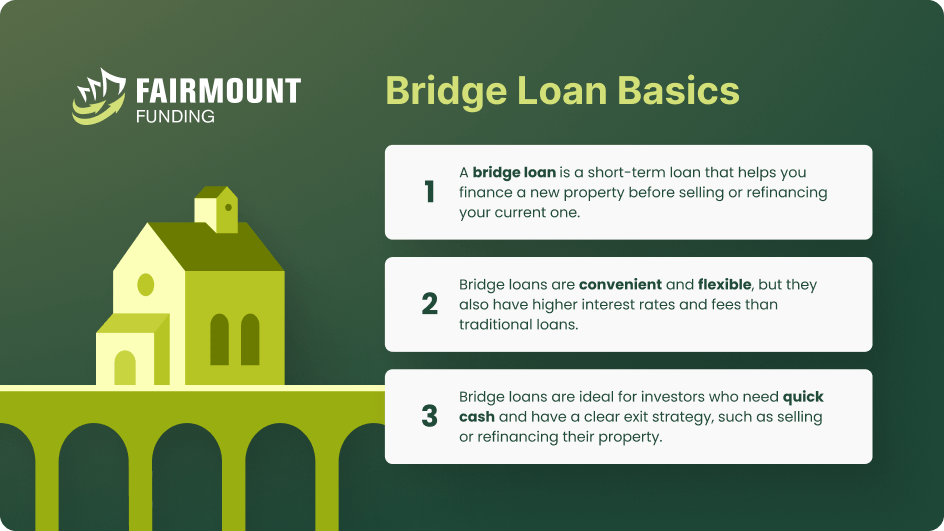

If you are buying a new property while selling your existing one, consider applying for a bridge loan. This type of loan allows you to have the necessary funds to buy a new house or pay off an existing debt.

However, this short-term loan also has advantages and disadvantages. Conditions and fees vary between lenders and transactions. It can also pile new debt onto the overall amount that you owe.

That said, let Fairmount Financing help you understand what is a bridge loan, how it works, and how you can maximize it.

What Is a Bridge Loan?

A bridge loan, also known as a “swing loan,” is short-term financing that enables you to settle an obligation or buy a new property until you can secure permanent financing. This is helpful since most home sellers prefer to wait until a property is under contract before placing an offer on a new one. You can then use the money from the sale to fund a new property acquisition.

If you cannot complete a sale and offload your property, a bridge loan mortgage lets you secure the funds needed to buy a new property. However, this type of loan requires you to use existing property as collateral. It is also not meant to replace long-term financing, as bridge loans usually last six months to a year.

A bridge loan is commonly used by people who need to relocate suddenly. Hence, they need additional money they can access quickly and use as a down payment for a new house. Property investors and brokers use this type of loan to acquire houses in a fast-selling market.

That said, you can consider applying for a bridge loan if:

- The home seller is not comfortable with contingent purchase offers.

- You prefer to secure a new property before listing your current house on the market.

- The closing date for your existing property comes at least a day after you can close a purchase on a new one.

- You have an urgent need to secure a new house.

A bridge loan application is similar to applying for a traditional mortgage. Your lender will consider various factors like credit history, credit score, and debt-to-income ratio (DTI). Most lenders offering bridge loans let you borrow as much as 80% of your loan-to-value ratio (LTV). This entails that you can qualify if you have at least 20% equity in your current property.

Different Types of Bridge Loans

There are different types of bridge loans based on the loan terms that real estate investment lenders are willing to offer. Meanwhile, your creditworthiness and financing needs can impact them. Here are some common types of bridge loans:

- Real Estate Bridge Loans. This type of loan bridges the gap between selling an existing house and buying a new one. Its purpose is to fund the new property’s down payment or until the sale of the existing one is completed.

- Construction Bridge Loans. This type of loan is ideal for funding the construction of a real estate project. You can use this to pay for materials, labor, and permits until long-term construction financing is secured.

- Hard Money Bridge Loans. These short-term loans require securing an existing real estate property as collateral. They are commonly used by investors or developers seeking quick financing to fund time-sensitive opportunities. Hard money bridge loans are also helpful in covering temporary cash flow gaps.

Most Common Uses of Bridge Loans

Real estate investors and brokers can use bridge loans to take advantage of opportunities and fund short-term expenses. Based on how does a bridge loan works, below are the two common uses for this type of loan:

- It is used as a second mortgage to fund a new property’s down payment until you can sell your existing one.

- You are using part of the loan to pay off the mortgage of your current property, while the rest is for the down payment of a new one.

A real estate bridge loan is also helpful for covering operating expenses while waiting for long-term financing, securing funds needed to acquire a new property quickly, and leveraging limited-time offers on business resources.

How Long Before My Bridge Loan Is Approved?

The length of loan approval varies depending on the type of lender and property you secured as collateral. Some conventional lenders, like banks and credit units, take at least a month before approving a loan application.

On the other hand, hard money lenders can take three to five days to do so. The shortest time frame would be same-day approval. That is because lenders are more concerned with the value of the property and your equity in it.

Bridge Loan FAQs

How can I best use my mortgage bridge loan?

You can use your bridge loan to buy a new house before selling your current one. Pay off your current mortgage using a part of your loan, while the rest goes to the down payment of the new property.

What types of residential properties you can buy using your mortgage bridge loan will depend on your lender. Here at Fairmount Funding, properties eligible for a bridge loan are attached or detached single-family rentals, multiple-unit properties, townhomes, and condos.

How much are bridge loan interest rates?

Bridge loan interest rates are often higher than a traditional mortgage. It can also incur closing costs and originator fees, skewing up expenses. Your lender may also require you to pay for an appraisal.

How long does it take to get a bridge loan?

How long does it take to get a bridge loan will depend on the type of lender and the property you are using as collateral. Banks and credit unions can take 30 to 45 days to approve a loan application. On the other hand, some hard money lenders can do same-day approvals, while some can take a couple of days.

You should also note that bridge loan terms and conditions differ from one lender to another. Hence, consider the interest rates, repayment terms, and other fees when applying for a bridge loan.

Conclusion

A bridge loan can be helpful in certain situations. For instance, if you want to secure a new property before selling your existing one. Another is when covering operating expenses while waiting for long-term funding.

However, it may require you to secure an existing property as collateral and have at least 20% equity in it. It can also be costly and add to your overall debt load. It does not replace long-term financing, either, since terms for bridge loans only last six to 12 months.

That is why it would be better to sell your old property before acquiring a new house. Otherwise, you must ensure that you can quickly sell your existing property.

A bridge loan can help you get out of a tight spot. If you are ready to close the gap between selling an existing property and buying a new one, give us a call and discover how we can help you grow your real estate investing business.

KEY TAKEAWAYS

- A bridge loan is helpful for buying a new property while selling an existing one or until a long-term financing is secure.

- You can apply for different types of loan terms depending on your credit worthiness and financing needs.

- It can take a couple of days before a lender approves your bridge loan application.