--

A DSCR greater than 1.25 is considered optimal

The Debt Service Coverage Ratio (DSCR) is a vital metric for real estate investors when assessing the financial viability of a property. It provides a clear picture of a property’s ability to make enough income to cover its debt obligations.

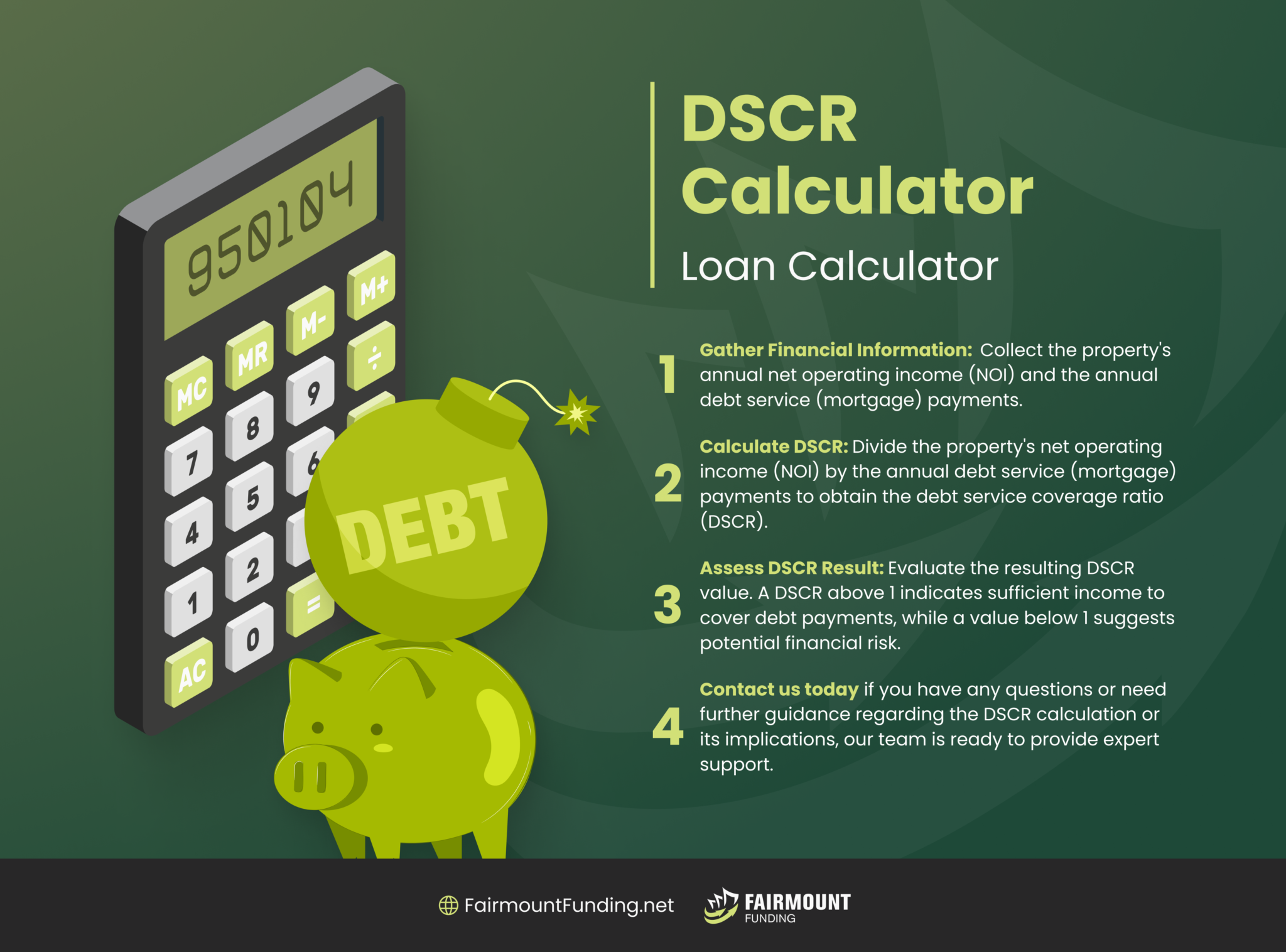

You can calculate the DSCR by dividing the property’s net operating income (NOI) by its debt service. Meanwhile, real estate investors can utilize a DSCR calculator to evaluate different scenarios, like changes in rental income, interest rates, or operating expenses, enabling them to make informed decisions about possible investments.

By carefully analyzing the DSCR, real estate investors can gain insight into the financial health and risk associated with an investment property.

Using a DSCR calculator effectively is a straightforward way for property investors to evaluate whether the property can generate consistent income to meet its debt obligations. You can do this by plugging in the financial information about the property into the calculator.

The result should give you an idea of the property’s potential profitability and long-term sustainability. A DSCR of more than 1 indicates that the property’s cash flow is sufficient to cover its debt payments, providing a safety net for the investor. In relation to this, real estate money lenders often require a minimum DSCR of 1.2 before granting financing to ensure a healthy margin of safety.

The DSCR calculation provides an objective measure of a property’s cash flow and ability to meet debt obligations. By using the DSCR calculator to assess investment feasibility, evaluate risk, and communicate effectively, investors can enhance their decision-making process and increase the likelihood of successful real estate investments.

Here’s how computing DSCR can help property investors:

Calculating a property’s DSCR can be beneficial to property investors and lenders. However, the DSCR formula also has its flaws. Here are some pros and cons to consider:

While there is no standard ideal DSCR ratio, a DSCR above 1 is generally considered favorable for real estate investments. However, the desired ratio may vary based on property type, location, market conditions, and lender requirements.

Lenders typically prefer a DSCR higher than 1, with many aiming for a DSCR of 1.2 or higher, to ensure a margin of safety. Moreover, it is recommended to use DSCR with other financial indicators when evaluating whether a property is worth investing in.

The minimum acceptable DSCR depends on various factors, including the property type, lender requirements, and individual risk appetite. Lenders often have their criteria for minimum acceptable DSCR.

In general, a DSCR of 1 or slightly above indicates that the property generates just enough income to cover its debt obligations. However, most lenders prefer a higher DSCR to ensure adequate cash flow to cover debt payments and provide a buffer for unforeseen circumstances.

A DSCR loan, also known as a DSCR mortgage, focuses on the property’s cash flow and DSCR rather than solely relying on the borrower’s creditworthiness. In multifamily investing, the DSCR loan considers the rental income generated by the property and compares it to the debt service.

Lenders typically have specific requirements for the minimum acceptable DSCR to qualify for the loan. Hence, it allows investors to leverage the property’s income potential to secure financing.