Mixed-use loans are a type of real estate loan typically used to finance properties that have multiple purposes. These properties combine residential, commercial, or industrial uses within the same structure or on the same piece of land. For example, a building with retail shops on the ground floor and apartments above would be considered a mixed-use property.

The uses of mixed-use loans can be quite diverse. They are often used to purchase, refinance, or construct mixed-use properties. Businesses or individuals might use these loans to acquire a mixed-use property as a form of investment, to generate income through rents, or to establish a business presence while also having a residential space. They can also be used to improve or renovate an existing mixed-use property. The exact use will depend on the borrower’s needs and objectives.

We’ve got you completely covered, from funding to talent and more.

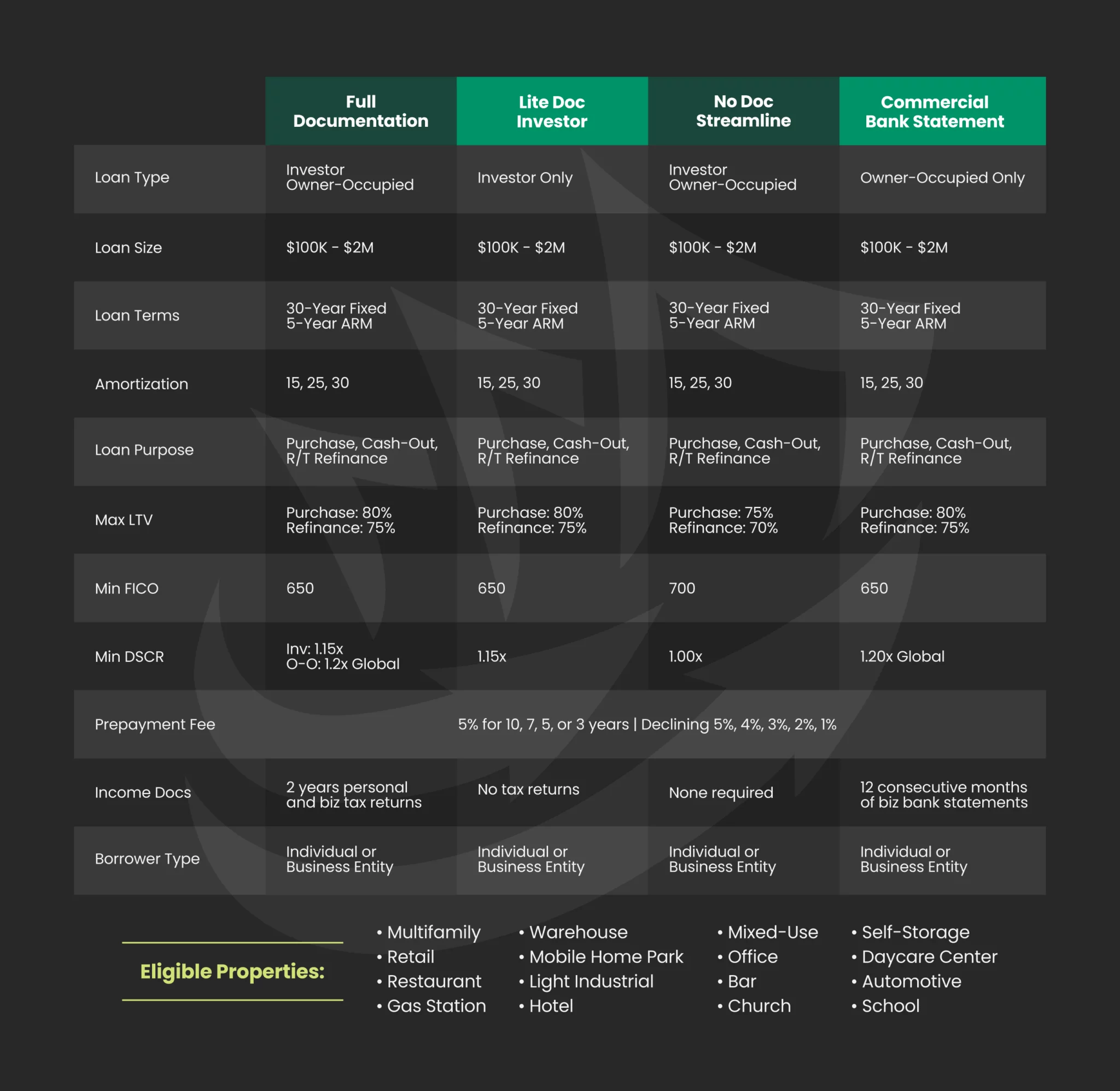

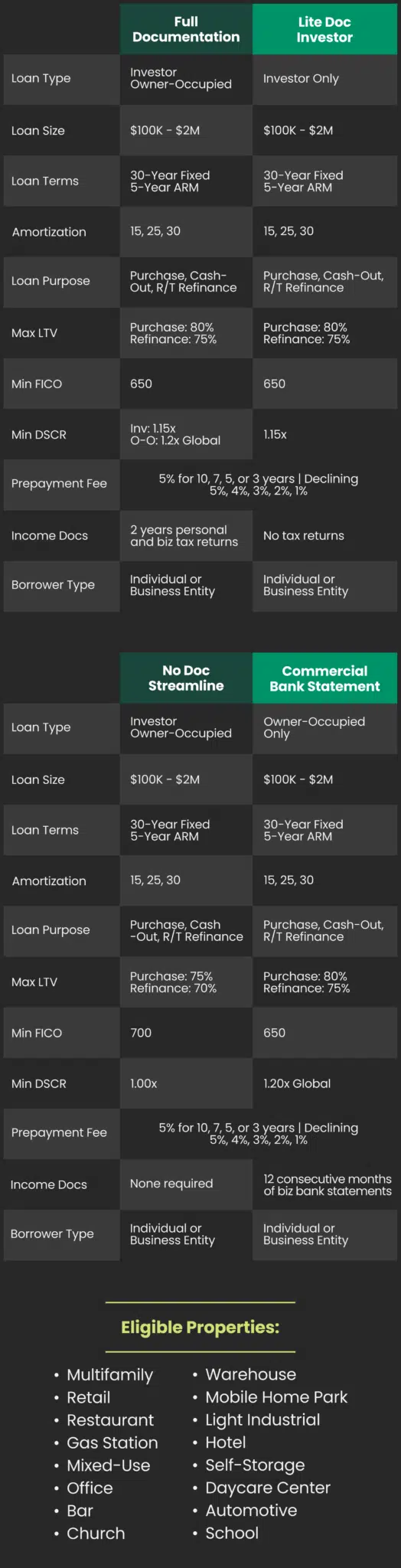

General loan terms for mixed-use can be stated as follows, but may vary and depend on the individual case:

Loan Size: $100,000 – $2M

Loan Purpose: Purchase, Cash-Out, R/T Refinance

Loan Term: 5-year ARM, 30-year Fixed

Amortization: 15, 25 and 30-year options

Leverage: 70-80% Max LTV

DSCR: 1.00-1.20 minimum DSCR

Credit Score Requirement: 650 minimum