Restaurant property loans are a type of financing aimed at aiding restaurant owners in acquiring or refinancing commercial real estate. Fairmount, in addition to other various lending institutions such as banks, credit unions, non-bank lenders, and private lenders provide these types of loans.

Loans such as these typically cater to various needs such as startups, construction, refinancing, property acquisition, and remodeling of the restaurant properties. Fairmount provides easy and fair funding for restaurant businesses which a demonstrated record of success. Funding includes SBA loans, conventional loans, and conduit loans (CMBS loans). The loan sizes typically start at $500,000, with conduit loans offered for larger commercial property financing starting at $2,000,000.

We’ve got you completely covered, from funding to talent and more.

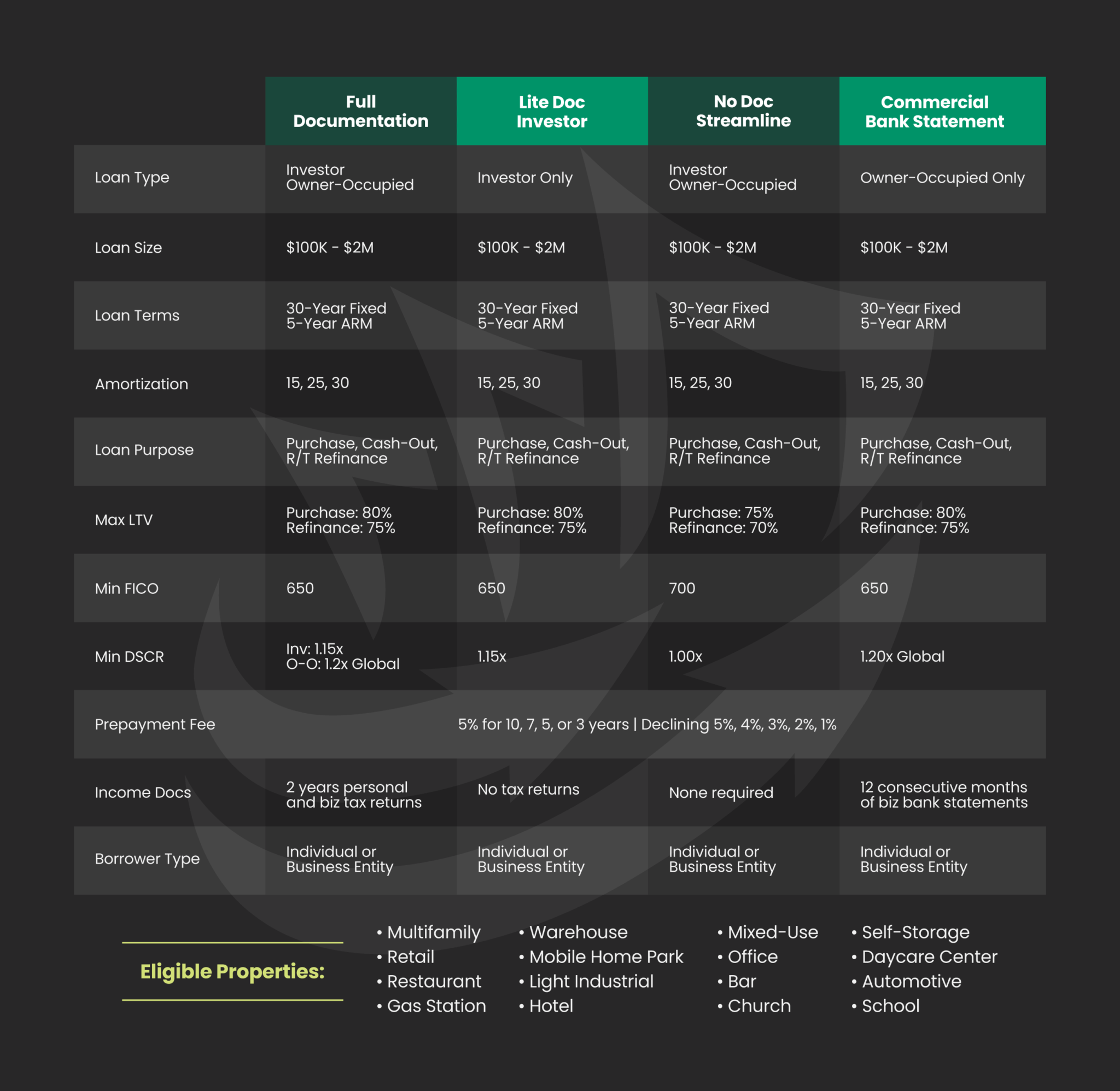

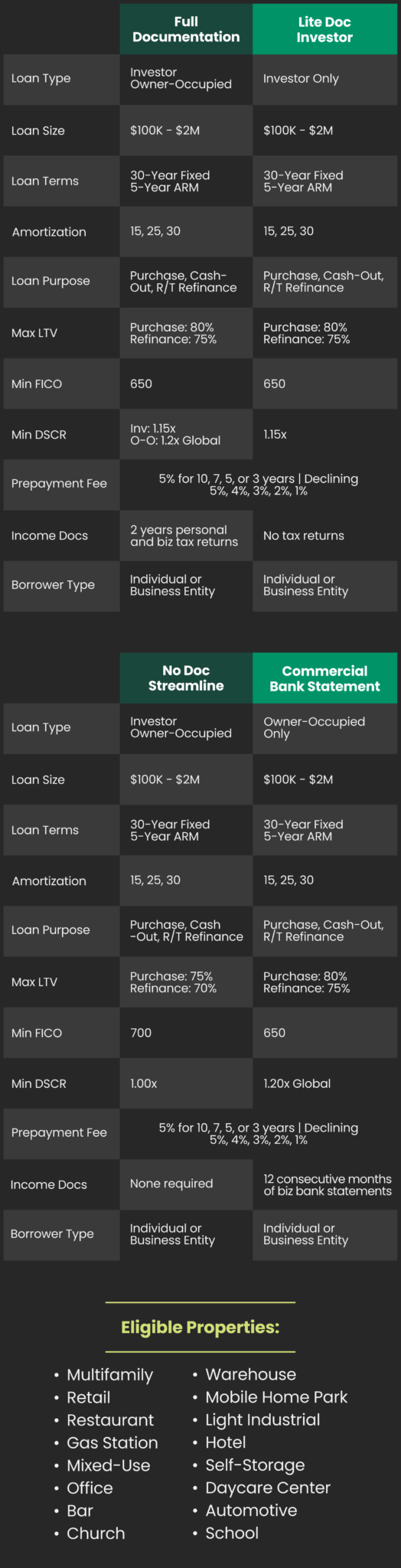

General loan terms for restaurants can be stated as follows, but may vary and depend on the individual case:

Loan Size: $100,000 – $2M

Loan Purpose: Purchase, Cash-Out, R/T Refinance

Loan Term: 5-year ARM, 30-year Fixed

Amortization: 15, 25 and 30-year options

Leverage: 70-80% Max LTV

DSCR: 1.00-1.20 minimum DSCR

Credit Score Requirement: 650 minimum

The Small Business Administration (SBA) offers two main types of loans for restaurants: SBA 7(a) loans and SBA 504 loans. SBA 7(a) loans are particularly popular among restaurant owners as they can be used to cover various expenses such as real estate, working capital, and equipment. These loans are also considered to be versatile and can be tailored to meet the specific needs of your business.

The SBA can provide funding up to $5 million per location, however, the total amount must not exceed $10 million for the applicant and any affiliated businesses. To qualify for an SBA loan, you need to have good credit, sufficient collateral, and be willing to wait while your loan application gets processed.

Commercial Mortgage Backed Securities (CMBS) loans, also known as Conduit loans, are another financing option for restaurant owners looking to refinance or purchase their properties. These loans range from $1 million to over $50 million, with typical terms lasting between 5 to 10 years and a 30-year amortization schedule. One of the major advantages of CMBS loans is their non-recourse nature, meaning in the event of default, the lender can only seize the property.