When considering real estate investments, it is crucial to analyze various financial metrics to assess the potential risks and returns. One such metric is the debt yield. It is a ratio that measures the relationship between the net operating income (NOI) generated by a property and its total outstanding debt.

By focusing on the income-generating ability of the property relative to its debt, the debt yield provides valuable insights for lenders and investors alike. A higher debt yield indicates a property’s ability to generate enough income to pay its debt obligations. Conversely, a lower debt yield suggests a higher level of risk as the property’s income may not adequately support its debt.

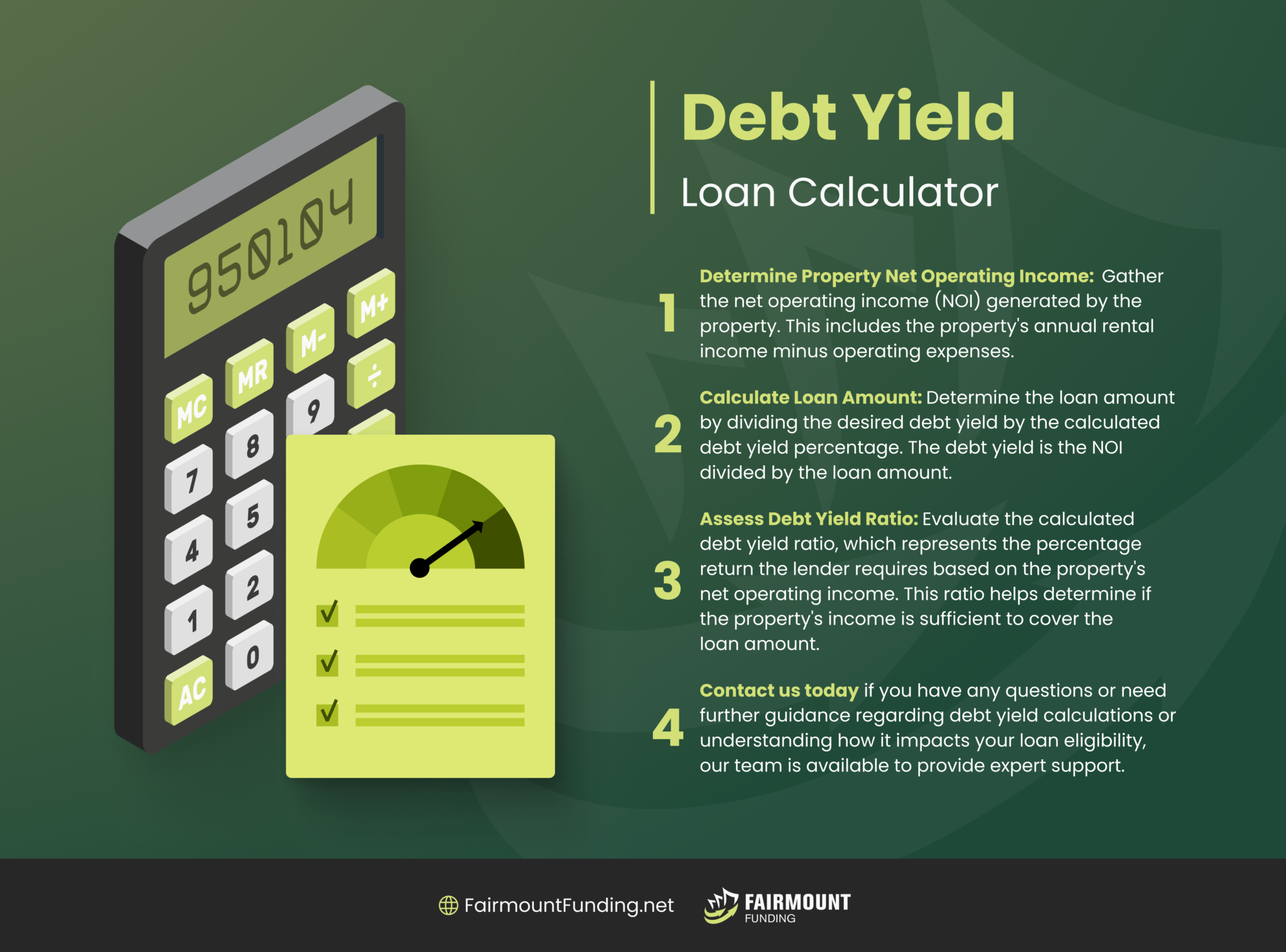

Financial professionals often use a debt yield calculator to determine the debt yield for a property investment. This tool streamlines the calculation process, enabling investors to assess the property’s financial feasibility quickly. Hence, they can gain valuable insights into the project’s risk profile and potential profitability.

To calculate a property’s debt yield, you need to divide its NOI by its total loan amount. On the other hand, using Fairmount Funding’s debt yield calculator eliminates the need to crunch the number manually.

The first step is to input the property’s net operating income. This NOI represents the property’s annual income generated from operations. It includes rental income minus expenses like property taxes, maintenance costs, and property management fees.

The next step is to enter the property’s outstanding loan amount. This refers to the total debt owed on the property, like mortgages or loans. The calculator will show the debt yield percentage, representing the property’s ability to generate income relative to its debt.

The formula for computing the debt yield is relatively straightforward, and the result is expressed as a percentage. Here is the formula for calculating a property’s debt yield ratio:

Debt Yield = (Net Operating Income / Outstanding Loan Amount) * 100

Moreover, the debt yield ratio formula involves two key components:

By dividing the NOI by the loan amount and multiplying the result by 100, the debt yield formula calculates the debt yield percentage. This percentage represents the property’s ability to generate income relative to its debt.

A higher debt yield indicates a lower risk as the property’s income sufficiently covers its debt obligations. Conversely, a lower debt yield suggests a higher risk, indicating that the property’s income may not adequately support its outstanding debt.

It is important to note that the debt yield is primarily used as a risk assessment tool by lenders and investors when evaluating real estate investments. It provides insights into the property’s income-generating capacity and ability to service its debt.

Primarily, debt yield estimates the risk associated with a real estate property. However, there are other ways a debt yield calculator can come in handy for property investors and real estate hard money lenders:

Debt yield acts as a safeguard for lenders, preventing them from engaging in overly risky investment choices and facilitating the evaluation of investment feasibility. If they can calculate the debt yield, they can anticipate potential losses and make better risk management.

Real estate investors can compare different property investments based on their debt yields. This allows them to identify the most profitable and productive properties available to them.

Debt yield complements other traditional metrics like loan-to-value (LTV) and debt service coverage ratio (DSCR). While LTV and DSCR focus on different aspects of risk assessment, debt yield provides an additional perspective on the property’s income viability. By considering multiple metrics, investors and lenders can gain a more comprehensive understanding of the property’s risk and make well-informed decisions.

When analyzing mortgage risk in real estate, several metrics are commonly used. Let’s compare debt yield with each of these metrics to understand their respective implications:

Debt yield and LTV are complementary metrics that provide different perspectives on mortgage risk. The former measures income sufficiency, while the latter highlights the property’s equity position and potential for losses in case of default.

Debt Yield focuses on the property’s income-generating ability relative to its outstanding debt. A higher debt yield indicates that the property generates sufficient income to cover its debt.

In contrast, LTV assesses the percentage of the property’s value financed by the loan. A higher LTV represents that the property has a greater debt burden relative to its value.

Debt yield and DSCR also provide distinct perspectives on mortgage risk. Debt yield assesses the property’s income-generating capacity relative to its debt, while DSCR measures the property’s ability to cover its debt service payments.

DSCR is calculated by dividing the property’s NOI by its annual debt service payments. A higher DSCR indicates a lower risk, as the property generates sufficient income to meet its debt obligations comfortably. On the other hand, debt yield focuses on the overall income-to-debt relationship and provides a broader risk assessment beyond just the debt service coverage.

Debt yield and capitalization rate are both important metrics but serve different purposes. Debt yield evaluates the property’s income relative to its outstanding debt, whereas cap rate measures the property’s net operating income as a percentage of its market value.

Cap Rate determines the property’s potential return on investment and market value, while debt yield assesses the property’s risk profile based on its income-to-debt ratio. While both metrics are valuable in evaluating mortgage risk, debt yield focuses on debt coverage, and cap rate emphasizes the income and value relationship.

A high debt yield in real estate offers several advantages. Firstly, it indicates that the property generates sufficient income to cover its debt obligations. This reduces the risk for lenders, making it easier to secure financing and negotiate more favorable loan terms.

Secondly, a high debt yield signifies the property’s solid income-generating potential. This makes a real estate asset an attractive investment for lenders and investors.

Lastly, a high debt yield can contribute to the property’s overall financial stability. That is because it indicates that the real estate asset can weather market fluctuations and economic downturns more effectively.

A low debt yield in real estate poses several risks. Firstly, it indicates that the property’s income may not be sufficient to cover its debt obligations. This increases the risk of default and may make it challenging to secure financing or renegotiate loan terms.

Secondly, a low debt yield suggests that investors must increase the property’s income-generating potential. This can impact its long-term profitability and sustainability.

Lastly, a low debt yield may result in higher interest rates or less favorable loan terms. Thus, it can be more expensive to finance the property.

There are several strategies to increase a property’s debt yield rate: