For seasoned investors and newcomers alike, cash-on-cash return is a key metric for evaluating the profitability of an investment property. It provides a clear picture into how much cash income an investor can expect to receive in relation to the amount of cash they initially put into the property. It directly shows your property’s bottom line, making it an invaluable tool for decision-making in real estate investing.

At its core, the cash-on-cash return is a percentage that reflects the annual return on investment, based on the actual cash flows a property generates. This metric factors in the property’s purchase price, financing terms, operational expenses, and rental income. Thus, real estate investors have a tangible sense of their cash-based returns.

Being able to gauge the immediate income potential of an investment also makes it especially relevant for investors interested in rental properties or income-producing assets. Understanding and calculating a cash-on-cash return provides clarity on the profitability of a property and aids in comparing various investment opportunities.

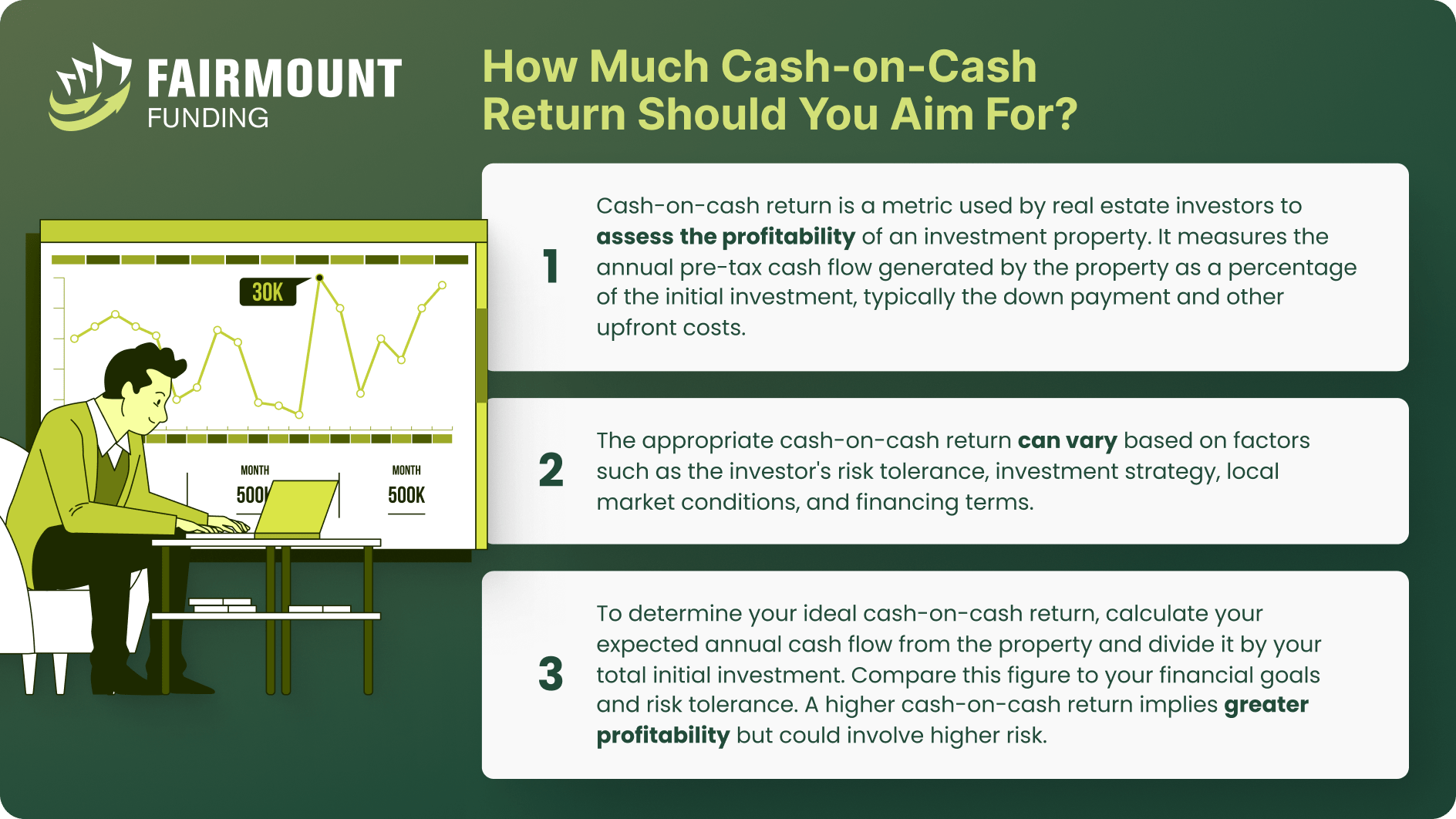

What is a cash-on-cash return?

The cash-on-cash return, or CoC for short, is a financial metric used in real estate investment to assess the profitability of an investment property. It measures the annual return on the actual cash invested in a property, relative to the income generated from that property.

In other words, it calculates the percentage return on the cash you put into the property, considering purchase price, financing terms, operational expenses, and rental income. A higher cash-on-cash return indicates a better return on the cash invested in the property, which is typically a desirable outcome for real estate investors.

How can property investors use a cash-on-cash return?

A cash-on-cash return is primarily used to assess a prospective investment. It is helpful in fluctuating rental prices as it enables ongoing assessment of your investment portfolio. Below are various ways property investors can effectively use CoC returns:

- Evaluate Investment Opportunities: CoC return helps investors assess the potential profitability of different properties. By comparing CoC returns across various investment options, investors can identify properties that offer the best immediate cash flow. This allows them to focus on investments that align with their goals and risk tolerance.

- Assess Risk and Reward: CoC return clearly indicates the income relative to the initial investment. Investors can use this metric to assess the risk associated with a property. A higher CoC return generally suggests a better return on investment but may also come with higher risks or maintenance costs. Investors can weigh the CoC return against their risk tolerance to make informed decisions.

- Monitor Investment Performance: Investors can use CoC returns to track their ongoing performance after acquiring a property. Investors can identify any deviations from their expectations by regularly calculating and comparing the actual CoC return with their initial projections. This allows them to adjust their investment strategy, such as raising rents or reducing expenses, to optimize their returns.

- Financing Considerations: CoC return considers a property’s financing terms. Investors can use this metric to determine whether mortgage rates and down payment are favorable or need adjustment to improve the CoC return. Refinancing options can be explored if there is potential to increase cash flow.

- Long-Term Planning: CoC return can inform long-term investment strategies. Investors can use this metric to assess the potential for future appreciation in property value and the ability to generate consistent cash flow over time, helping them plan for retirement or other financial goals.

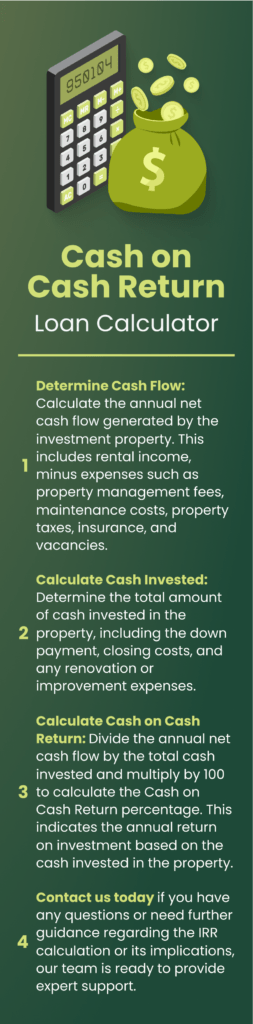

How to Calculate Cash-on-Cash Return

To know how to calculate cash on cash return, you must identify the annual pre-tax cash flow that the property generates. Next is to divide it by the total cash investment. You can use Fairmount Funding’s cash-on-cash return calculator or use the formula below to compute your property investment’s CoC return:

Cash on Cash Return = (Annual Pre-Tax Cash Flow / Total Cash Investment) x 100

Relatively, you can use the following formula to determine the annual pre-tax cash flow:

Annual Pre-Tax Cash Flow = Annual Rental Income – Annual Mortgage Payments

Let’s break down the different components of the formula:

- Annual Pre-Tax Cash Flow. This refers to the net cash flow the investment property generates over a year. It takes into account the rental income received minus the operating expenses.

- Total Cash Investment. This includes the total amount of cash invested in the property. It typically consists of the down payment made when purchasing the property, closing costs, and any upfront renovation or repair expenses. In contrast, it excludes the amount financed through a mortgage or other loans.

The resulting figure represents the CoC return percentage by dividing the yearly pre-tax cash flow by the total cash investment and multiplying it by 100. This indicates the annual return on the cash invested in the property.

Suppose the annual pre-tax cash flow is $10,000, and the total cash investment is $100,000. As such, the cash-on-cash return formula would be (10,000 / 100,000) x 100 = 10%. This means that the investor is earning a 10% return on their cash investment in the property.

Cash-on-Cash Return vs. Other Metrics

Various metrics play an essential role in real estate investment analysis. That said, cash-on-cash returns are handy for evaluating the cash-based returns on investment properties. Meanwhile, here’s how a CoC return differs from other metrics:

vs. Capitalization Rate (Cap Rate)

Cap rate measures the property’s potential return on investment based on its market value or acquisition cost. Compared to CoC return, the cap rate does not consider specific financing terms like mortgage interest rates and down payment.

Thus, the cap rate is helpful for quickly comparing the relative profitability of different properties and assessing market conditions. CoC return, on the other hand, provides a more detailed picture of a property’s cash flow close to the cash invested.

vs. Net Operating Income (NOI)

NOI represents the property’s income after deducting all operating expenses before accounting for financing costs. It indicates a property’s ability to generate revenue from its operations alone. CoC return, however, considers both NOI and the cash invested in the property, offering a clearer picture of how that income relates to the cash investment.

NOI is valuable for assessing a property’s operational efficiency and potential for generating income. On the other hand, CoC return adds a financing dimension to help investors understand their actual returns after considering financing expenses.

vs. Return on Investment (ROI)

ROI is a broad financial metric that calculates the overall return on an investment, typically expressed as a percentage. It considers the total return (including appreciation and cash flow) in relation to the initial investment. However, it does not specify the source of returns or differentiate between cash invested and financing.

As the name suggests, CoC return focuses solely on the cash portion of ROI and provides a more targeted assessment of cash-based returns. It is also specific to real estate and is particularly useful for analyzing cash flow properties.

vs. Internal Rate of Return (IRR)

IRR is a complex financial metric that calculates the annualized rate of return on an investment. It considers the timing and amount of cash flows, including income and expenses. It is a comprehensive metric that factors in all financial aspects of an investment.

CoC return, while also considering cash flows, focuses specifically on the cash invested and provides a more straightforward measure of returns. It is used to gauge the cash-based return in real estate, offering a more precise analysis for investors concerned primarily with immediate income and cash flow.

Cash-on-Cash Return FAQs

What is a good cash-on-cash rate of return?

Real estate investors keen to know what is a good cash-on-cash return must remember that it can vary widely. You must consider property type, location, and investment goals.

Generally, a CoC return greater than 8-12% is favorable for most real estate investors. However, what is considered a good CoC return for you should align with your investment strategy, risk tolerance, and market conditions.

Is cash-on-cash return the same as return on investment (ROI)?

Cash-on-cash return and return on investment (ROI) are not the same. CoC return is a specific subset of ROI. While CoC return focuses exclusively on the cash invested in a property and the income generated from it, ROI encompasses the entire return on the investment, including any property appreciation and non-cash benefits.

Is cash-on-cash return the same as cash flow?

No, cash-on-cash return is not the same as cash flow. Cash flow represents a property’s income minus all its operating expenses, including mortgage payments. It is an ongoing metric that tells you how much cash is coming in and going out each month or year.

On the other hand, CoC return is a rate of return that compares the annual cash income to the initial cash investment in the property. It provides insight into the efficiency of your cash utilization and the return on the cash you invested into the property.

Use Cash-on-Cash Return as Your Property Investment Compass

Mastering the concept of cash-on-cash return is akin to having a compass in uncharted territory. This metric serves as your north star and your litmus test for the financial health of your investments.

A good cash-on-cash return can translate into stable, immediate income from your property, providing the financial fuel to navigate your investment journey effectively. However, what constitutes a “good” cash-on-cash return can vary based on your goals and the market conditions.

Whether you are a seasoned real estate investor or just starting, remember that cash-on-cash return is dynamic. It evolves as your property appreciates, rental prices change, and financing terms shift. Regularly monitoring this metric will help you stay on course and adapt to the ever-changing real estate investment landscape.

KEY TAKEAWAYS

- Cash-on-cash return is a key metric that provides a clear picture of how much cash income an investor can expect to receive in relation to the amount of cash they initially put into the property.

- A cash-on-cash return is primarily used to assess a prospective investment. This includes evaluating investment opportunities, assessing risk and reward, and monitoring investment performance.

- A CoC return greater than 8-12% is favorable for most real estate investors. However, what is considered a good CoC return should align with your investment strategy, risk tolerance, and market conditions.