Calculate the Cash on Cash Return of your property using our calculator.

Cash on cash return is a fundamental concept in real estate investing. It measures whether an investment property is profitable in relation to the amount of cash invested. Thus, it is a key metric that allows investors to assess the potential return on their investment.

By calculating the cash on cash return, investors can determine how much their initial investment earns. Meanwhile, a cash on cash return calculator simplifies the computation by automating the process. This allows investors to evaluate different investment opportunities quickly.

By utilizing a cash on cash return calculator, investors can save time and gain valuable insights into the financial viability of various real estate investment opportunities. Additionally, our tools make it simple for users to evaluate an investment property’s potential profitability.

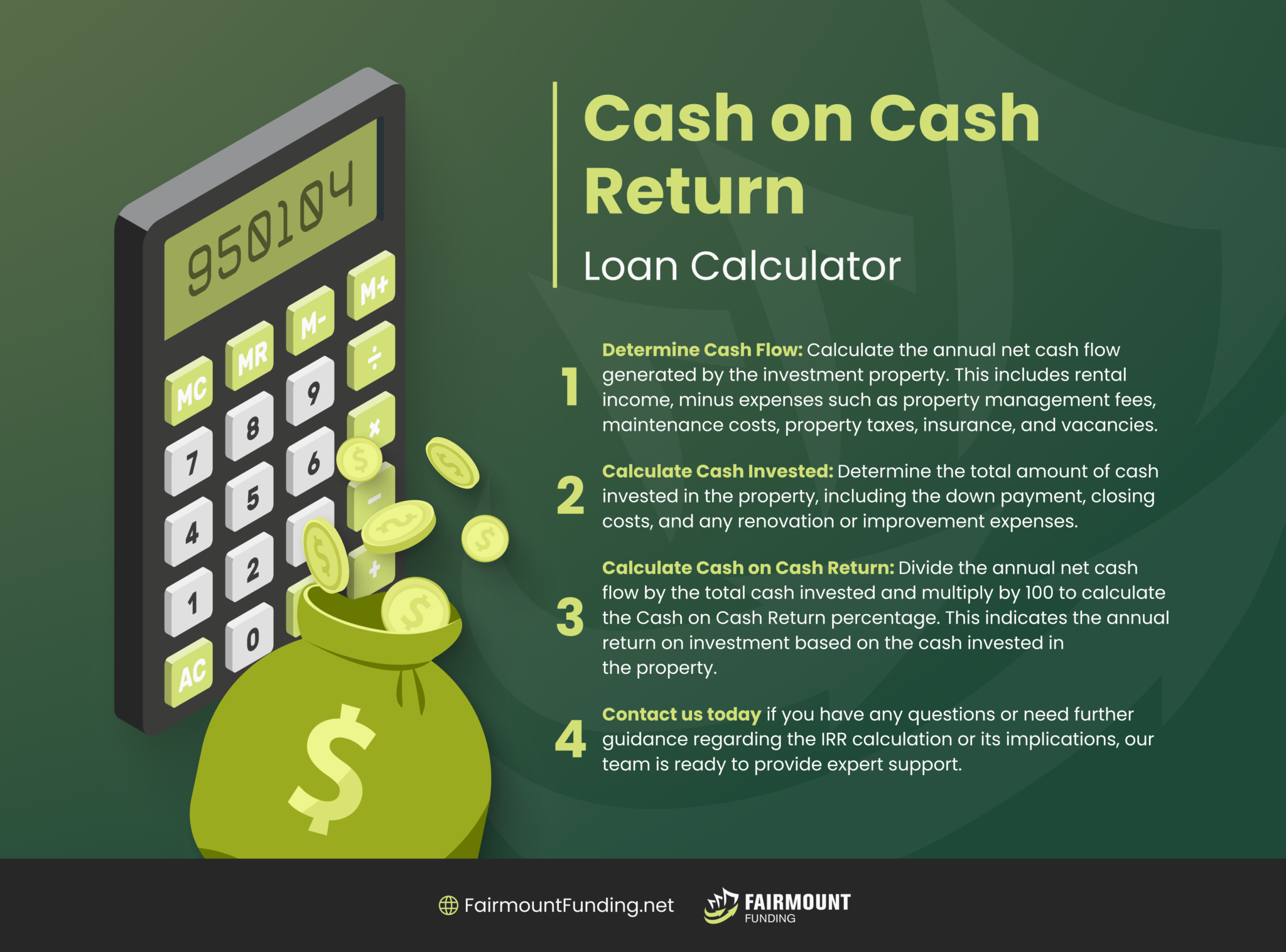

Here are the steps to effectively use Fairmount Funding’s cash on cash return calculator:

To calculate the cash on cash return, you can take the annual pre-tax cash flow generated by the property. Next is to divide it by the total cash investment. The formula to compute cash on cash return is:

Cash on Cash Return = (Annual Pre-Tax Cash Flow / Total Cash Investment) x 100

Relatively, you can use the following formula to determine the annual pre-tax cash flow:

Annual Pre-Tax Cash Flow = Annual Rental Income – Annual Mortgage Payments

Let’s break down the different components of the formula:

By dividing the yearly pre-tax cash flow by the total cash investment and multiplying it by 100, the resulting figure represents the cash on cash return percentage. This indicates the annual return on the cash invested in the property.

Suppose the annual pre-tax cash flow is $10,000, and the total cash investment is $100,000. As such, the cash on cash return would be calculated as (10,000 / 100,000) x 100 = 10%. This means that the investor is earning a 10% return on their cash investment in the property.

Investors use the cash on cash return calculation as a valuable metric for several reasons:

While cash on cash return offers simplicity and comparative analysis for evaluating investment properties based on current cash flow and initial investment, it has limitations in scope, financing considerations, and the time value of money. Here are the pros and cons of using cash and cash return as a metric:

Advantages of Calculating Cash on Cash Return:

Disadvantages of Calculating Cash on Cash Return:

What makes cash on cash return “good” depends on factors like the investor’s risk tolerance, market conditions, and investment goals. A higher cash on cash return indicates a greater return on the cash invested, making a real estate asset attractive to investors.

Cash on cash return and capitalization rate are both real estate investment metrics, but they measure different aspects of profitability. The former focuses on the return generated on the initial cash investment, taking into account cash flow. On the other hand, the cap rate assesses the relationship between a property’s net operating income and its market value.

No, cash on cash return is not the same as ROI (return on investment). Cash on cash return measures explicitly the return on the cash invested in a property. In contrast, ROI is a more comprehensive measure that considers the total return on the investment, including both cash and non-cash components.