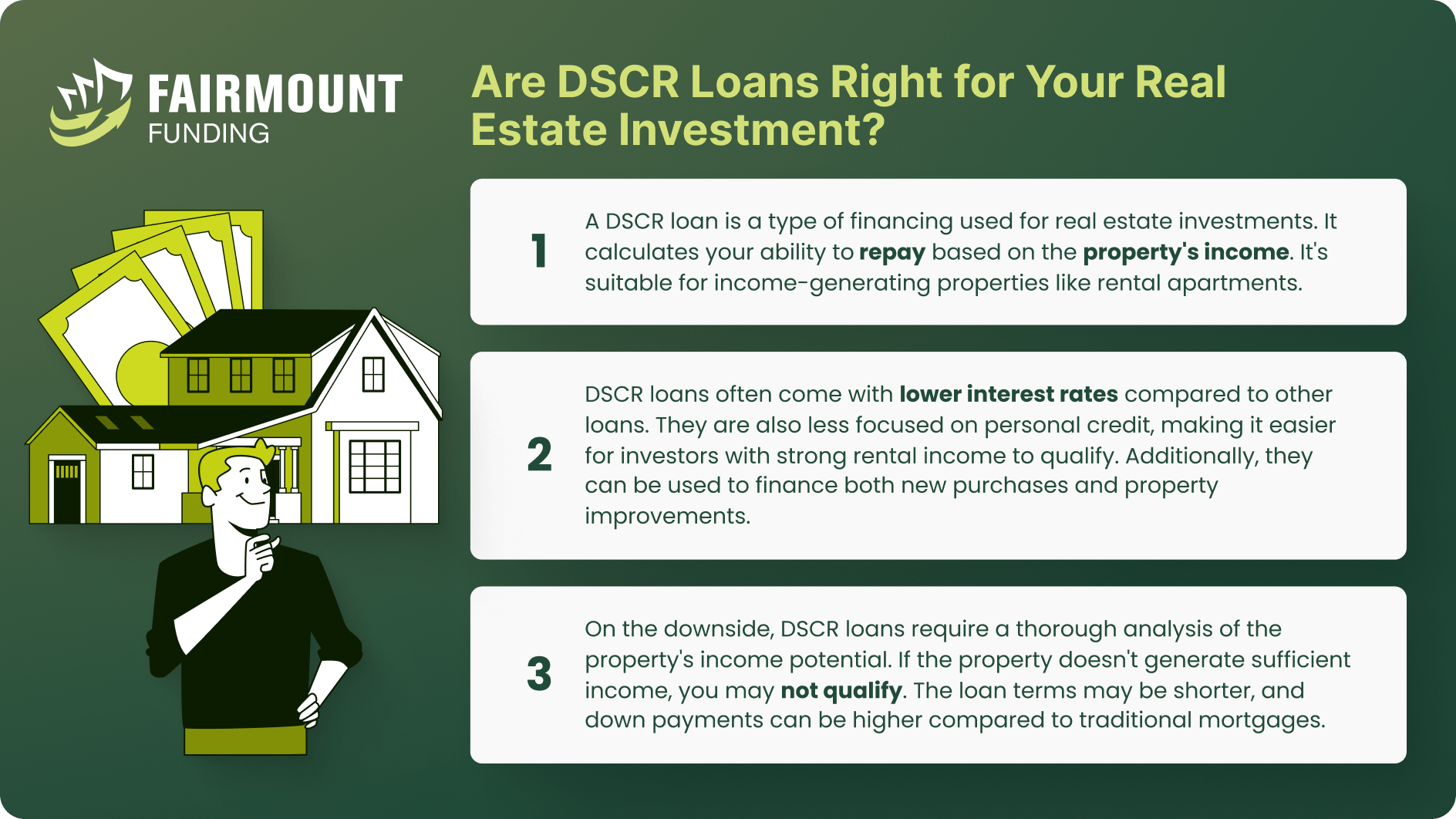

Investing in real estate properties, rental units, and commercial spaces consistently prove to be indispensable commodities when it comes to human needs. However, real estate investment is no walk in the park. It demands more than just capital; it requires a deep understanding of markets, trends, and the art of selecting investments that yield long-term returns. When it comes to the financial aspect, a DSCR loan can be a tremendous help. Let’s explore what is a DSCR loan, DSCR loan pros and cons, and how it can help you realize your wealth-building dreams.

Benefits of DSCR Loans

Using DSCR (Debt Service Coverage Ratio) loans to fund your real estate investments is a strategic financial approach that can significantly enhance your ability to grow and profit in the real estate market. While alternative methods exist for real estate financing options, a DSCR loan possesses unique attributes and benefits.

Easier to Qualify

A DSCR (Debt Service Coverage Ratio) loan can be easier to qualify for when compared to regular mortgages, which is great news for real estate investors. While a credit score of 620 or higher is generally required, some lenders may be more flexible. What sets DSCR loans apart is that they primarily consider the income potential of the property itself rather than relying heavily on your personal financial situation. This means you can secure financing even if your credit isn’t stellar. The common requirements include a 20-25% down payment, property appraisal, rent schedule analysis, and a DSCR ratio of at least 1. So, if you have a promising income-generating property, a DSCR loan could be your ticket to real estate investment success.

Relies on Property Cash Flow

When comparing DSCR loans vs. conventional loans, it’s evident that conventional loans typically necessitate a demonstration of a certain personal income threshold before approval, as lenders require assurance of the borrower’s ability to repay the loan. When income falls short, securing the loan becomes more challenging, especially for those aiming to invest in larger properties.

In contrast, a DSCR (Debt Service Coverage Ratio) loan evaluates the discrepancy between the anticipated property cash flow and the total expenditures. If the ratio exceeds one, the cash flow is deemed sufficient to cover both expenses and loan repayments, making it more likely for the lender to approve the loan. Conversely, the ratio below one might hesitate lenders to proceed unless you can provide evidence of your ability to bridge the gap. You can calculate your DSCR loan ratio using our DSCR loan calculator here.

Quick Application and Approval

When you come across a promising investment opportunity for a specific property, there might be a need to present your offer swiftly. If you intend to secure the property using a conventional loan, the seller’s patience may wear thin, and they could entertain offers from other buyers while awaiting the completion of your loan application. In contrast, DSCR loans, designed with investors in mind, require less documentation. As a result, they can be processed expeditiously, enabling you to submit your offer promptly and avoid the risk of missing out on the opportunity.

Eligible for Various Property Types

DSCR (Debt Service Coverage Ratio) loans offer investors a valuable advantage through their remarkable adaptability to diverse property types, including both short and long-term rental properties. This versatility empowers real estate investors to confidently pursue a broad range of opportunities, whether they involve residential properties for short-term vacation rentals or long-term residential and commercial investments. With DSCR loans, investors can diversify their portfolios across different property categories, each offering unique income potential and investment timelines. This comprehensive financing approach enables investors to explore various real estate prospects, from vacation homes to multi-unit apartment complexes and commercial spaces, all while knowing that DSCR loans provide the financial support needed to realize their investment goals in an ever-evolving market.

Unlimited Loan Application

When searching for DSCR loan pros and cons, one of the significant benefits is their flexibility when it comes to the number of loan applications you can submit. Unlike some traditional loan programs that limit borrowers to a certain number of concurrent loan applications, DSCR loans often come with no such restrictions. As long as each loan application is tied to a property with a debt service coverage ratio meeting or exceeding the lender’s minimum criteria, you are eligible to obtain further loans for your future investment ventures. This provides investors with the agility to respond promptly to market conditions and capitalize on multiple investment prospects, all under the umbrella of a single DSCR loan program.

Limitations of DSCR Loans

While DSCR loans offer various benefits for real estate investors, they do come with certain limitations that potential borrowers should consider. Let’s take a look at some of the limitations that could help you weigh DSCR loan pros and cons.

- Large Down Payment Given the lender’s need for additional assurances regarding the repayment of a DSCR loan, the initial investment tends to be more demanding. In most cases, prospective borrowers must be prepared to make a downpayment of 25%. As a result, individuals seeking this type of loan will need a substantial amount of capital to allocate toward the required down payment, which is essential to secure financing for the remaining purchase amount.

- High Credit Score. Prior to approving a DSCR loan, lenders further want a higher credit score, typically at a minimum of 680. This demonstrates the borrower’s track record of timely payments and responsible debt management. While the loan’s approval primarily centers on property cash flow, it still mandates a borrower with a good credit history, establishing trust that the loan will be repaid in full by a reliable individual.

- Interest Rates. DSCR loan rates tend to be higher because they are considered riskier investments for lenders. The increased interest rates are a precautionary measure to offset potential risks associated with the borrower’s ability to maintain the required debt service coverage ratio. Additionally, as loan amounts rise, lenders may require higher service fees to manage larger and more complex transactions, resulting in increased overall borrowing costs for the borrower.

Should I Apply For a DSCR Loan?

After considering DSCR loan pros and cons, you might be wondering if they’re a good fit for your upcoming real estate project. Just remember, DSCR loans are designed specifically for rental properties used for business purposes and can’t be used for your primary home.

DSCR loans can be a smart choice for both beginners and experienced real estate investors because they focus on rental income instead of your personal income. If you’re new to real estate investing, a DSCR loan can be a helpful tool to secure financing for your first property. And if you’re already an experienced investor, it can speed up the financing process and assist in expanding your real estate portfolio.

But again, while a DSCR loan can be a valuable tool for investing, it does come with some downsides like requiring a larger upfront payment and having higher interest rates. So, if you don’t have the cash for a big down payment and prefer lower monthly payments, this might not be the best choice for you.

To decide if a DSCR loan is right for you, it’s a good idea to carefully consider your investment goals and the expected income from the property. See if these factors match up with the requirements of a DSCR loan. If they do, then a DSCR loan could be a great fit for your investment plans.

5 Steps to Apply for a DSCR Loan

Securing a DSCR (Debt Service Coverage Ratio) loan for your real estate investment involves a series of key steps to follow. Here are 5 steps on how to get a DSCR loan.

- Look for a DSCR Lender. Start by researching and identifying a lender that specializes in DSCR loans, as not all financial institutions offer these unique financing options. Look for lenders with experience in real estate investment lending.

- Apply for a DSCR Loan. Once you’ve found a suitable lender, initiate the application process. Provide your financial information, details about the property, and any other required documentation. Be prepared to outline your investment strategy.

- Submit Your Documents. To determine if you qualify for a DSCR loan, they’ll look at how much money the property you’re buying can make. You need to show that the property’s income can cover the loan payments. To do this, provide documents that prove the property’s earnings compared to the loan amount.

- Compute Your DSCR. The lender will calculate the Debt Service Coverage Ratio to assess the property’s ability to generate enough income to cover the loan payments. A DSCR above one indicates a higher likelihood of loan approval.

- Accept the Loan Terms. If your application is approved, carefully review the loan terms, including interest rates, repayment schedule, and any associated fees. Once you’re satisfied with the terms, accept the loan offer and move forward with the financing for your real estate investment.

DSCR Loan Pros and Cons FAQs

What are the risks involved in applying for a DSCR loan?

The risks of applying for a DSCR loan include the potential for higher interest rates, the need for a larger down payment, and the requirement for a strong property income to cover the loan payments. There is also the risk of not achieving the lender’s strict eligibility requirements, which may include a high credit score requirement,

What can I do if my DSCR is low?

There are several steps that property owners can do to increase DSCR ratio such as increasing rental income and reducing expenses. Refinancing existing debt with more favorable terms, cutting non-essential costs, and improving occupancy or sales can also help. Additionally, renegotiating loan terms with lenders can lead to a more manageable debt service, improving the DSCR and increasing financing opportunities.

I don’t think a DSCR loan is right for me. What other real estate financing options do I have?

Understanding DSCR loan pros and cons is essential to determine if they suit your real estate investment needs. If they don’t or you don’t qualify, you have alternative options.

One option is bank statement loans, which assess eligibility using alternative underwriting methods, such as reviewing bank statements rather than traditional pay stubs and W2s. Asset-based loans offer another route, allowing you to qualify for a mortgage by leveraging your assets as income sources, including bank, investment, and retirement accounts. For investors in need of higher loan amounts and more flexible down payment and debt-to-income ratio (DTI) requirements, jumbo loans are a viable choice, particularly suited for high-income earners. Additionally, commercial real estate loans can be tailored to individual borrowers, enabling portfolio expansion across various property types, from single-family homes to commercial properties. These diverse financing alternatives ensure that you can find a suitable solution to align with your unique real estate investment objectives.

Start Your DSCR Loan Today!

DSCR loans serve as a valuable tool for serious real estate investors. Unlike conventional loans, they rely on property cash flow rather than personal income, making them swift options for fast deals. So, understanding the DSCR loan pros and cons is vital to determining their rightful place in your investment strategy.

But unlike conventional loans, they rely on property cash flow rather than personal income, making them a quick option for fast deals. Moreover, there are no limitations on the number of DSCR loans you can secure when reinvesting your profits into more properties. If you possess the capital and a strong credit score, leveraging DSCR loans can be a strategic asset for your real estate investment endeavors.

KEY TAKEAWAYS

- DSCR loans come with distinct qualities and offer exceptional benefits.

- DSCR loans require larger down payment, a reputable credit score, and higher interest rate.

- To determine if a DSCR loan fits your needs, assess your investment goals and expected property income closely.