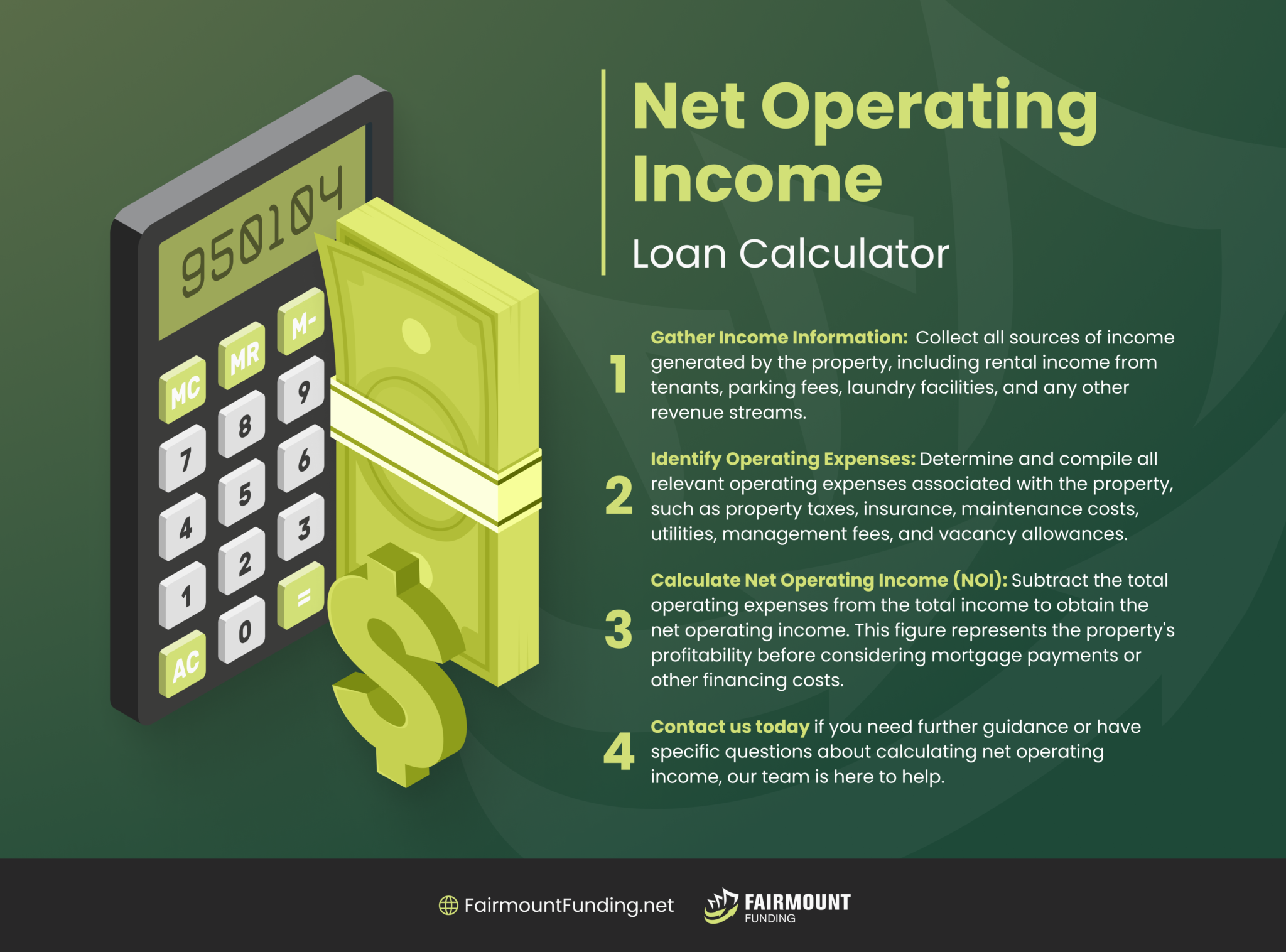

Utilizing an NOI calculator is a straightforward and efficient way for property investors to evaluate the net operating income of a potential investment property. All you need to do is input the amount of revenue you earned from a specific property and how much you spent on operating expenses. Following a few simple steps can give investors valuable insights into the property’s financial performance.

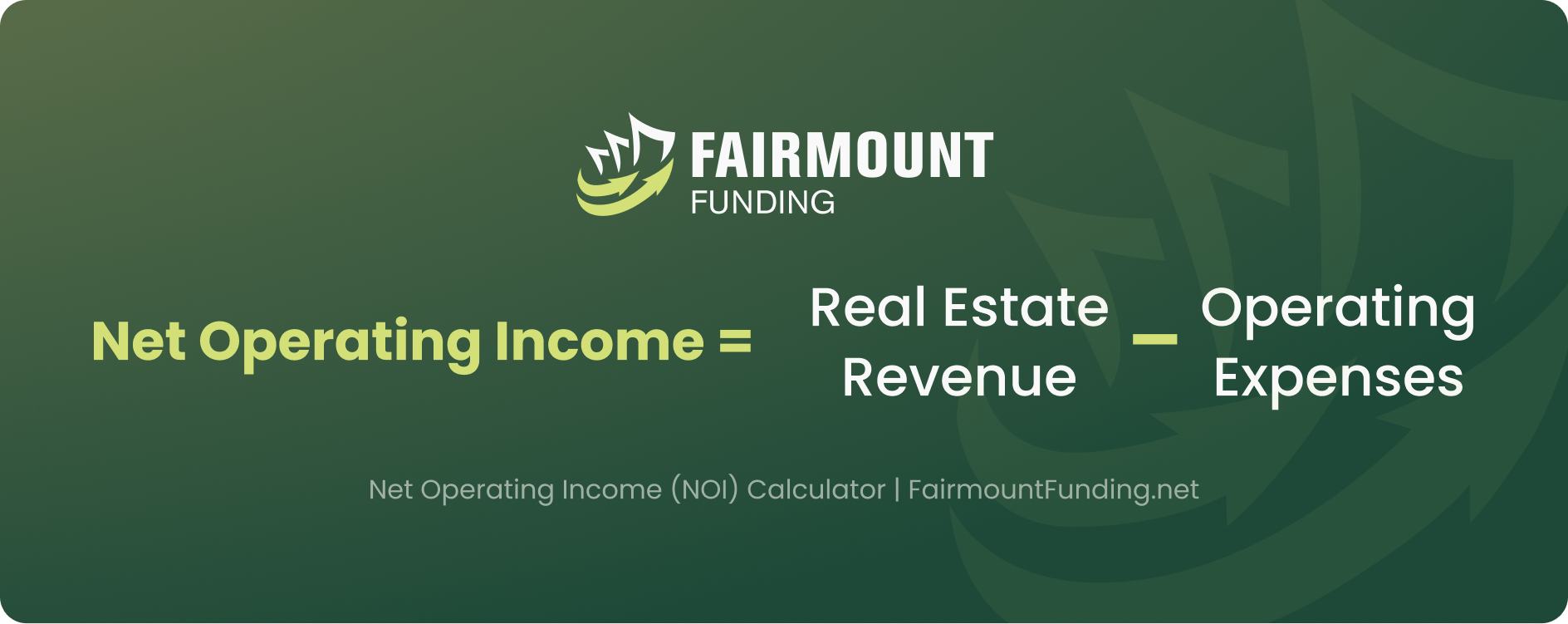

The NOI formula calculates a property’s income potential by subtracting its operating expenses. The formula is as follows:

NOI = Real Estate Revenue – Operating Expenses

Let’s break down the different components of the NOI formula:

By subtracting the total operating expenses from the total income, the net NOI is derived. This indicates the property’s profitability and cash flow potential, excluding factors such as debt service and income taxes. Understanding the components of the NOI formula allows property investors to analyze the financial performance of an investment property.

Lenders use debt yield to understand how long it would take for them to recoup their investment if they had to take possession of a property after a loan default.

The NOI formula calculates a property’s income potential by subtracting its operating expenses. The formula is as follows:

Click here to use our Debt Yield Calculator.

Calculating a property’s NOI can be helpful to real estate investors and money lenders. However, the NOI formula also has its flaws. Let’s explore the pros and cons of calculating NOI:

Advantages of Calculating NOI:

Disadvantages of Calculating NOI:

Net operating income (NOI) and gross operating income (GOI) are essential financial metrics used in real estate analysis, but they differ in scope and components. GOI represents the total income generated by a property before deducting any operating expenses, while NOI reflects the income remaining after subtracting operating expenses from the GOI.

The determination of a good NOI percentage depends on various factors, including the property type, location, market conditions, and individual investment goals. A higher NOI percentage generally indicates a more favorable financial performance, but what is considered “good” can vary across different markets and investment strategies. Investors should compare NOI percentages within the specific market they are operating in to assess what would be considered favorable based on local benchmarks and their investment objectives.

Calculating NOI is an essential step in determining the capitalization rate (cap rate), which is a measure of the property’s potential return on investment. You can compute the cap rate by dividing the property’s NOI by its market value or purchase price.

By using NOI to determine a property’s cap rate, investors can assess its income-generating potential relative to its value. Thus, they can make comparisons to other investment opportunities. A higher cap rate generally indicates a higher potential return but may also entail higher risk, while a lower cap rate suggests lower potential returns but potentially lower risk.