Are you dreaming of becoming a real estate investor but short on funds? Knowing how to buy a multifamily property with no money might sound like a real estate unicorn. While it is true that real estate investment typically requires substantial capital, there are creative strategies that you can use to break into the market with minimal upfront cash.

Multifamily property investing can be an excellent way to build wealth over time. Imagine having multiple rental units under one roof, contributing to your financial stability. In this guide, we will explore innovative approaches and actionable tips to help you buy a multifamily property with little to no money down.

Why should you invest in multifamily properties?

Before deciding to buy a multifamily property, assessing the advantages and disadvantages of such a real estate investment strategy is crucial. Nonetheless, there are appealing aspects of knowing how to buy a multifamily property with no money.

- Regular income. One of the primary advantages of this investment is the consistent monthly income a multifamily property can generate. Well-structured deals can offset your monthly expenses, ensuring a steady cash flow.

- Income diversity. In the case of a vacancy in a single-family property, you face a complete loss of income during that period. Conversely, in a multifamily property, if one unit remains unoccupied, the other units continue to generate income, mitigating the impact of vacancies.

- Low maintenance. Many maintenance tasks, such as roofing or central heating repairs, can be addressed simultaneously for all units within a multifamily property. This approach saves both time and money on materials and labor.

- Diverse revenue streams. In more significant multifamily properties, investors can establish additional income sources on-site. This may involve charging tenants extra fees for parking or garage spaces or installing coin-operated laundry facilities, generating supplemental income alongside monthly rent.

- Performance-based financing. Financing for multifamily properties is contingent on the property’s performance, not solely on your financial situation. This can be advantageous if you seek to invest in real estate but need a strong credit score.

Is it possible to buy a multifamily property with little to no money?

When acquiring real estate, you often have two options: Purchasing with cash or getting a mortgage loan.

There are various types of real estate loans. Many of these will require you to provide a portion of the property’s purchase price as an initial cash payment. This is commonly known as a down payment.

The minimum sum you must put down depends on your chosen mortgage category, although making a 20% down payment is typical. Regardless, your down payment is pivotal in shaping the terms and interest rates lenders will extend to you.

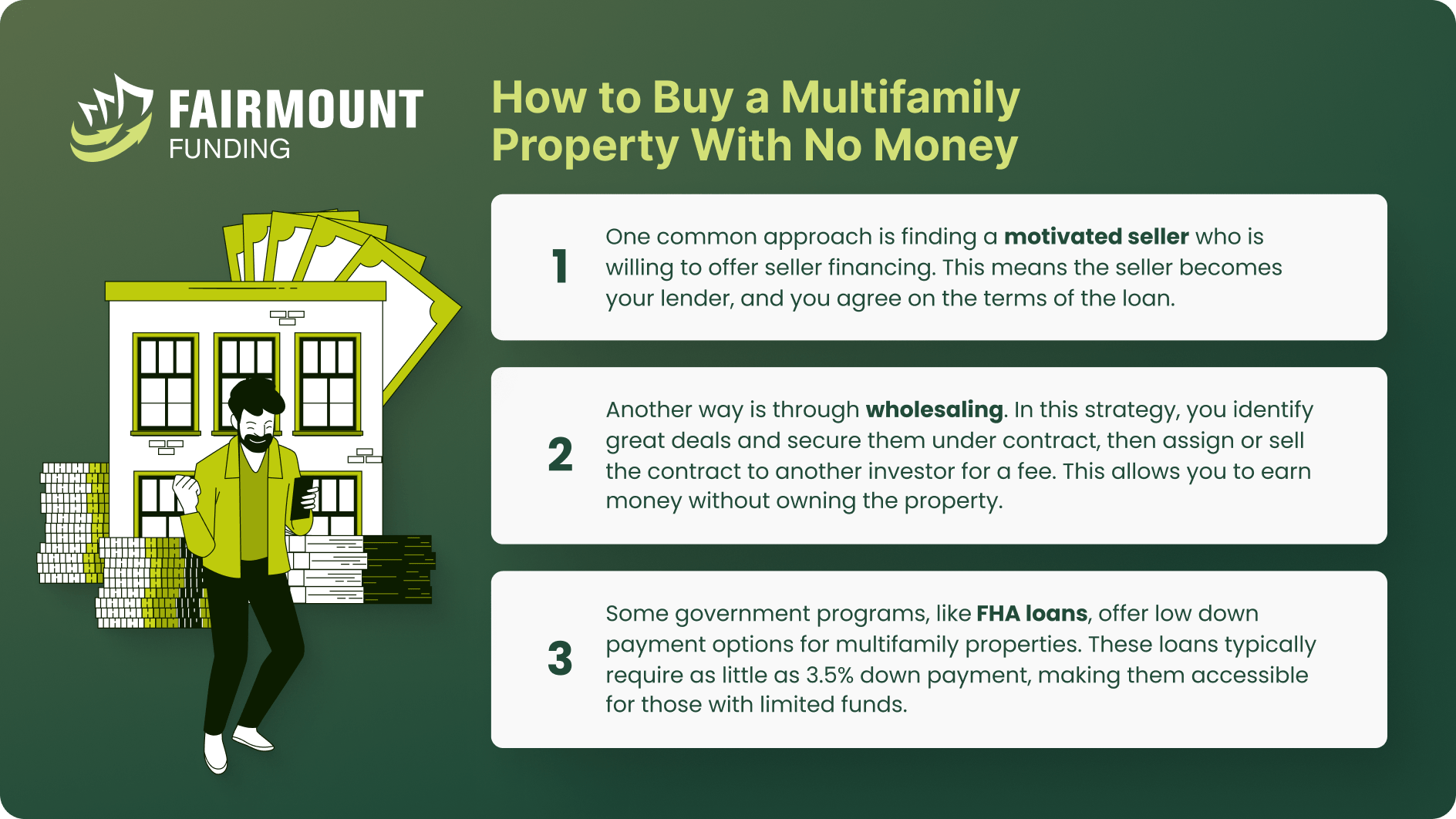

Recognizing that this capital does not necessarily have to originate from your funds is essential. When investors engage in “no money down” strategies for purchasing multifamily properties, it signifies their utilization of minimal to no private funds to cover the upfront expenses associated with the transaction.

If your finances are limited, several alternative methods on how to buy multiple properties with no money are available.

8 Ways to Buy a Multifamily Property Without Money

Having a multifamily property can be an excellent investment for real estate investors. However, doing so comes at a significantly greater cost than purchasing single-family homes. Fortunately, there are eight creative ways on how to buy a multifamily property with no money.

1. Start With a Duplex

Starting small can be a smart move. Purchase a duplex, a two-unit property, and live in one unit while renting out the other. The rental income from the second unit can help cover your mortgage payments, making it an affordable way to begin investing in multifamily properties.

2. House Hacking

House hacking involves living in one of the units within a multifamily property you own while renting out the others. This strategy can significantly reduce or eliminate your living expenses, as rental income can cover your mortgage and operating costs.

3. Find a Co-borrower

Partnering with someone with the financial means to invest can allow you to enter the multifamily property market with limited personal funds. Your co-borrower’s economic strength can enhance your chances of securing a loan.

4. Offer a Share of Equity

If you have valuable skills or expertise, you can negotiate with potential investors or partners to provide equity in exchange for their financial contribution. This arrangement can allow you to pool resources and acquire multifamily properties.

5. Consider Seller Financing

Some sellers may be open to financing part or all of the purchase price themselves. In such cases, you can negotiate favorable terms, such as a lower down payment or flexible repayment terms, to acquire the property with minimal upfront cash.

6. Get a Cash-Out Refinancing

If you own a multifamily property with equity, you can refinance it to cash out some of the equity. This cash can be used as a down payment for another multifamily property, essentially recycling your investment.

7. Apply for a Hard Money Loan

Hard money loans are short-term, asset-based lending options. Compared to traditional mortgages, they are easier to qualify for. While they typically come with higher interest rates, they can be a viable option to secure a property with little to no money down, such as a multifamily rehab loan.

8. Assume a Seller’s Loan

In certain situations, you can assume the seller’s existing mortgage, effectively taking over their loan. This can save you from needing a new mortgage and a substantial down payment. However, ensuring that the terms are favorable and that the lender allows assumption is essential.

If you are curious about how to buy an apartment complex with no money, these strategies provide creative ways to do so. Nonetheless, thoroughly researching and carefully assessing each option would be best to determine which aligns with your financial goals and risk tolerance. Additionally, consulting with real estate professionals and financial advisors can provide valuable insights into executing these strategies effectively.

Choosing a Suitable Multifamily Property Investment Option

There is no singular method on how to buy a multifamily property with no money. Each of the options stated above offers its unique advantages. That is why it is advisable to seek guidance from a financial expert before making any definitive choices.

However, it is worth noting that embarking on real estate investment can be a gradual process. As you gain confidence and familiarity with real estate investment, you can assess whether strategies like house hacking, leveraging home equity loans, or exploring various methods to acquire individual properties align with your investment goals.

Buy a Multifamily Property FAQs

What are the pros and cons of taking a hard money loan to buy a multifamily property?

You can quickly secure a hard money loan to buy a multifamily property. It is also accessible for investors with less-than-ideal credit or limited financial history.

On the other hand, a hard money loan comes with a higher interest rate than traditional mortgages. It also comes with short repayment terms, resulting in higher monthly payments and the need for a quick exit strategy. Lastly, lenders may only finance a percentage of the property’s value, requiring a larger down payment.

What are the qualifications to get a loan for purchasing multifamily properties?

Qualifications for a multifamily property loan can vary depending on the lender. However, the typical requirements include:

- Good Credit Score: A strong credit history and score are often necessary, with higher scores improving loan terms.

- Income and Cash Reserves: Lenders may assess your income, cash reserves, and debt-to-income ratio to ensure you can manage the loan.

- Down Payment: You will need a down payment, usually ranging from 15% to 35% of the property’s purchase price.

- Property Evaluation: The multifamily property will undergo evaluation to determine its condition, value, and income potential.

- Business Plan: A well-thought-out business plan outlining your investment strategy and projected cash flow is highly beneficial.

What are the risks of multifamily property investing?

Investing in multifamily properties carries several risks. This includes fluctuations in the real estate market, impacting property values and rental income.

Economic downturns can increase vacancies and lower rental rates, while inefficient property management can result in higher expenses and tenant issues. Repairs, maintenance, and capital expenditures can arise unexpectedly, affecting cash flow. This is where hiring multifamily property management companies can be helpful.

Buying a Multifamily Property With No Money is a Viable Option

Buying a multifamily property with no money is a daunting challenge. However, careful planning, creative financing, and a willingness to explore various strategies can make it a viable and rewarding endeavor.

As you embark on your journey toward multifamily property ownership, remember there is no one-size-fits-all approach. Your path to success may involve a combination of the abovementioned strategies tailored to your unique circumstances and goals. Ultimately, the road to buying a multifamily property with no money begins with determination, resourcefulness, and a commitment to build a solid foundation of knowledge.

Remember that education is your most valuable asset. Continuously expand your knowledge of real estate investment, financing options, and property management. Seek guidance from experienced investors and financial experts who can provide invaluable insights and mentorship.

KEY TAKEAWAYS

- Investing in multifamily properties results in consistent monthly income, access to diverse revenue streams, and performance-based financing.

- If your finances are limited, several alternative methods on how to buy multiple properties with no money are available.

- Multifamily property investing is a gradual process wherein you should gain confidence and familiarity before leveraging other financing options.