Our hard money calculator factors in all the common costs and fees that a hard money loan entails.

Hard money loans address unique borrowing needs. It is a specialized type of short-term loan secured by real estate collateral. The primary purpose of a hard money loan is to offer a swift and convenient solution for borrowers who may not qualify for conventional financing due to credit challenges or the need for rapid funding.

Unlike traditional bank loans, hard money loans are often funded by private investors or real estate money lenders, making the approval process quicker and more flexible. That said, using a hard money loan calculator is essential in evaluating the feasibility of investment projects. This tool helps borrowers estimate interest rates, loan terms, and potential monthly payments before committing to a particular loan.

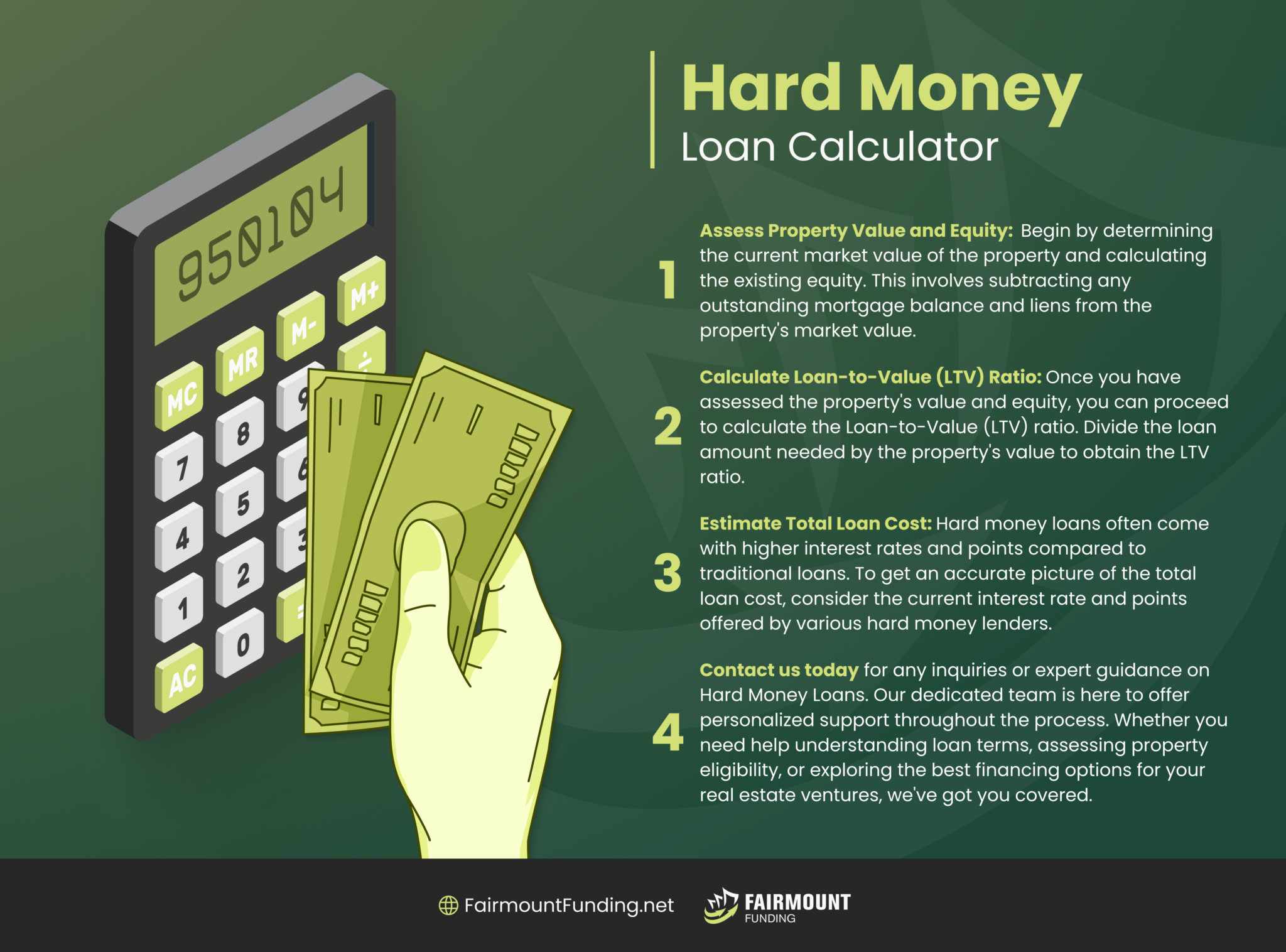

A hard money loan calculator can help you understand the financial aspects of your real estate financing needs. Here’s how you can effectively utilize Fairmount Funding’s hard money loan calculator:

Start by entering the following information:

Based on these figures, the calculator will compute your property investment’s Loan-to-Value (LTV) ratio. This is useful in determining the risk associated with the loan.

Next is to make the necessary adjustments to the hard money loan calculator results. It will then automatically show the amount of money you can borrow and other related fees.

The best time to consider hard money loans is when traditional financing options are not viable or cannot meet the urgency of your financial needs. This includes situations that require swift access to capital and where traditional lenders may pose challenges.

One such scenario is real estate investing. For property investors aiming to capitalize on time-sensitive opportunities, hard money loans offer a quick and efficient financing solution. Traditional banks often involve lengthy approval processes, strict credit requirements, and detailed property appraisals, which can hinder the timely acquisition of properties. In contrast, hard money lenders prioritize the property’s value and potential for profit, allowing investors to secure funds faster.

Additionally, hard money loans are ideal for borrowers with less-than-ideal credit scores. Individuals facing credit challenges may need help to secure traditional loans. Still, hard money lenders emphasize the property’s value as collateral, making credit history less of a barrier. This presents an opportunity for borrowers to access necessary funds and work towards improving their financial situation.

Furthermore, hard money loans become an attractive choice when borrowers require short-term financing for property renovations or fix-and-flip projects. That is because this loan is designed to be repaid over a shorter duration, aligning with the project’s timeline. It can also provide the needed liquidity for renovations or upgrades, ultimately increasing the property’s value.

The hard money loan formula involves three key components: the loan amount, the interest rate, and the loan term. Here’s the formula and a description of each component:

By multiplying the loan amount by the interest rate and then multiplying the result by the loan term, you can compute the total interest amount due on your hard money loan. This formula enables you to estimate the overall cost of the loan and understand your repayment obligations over the agreed-upon loan term.

Keep in mind that this is a basic formula for estimating hard money loan interests. Some real estate lenders would include other fees, such as loan origination fees, which a hard money loan calculator may overlook.

While hard money loan calculators can be valuable for estimating potential costs and gaining insights into loan options, they have limitations. Here are some of the key constraints to be aware of:

Qualifying for a hard money loan is typically based on the value of the property being used as collateral rather than the borrower’s creditworthiness. Hard money lenders prioritize the property’s market value and potential for profit or as a means of repayment. As a result, borrowers with credit challenges or lower credit scores can qualify for a hard money loan if the property’s value justifies the loan amount. Additionally, real estate investors, developers, and individuals seeking short-term financing for property projects are typical candidates for hard money loans.

Hard money lenders generally do not have strict credit score requirements like traditional lenders. Instead, they focus on the property’s value and the borrower’s equity.

While credit history may be considered, it is usually not a primary factor in the approval process. This flexibility is one of the reasons hard money loans are popular among borrowers with lower credit scores or past credit issues.

Yes, it is often possible to pay off a hard money loan early. Hard money loans are generally short-term loans, and some borrowers may prefer to repay them quickly to minimize interest costs. However, reviewing the loan terms and any potential prepayment penalties is essential. Some hard money loans may include prepayment penalties, which are fees charged if the borrower pays off the loan before a specific period.