The higher the cap rate, the higher the risk

— but also the higher your potential return. Calculate your cap rates with our calculator.

The capitalization rate is used to measure a real estate asset’s potential return on investment. Property investors also use the cap rate to compare the relative value of similar real estate investments in the market.

There are many ways to compute a property investment’s cap rate. At Fairmount Funding, we consider the property’s market value and net operating income in our cap rate calculator. Nonetheless, you can use other metrics in determining a real estate asset’s strength. That is because the cap rate excludes several factors, such as future cash flow from property improvements, from the equation.

Capitalization Rate = Net Operating Income ÷ Current Market Value

Real estate investors and real estate money lenders use cap rates to assess a property’s profitability and return potential. You can calculate it by dividing a property’s net operating income (NOI) by the current price in the market.

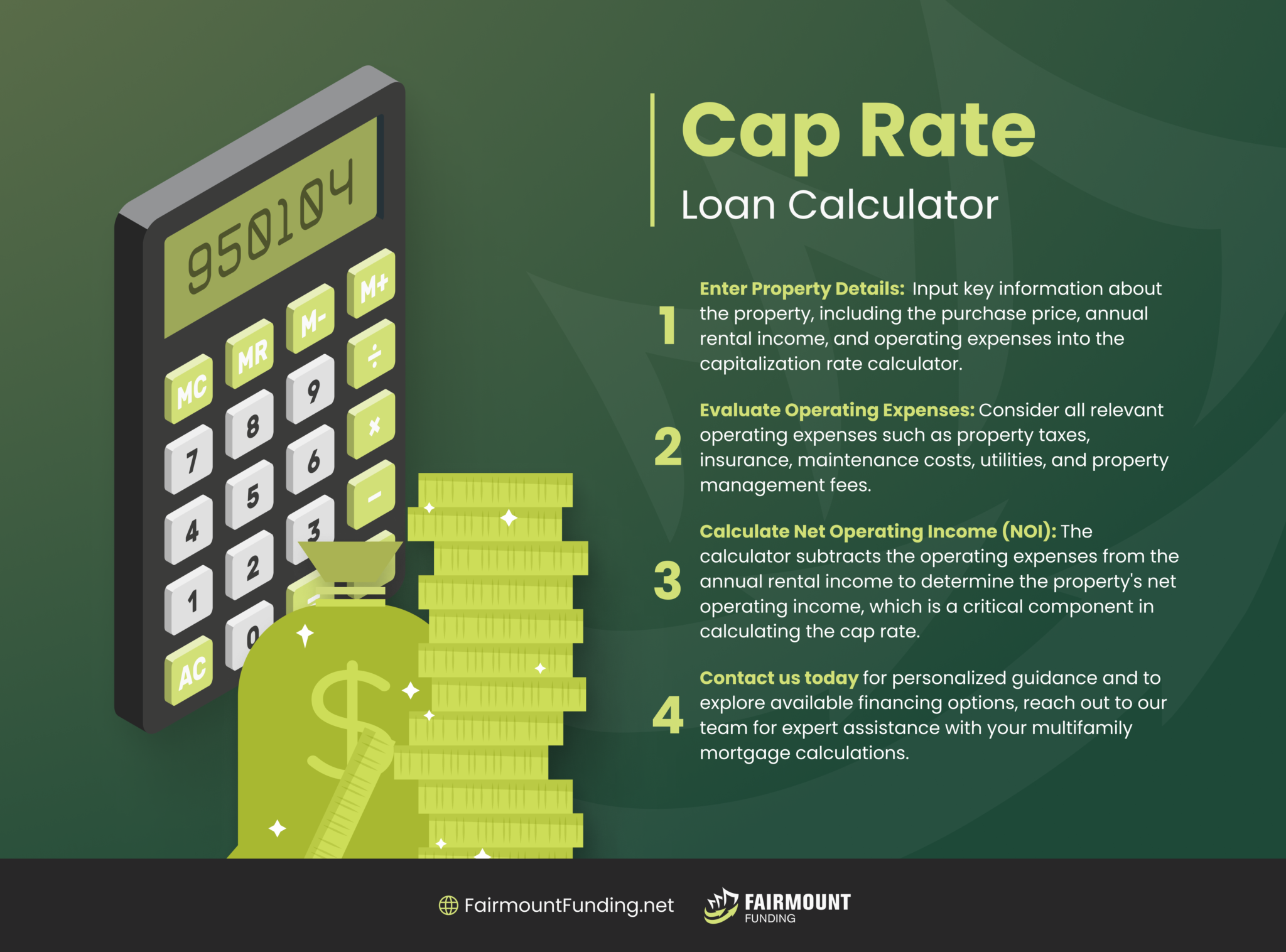

Fortunately, you can use our cap rate calculator, so you do not have to manually crunch the number. All you need to do is input the following:

The cap rate signifies the time required to recoup the invested amount in a property. For example, a property with a cap rate of 10% would take approximately ten years to recover the investment.

Meanwhile, an examination of the formula reveals that properties generating higher net operating income and having a lower valuation will yield a higher cap rate and vice versa.

Consider two similar properties that differ only in their locations. One is located in an upscale city center area, while the other is on the city’s outskirts. Assuming all other factors are equal, the first property will generate higher rental income than the second property.

However, the rental from the first property will be partially offset by higher maintenance costs and taxes. Due to its significantly higher market value, the city center property will have a relatively lower cap rate than the second property.

This indicates that a lower cap rate corresponds to a more favorable valuation and better potential returns with a lower level of risk. Conversely, a higher cap rate suggests relatively lower prospects of return on property investment and, therefore, a higher level of risk.

The cap rate is used to make informed property investment decisions. However, it is crucial to understand that numerous factors can influence your cap rate calculation:

Real estate investors often use cap rates when assessing the risk associated with purchasing various properties. However, it has limitations when used to inform other real estate investment choices.

If you intend to use the cap rate to evaluate prospective properties, keep in mind that numerous tools are available to assist you. You can also leverage alternative metrics to gauge risk levels and the potential returns of an investment rental property.

There is no rule that determines an ideal cap rate. Nonetheless, a higher cap rate generally indicates a higher potential return but may also come with increased risk. Conversely, a lower cap rate suggests lower potential returns but may be associated with lower risk. Determining what is a good cap rate depends on factors like location, property type, and market conditions.

Whether a cap rate calculator is accurate will depend on the data input and the assumptions made. You can use Fairmount Funding’s cap rate calculator to estimate the cap rate of a property based on the provided information. That said, it is essential to note that this metric relies on projected or historical data and may not capture all the nuances of a specific property or market.

Capitalization rate and return on investment (ROI) are related but differ in their focus. The cap rate shows the relationship between a property’s NOI and its current market value. It provides an estimate of the property’s potential return on investment based on its income-generating capacity and prevailing market conditions.

On the other hand, ROI is a broader measure that considers the total return generated from an investment relative to the initial investment cost. It considers factors like property appreciation, cash flow, financing costs, and holding period.