Are you thinking about getting a DSCR loan to buy your next property? If you are, it’s important to understand that you might need to make an upfront payment. Knowing how this payment works can help you make a smart decision when applying for this type of loan.

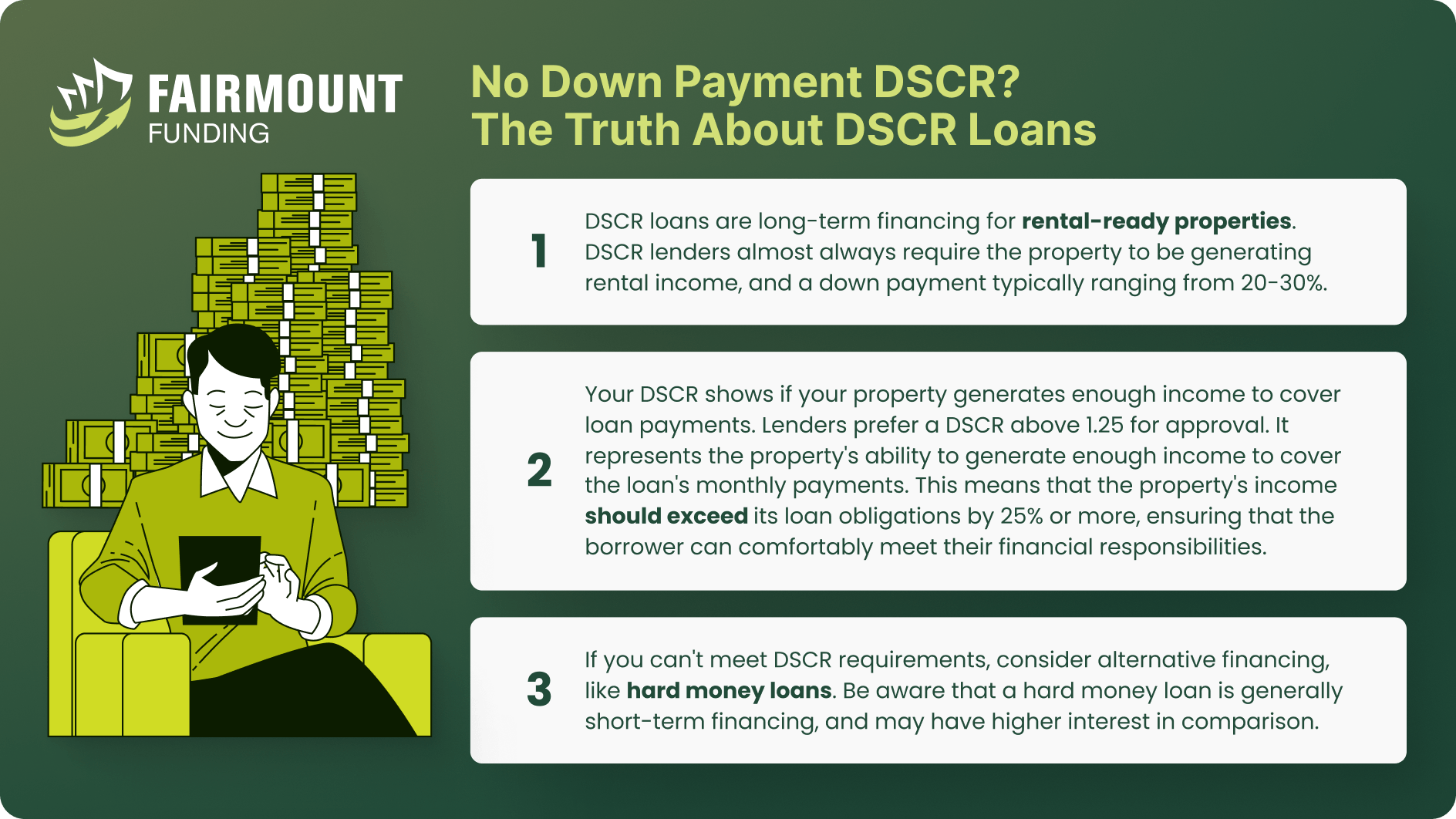

But what if you don’t want to save up a big upfront payment? In this case, you might be interested in learning about a DSCR loan with no down payment. DSCR loans are designed for long-term rental investments and don’t need things like W2 forms, tax returns, or proof of income. You can find all the details you need about DSCR loans in the guide below.

How Does a DSCR Loan Work?

A DSCR loan is a special type of mortgage for rental-ready, income-generating properties. Instead of looking at how much money you earn, it mainly checks how much money the property makes. Unlike regular mortgages, which need proof of your income, tax records, and a measure of your debts compared to your earnings, DSCR loans don’t ask for any of that. Instead, they focus on the property’s ability to generate sufficient income to cover the loan payments.

In simple terms, a DSCR loan is for investors who want to buy rental properties and don’t want the hassle of proving their income or dealing with lots of paperwork. This makes a DSCR loan an attractive option for real estate investors who may not have traditional income documentation or those seeking to leverage the property’s income potential.

As a metric in property investing, the DSCR is a key tool for evaluating the financial viability of income properties. Investors use it to assess whether a property generates enough cash flow to cover its debt obligations. A DSCR of 1 or higher is generally considered safe, indicating that there’s a comfortable margin for covering loan payments. Investors can use a DSCR loan calculator to quickly determine this ratio and assess a property’s potential.

DSCR Loan Requirements

While DSCR Loans do have less paperwork than traditional loans, they are not typically “no doc” loans. These loans are popular because they make things easier by asking for only what’s necessary and sensible to qualify for the loan, striking a balance between simplicity and responsible lending. Here are the DSCR loan requirements that you’ll need:

- Property Income Records: The property must generate adequate income to not just meet loan payments but also cover supplementary costs like property taxes and insurance. Lenders often request financial statements and rental income records to validate the property’s income.

- Debt Service Coverage Ratio (DSCR): The DSCR compares how much a property makes (NOI) to what it has to pay in loans. Generally, lenders insist on a DSCR of at least 1.2 to 1.25. This signifies that the property’s NOI should be at least 120-125% of the annual loan payments.

- Appraisal Report: The lender usually asks for an appraisal of the property to make sure it’s in good shape and that its value is enough to back the loan.

- Credit Score and Track Record: The credit score is an important measure in evaluating a borrower for a DSCR loan. Lenders check if the borrower has experience managing similar properties and assess their credit and financial history alongside property income for loan risk evaluation.

- Reserve: A reserve to handle unexpected expenses or vacancies may be required by certain lenders from the borrower.

How can I get a DSCR loan with no down payment?

DSCR loans typically require a down payment, but the specific requirements can vary depending on the lender and the details of the loan. While some lenders may offer DSCR loans with lower down payment requirements compared to traditional mortgages, it will prove difficult to find a reputable lender willing to take on a deal with no down payment at all. This is because lenders normally want the borrower to have “skin in the game,” and unless special conditions are met, like cross collateralization, they aren’t likely to take on the burden of 100% financing a property.

A DSCR loan program down payment can vary based on the lender and the borrower’s financial circumstances, but it is important to first understand the DSCR loan down payment requirements and expectations when applying for this type of loan.

In general, lenders usually expect borrowers to contribute between 20% to 30% DSCR down payment of the home’s purchase price, along with a minimum credit score of 650-700. These requirements are justifiable given that this loan doesn’t necessitate tax returns, W2s, or pay stubs. Keep in mind that the better the down payment, the lower the interest rates and the more favorable your terms will be.

Benefits of Making a DSCR Loan Down Payment

DSCR loans are designed to meet the needs of investors in rental-ready properties and are well-suited for investors in various situations. Borrowers can benefit from making a DSCR loan down payment in many ways:

- Reduced Monthly Payments. Putting money down when you get a DSCR loan can make your monthly payments smaller. This happens because you’re borrowing less money, which means you owe less, and your monthly payments can go down.

- Increased Equity. Equity represents the gap between the property’s current market value and the remaining amount owed on it. Making a down payment on a DSCR loan means they own a larger share of the property from the start, which can provide financial security and potential for greater profits when the property’s value increases over time.

- Better Chance of Loan Approval. Providing a substantial down payment can enhance the probability of securing loan approval from lenders. This is because a larger down payment signals to lenders that the borrower is financially secure and has a higher likelihood of repaying their loans as agreed.

- Potential Interest Rate Discount. A bigger down payment can also result in reduced interest rates. This happens because lenders see borrowers who invest more upfront as less risky, making them eligible for more favorable interest rates.

What Is a No-DSCR Loan?

In some respects, a no-DSCR loan sits on the opposite end of what a DSCR loan represents. While they are both DSCR loans and serve rent-ready properties, the No-DSCR loan, or No-Ratio-DSCR loan, does not need to know if the monthly rental income can cover the monthly expenses. Instead, it is more concerned with the quality of the property and financial capacity of the borrower.

Despite needing the borrower to be financially sound, a no-DSCR loan does not need to have income verification in the same way that a conventional lender would require. No-DSCR loans require less documentation overall, and are usually not based on credit score, like a DSCR loan. While a DSCR loan may allow for up to 80% financing, No-DSCR loans would only allow for up to 60% or 70% financing.

What Do No-DSCR Loans Require?

No-DSCR loans will require most of the same documentation that a DSCR loan does, such as appraisals and rent rolls, as it is important to ensure that the investment is financially sound.

As mentioned previously, No-DSCR loans are primarily focused on the quality of the property and the financial capacity of the borrower. Unlike a DSCR loan, however, it won’t be from verifying income documentation, but instead likely take the form of the borrower’s personal bank statements, which demonstrates proof of liquidity to cover at least 6 and up to 24 months of interest, depending on the case.

DSCR Loan With No Down Payment FAQs

Why should I apply for a DSCR loan?

Traditional mortgage lenders typically rely on tax returns, W-2s, and pay stubs to assess monthly income. Salaried and hourly workers have their gross income considered for qualification. However, self-employed individuals face a disadvantage as lenders scrutinize net income, as reflected in tax returns.

DSCR loans offer a compelling alternative for real estate investors, enabling them to qualify for property purchases and refinances without the need for bank statements, tax returns, or debt-to-income ratio assessments. These loans prove especially valuable for borrowers who don’t fit traditional underwriting criteria but seek long-term loans with more favorable rates compared to hard money loans.

Is there a limit to the number of DSCR loans that I can get?

There isn’t a fixed limit to the number of DSCR loans you can obtain. The key factor is your ability to provide a down payment, typically ranging from 20% to 30% of the property’s purchase price, as most DSCR loans have an LTV (Loan-to-Value) ratio in the 70% to 80% range. DSCR loans are a valuable tool for experienced real estate investors, and you can continue to acquire them as long as you find profitable deals and your current business generates sufficient cash for down payments and associated fees, known as “cash to close”.

Do I need a good credit history when applying for a DSCR loan?

DSCR loans primarily consider the property’s income, not the borrower’s credit or financial situation. However, as part of the loan application, a credit check is usually performed, and borrowers with good credit histories may have a higher chance of approval and access to better interest rates.

Supercharge Your Investment Strategy with DSCR Loans!

Real estate investors often face hurdles when seeking loans for their projects. Traditional lenders assess personal income, which can be problematic for investors who utilize tax deductions to reduce their taxable income. This can impact their mortgage eligibility.

DSCR loans are tailored to aid both new and experienced real estate investors in acquiring properties and growing their portfolios. Unlike conventional loans, DSCR loans do not demand income verification. Instead, qualification is based on the property’s cash flow. This approach enables quicker approvals and more adaptable financing options.

As an investor, this approach can turbocharge your real estate acquisition strategy. You no longer need to concern yourself with meeting personal income requirements for each property. Instead, the property’s potential income is the determining factor when assessing qualification, comparing expected income to the mortgage payment.

KEY TAKEAWAYS

- DSCR loans are primarily tailored for real estate investors aiming to qualify for a mortgage based on their cash flow rather than providing income proof through tax documents.

- The debt-service coverage ratio (DSCR) represents the amount of cash flow that can be used to meet existing debt commitments.

- Typically, DSCR loans come with a larger initial payment, but the exact sum can vary based on several factors that impact the necessary down payment.