Investing in real estate is an excellent way to build long-term wealth while creating a stream of passive income. However, delving into the world of real estate is not a decision to be taken lightly. It requires careful consideration of several factors such as timing, local market dynamics, and financing in real estate.

So, the question remains: How do you know when you’re ready to invest in real estate? Let’s explore the key indicators that signify your readiness to enter the world of real estate financing and investment.

When is the best time to start financing in real estate?

The real estate market, similar to other markets, operates in cycles that can be influenced by things like interest rates, how well the economy is doing, and how confident people feel about buying houses. These elements can result in either a scarcity or surplus of housing. A seller’s market materializes when there’s a scarcity of housing. Think of this as a “low supply, high demand” situation. There are more people who want to buy houses than there are houses available. On the other hand, a buyer’s market means there are more houses for sale than there are people looking to buy them. A balanced market, in contrast, transpires when the number of homes for sale equals the number of buyers, creating equilibrium in the market.

When you’re in the market to buy or sell a home, understanding the current market conditions is fundamental. If you’re not sure, don’t hesitate to consult your real estate agent. Selling a home in a seller’s market is the ideal scenario, just as purchasing a property in a buyer’s market offers the most advantageous conditions.

6 Signs You’re Ready for Real Estate Financing

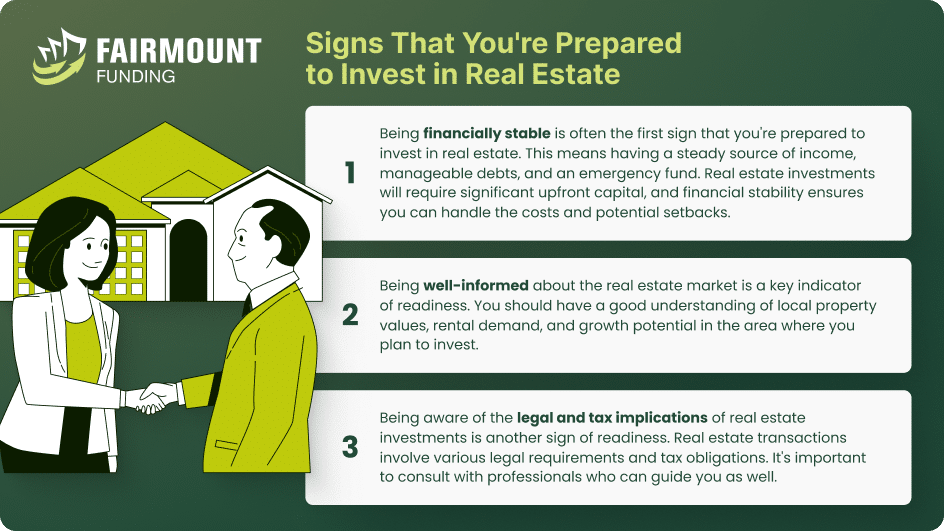

The best time to start financing in real estate largely depends on market conditions and your financial readiness. Here are six signs that indicate you are ready for financing a real estate investment.

Sign #1: You Know Your Investment Goals

Setting up clear financial goals indicates that you’re ready to buy a home. Many people fail to create financial objectives and frequently have insufficient savings and assets when they are ready to retire. You’re probably in the correct frame of mind to seriously consider real estate investment if you find yourself at a place in life when you’re sincerely devoted to creating a wealth-building strategy, or if you’re feeling trapped in a career that lacks long-term appeal.

Sign #2: You Have a Target Market

The ability to identify your target market is one indicator of real estate investing readiness. It entails comprehending the precise geographic regions or property types that support your investment objectives. The success of your investment may be considerably impacted by your market selection. Your market decision should be influenced by variables including job growth, demographic trends, and neighborhood amenities. While your property search and investment decisions should be guided by a thorough understanding of your target market.

Sign #3: You Have a Retirement Fund

When thinking about real estate finance, it is essential to secure your financial future. Financial readiness can be shown by having a savings or retirement plan that is well funded. With this safety net in place, you can be sure you have the resources to endure any potential ups and downs in the real estate investment market. Additionally, it adds an extra measure of protection for your later years of life.

Sign #4: You Have the Capital

Investing in real estate often requires a substantial amount of capital. Your readiness is evident when you have access to the necessary funds, either through personal savings, investment partners, or real estate investor funding. Adequate capital allows you to cover property acquisition costs, maintenance expenses, and unforeseen repairs without compromising your financial stability.

Sign #5: You Have the Time

It can take a lot of time to invest in real estate. If you find yourself with the time and commitment to manage your properties effectively, you’re well-prepared for this task. Having the time to devote to your investments is a great asset, whether it be for managing tenant issues, performing property maintenance, or keeping up with the market.

Sign #6: You Have Risk Tolerance

Being ready for real estate financing means having the right level of risk tolerance. You should be prepared for potential market fluctuations, property vacancies, and unexpected expenses. If you can withstand these uncertainties and view them as part of the investment journey, you’re in a good position to start investing in real estate.

Choosing a Real Estate Investment

Real estate has many different ways to invest, and each type suits a different kind of investor. But whether you’re just starting or have lots of experience, you can always choose a new real estate investment. Here are some tips for picking your first or next investment:

- Study the current market. The real estate market is no different from most investment options in that it is subject to market fluctuations. Timing is always a factor when it comes to real estate investment. The golden rule is to purchase when prices are low and sell when they’re high to maximize your return on investment.

- Determine your investment goals. Define your investment goals before you start. If you want your own home, consider residential property. For a steady income, explore commercial or rental options. Ensure your goals are realistic and achievable.

- Lay down your options. When you know your goals, it’s time to consider your choices. Homes far from the city center may cost less, but those near the action and transportation tend to be better investments. So, pick a property that finds the right mix of price, quality, and location.

- Consider the cash flow. When financing a real estate investment, choose options that generate positive cash flow, even after accounting for expenses and fees, as real estate can tie up your funds for extended periods.

- Get the right mortgage. Real estate investments often come with high costs, and you might not have enough funds on hand. Therefore, it’s essential to select the right mortgage plan that fits your current financial situation. Funding for real estate investors like loans and mortgages can provide the necessary resources to kickstart your real estate investment, but it’s imperative to manage them diligently to avoid financial strain.

Getting a Mortgage for Financing in Real Estate

Securing a mortgage is a common route for financing in real estate, and various options are available to cater different needs. Here’s a brief overview of some common mortgage sources:

- Conventional Bank Loan. Conventional bank loans, offered by traditional financial institutions, are the most common choice for real estate financing. They come with competitive interest rates and are ideal for borrowers with strong credit and a substantial down payment.

- Hard Money Loan. Hard money real estate loans are typically sought by investors looking for quick, short-term financing. These loans are provided by professional private lenders and are based on the property’s value rather than the borrower’s credit, making them a viable option for those with credit challenges.

- Private Financing. Private financing involves borrowing from individuals like relatives, friends, or private investors rather than traditional banks. It can offer flexible terms, but interest rates may vary depending on the agreement between the borrower and lender.

- Home Equity. Using the equity in your existing home to secure a loan for real estate investment is another option. This method allows you to tap into the value you’ve built in your primary residence and use it as collateral for your investment property loan.

- Government-Backed Loan. Government-backed loans, such as those offered by the Federal Housing Administration (FHA) or the Veterans Affairs (VA), are designed to assist homebuyers who might not qualify for conventional loans. These loans often require lower down payments, making them accessible to a wider range of borrowers.

Commercial Real Estate Financing Options

Commercial real estate financing is the lifeblood of many businesses and property investors, providing the capital needed to purchase, develop, or refinance commercial properties. These properties include office buildings, retail spaces, industrial facilities, and more. Options include:

- Commercial Mortgage Loans: Offered by banks, these suit medium-to-large projects with a 20% down payment and competitive rates.

- SBA Loans: Small Business Administration: Offers 7A loans for smaller projects and 504 loans for larger investments, reducing lender risk.

- Hard Money Loans: Quick, short-term financing secured by the property, appealing for investors.

- Soft Money Loans (Online Marketplace Loans): Connect borrowers with private investors, featuring interest rates between banks and hard money loans.

- Joint Venture Loans: For sharing risks and rewards in a property investment without forming a formal partnership.

Financing in Real Estate FAQs

How can I qualify for investment property financing?

Every lender has distinct qualification criteria. Hard money lenders are attracted to hot markets and high-value properties, while private lenders often prioritize relationships. Conventional lenders, especially home equity lenders, have stringent requirements. To navigate your way through a specific loan type, it’s advisable to engage in discussions with lenders to understand their unique prerequisites and the steps to follow. This information equips you with the knowledge necessary to plan the next steps for financing your investment properties.

How can I reduce my mortgage payments on your investment property?

You can reduce mortgage payments on your investment property by refinancing for a lower interest rate, extending the loan term, increasing your down payment, and enhancing property income through higher rent or occupancy. Seek competitive insurance rates, review property taxes, and consider loan modification with your lender for more manageable payments.

How can I sell my properties during different house markets?

Selling properties during varying market conditions requires adaptability. In a seller’s market, focus on competitive pricing and effective marketing. In a buyer’s market, be flexible on pricing, offer incentives, and maintain property conditions. In a balanced market, strike a pricing-incentives balance and emphasize property strengths. Local economic factors and guidance from a skilled real estate agent can provide market-specific advice and effective marketing.

The Big Decision: Real Estate Investment Calls for Assurance and Intuition

Real estate investing is a huge decision, one that is frequently accompanied by apprehension. It’s important to approach this decision with assurance and a thorough knowledge of the real estate market. Your basis is thorough research; it serves as the backbone for all other actions. You need to thoroughly check all the requirements and aspects involved in your investment. Location of the property, market trends, available financing in real estate, and prospective profits are all included.

However, while comprehensive research and due diligence are your cornerstones for a successful real estate investment, don’t underestimate the importance of your gut feeling. It acts as a final checkpoint, ensuring that all the facts and figures align with your readiness and instincts. Rushing into a risky investment without being adequately prepared can lead to regrets, whereas a well-informed and intuitively guided decision can set you on a path to financial growth and success in real estate.

KEY TAKEAWAYS

- The real estate market goes through cycles influenced by interest rates, economic conditions, and buyer confidence.

- The right time to initiate financing in real estate is primarily determined by market conditions and your financial readiness.

- Mortgages are a popular choice for financing real estate, with a range of options available to accommodate various needs.