There are multiple options for securing funding for commercial real estate, such as gas stations, including bank loans and SBA loans. These financing methods provide high loan-to-value ratios, up to 90%, and long-term amortization periods, extending up to 30 years.

We’ve got you completely covered, from funding to talent and more.

Gas stations, often overlooked, are integral to the American economy and the rhythm of daily life. Without them, the commerce and transportation sectors would face significant challenges, disrupting the flow of goods and services across the nation. Fairmount Funding can provide the lending solutions gas stations need to thrive, whether it’s for refinance or a new purchase, contact us today to discuss your case.

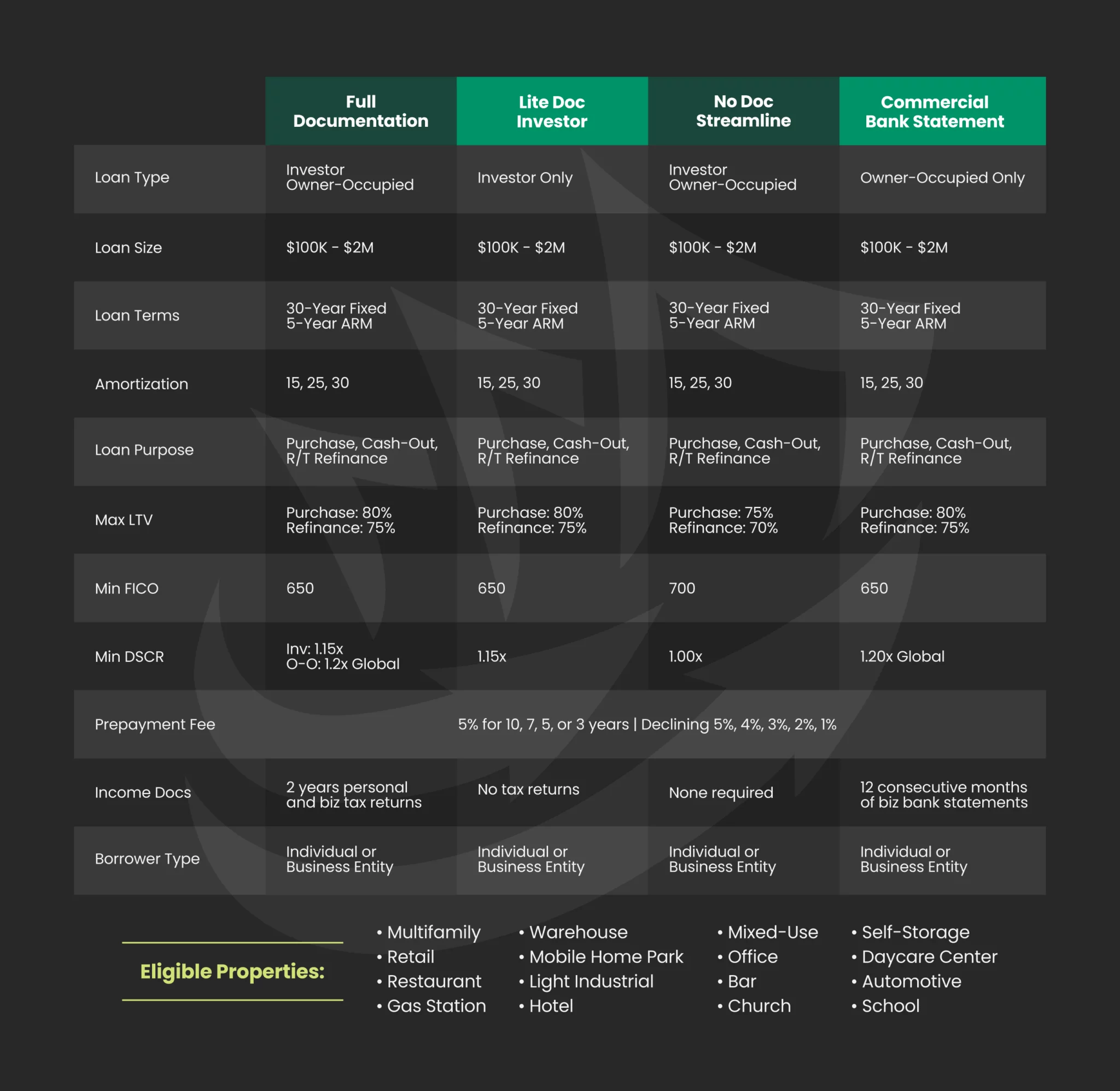

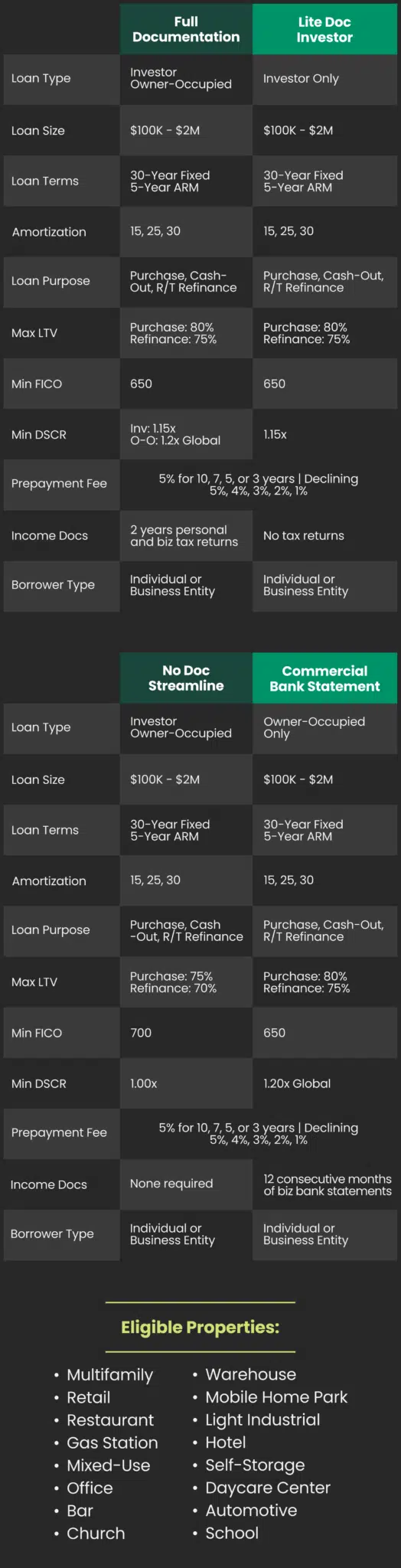

General loan terms for gas stations can be stated as follows, but may vary and depend on the individual case:

Loan Size: $100,000 – $2M

Loan Purpose: Purchase, Cash-Out, R/T Refinance

Loan Term: 5-year ARM, 30-year Fixed

Amortization: 15, 25 and 30-year options

Leverage: 70-80% Max LTV

DSCR: 1.00-1.20 minimum DSCR

Credit Score Requirement: 650 minimum