Contrary to popular belief, it’s not always the case that you need a large sum of money to start your real estate investment journey. With the right knowledge, strategy, and determination, you can leverage creative methods to enter the real estate market with little to no upfront cash. From leveraging other people’s resources to utilizing various financing options and tapping into your creativity, there are multiple ways of figuring out how to invest in real estate with no money.

This guide will teach how to invest in real estate using strategies that require minimal capital investment. Whether you are a seasoned investor diversifying your portfolio or a newcomer, Fairmount Funding is here to equip you with the knowledge and tools to succeed in your pursuit of financial freedom.

Is it possible to invest in real estate without money?

If you are new to real estate investing, you might wonder how to start investing in real estate with no money. Is it even possible?

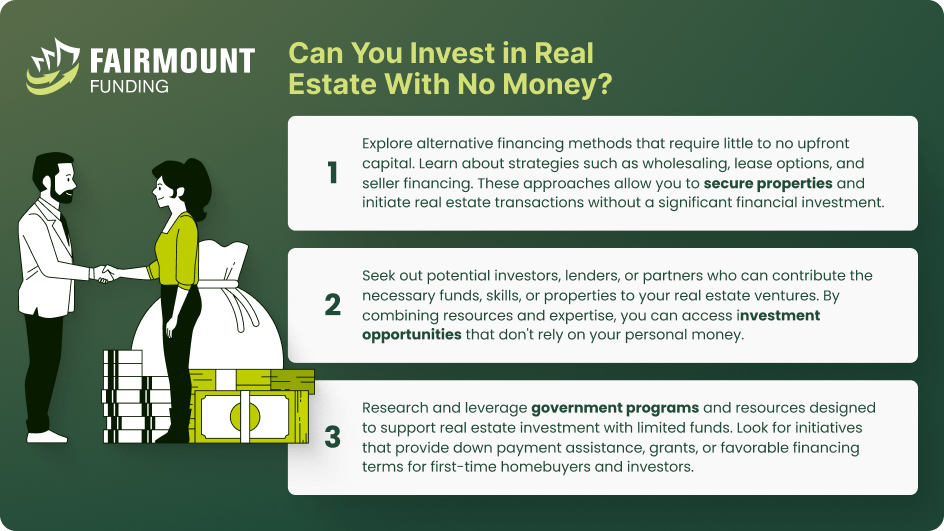

Luckily, you can invest in real estate without shelling out your own money. While having a significant amount of capital does have its benefits, there are a number of alternative strategies that allow investors to join the real estate market with little to no upfront cash.

However, it requires planning, knowledge of various strategies, and negotiating effectively. It is essential to conduct thorough research, network with experienced investors, and understand the specific risks associated with each method.

It is also advisable to consult with real estate attorneys, financial advisors, and/or real estate investment lenders to ensure you are making informed decisions that align with your financial goals.

7 Ways to Invest in Real Estate With Little or No Money

Investing in real estate without using your own money can be achieved through various tactics. Each method has its pros and cons, and success often depends on thorough research, networking, and building relationships within the real estate industry.

Here are seven ways you can invest in real estate with minimal upfront cost:

Home Equity Loans

If you are a property owner, you can tap into your home’s equity by taking out a home equity loan or line of credit. This enables you to access funds based on the difference between your property’s value and the outstanding mortgage balance. You can then use the borrowed money for a down payment or to finance the purchase of another property.

Real Estate Investment Trusts (REITs)

REITs are organizations that own or finance income-producing real estate properties. By investing in REITs, you can become a shareholder and benefit from these properties’ profits. This is a hands-off approach, as professional managers handle the properties, and it does not require direct ownership.

Money Mortgage or Seller Financing

In some cases, sellers may be open to financing their property’s purchase. This means they act as the lender, and you make payments directly to them over time. This method can be an alternative for buyers who’ve yet to secure traditional bank financing.

Hard Money Lending

Hard money lenders are private individuals or companies that offer short-term, high-interest loans based on the value of the property being used as collateral. While the interest rates are high, real estate hard money loans allow investors to secure quick funding without the strict requirements of traditional lenders.

Microloans

Some organizations or microfinance institutions offer small loans specifically for real estate investing. You can easily qualify for these microloans, allowing you to start with smaller-scale projects.

Real Estate Partnerships

Forming partnerships with other investors can effectively pool resources and share the financial burden of real estate investments. Each partner contributes what they can, and together they can pursue more substantial opportunities.

Special US Government Schemes

There are government programs that help first-time homebuyers or real estate investors. These programs include down payment assistance, low-interest loans, or tax incentives to make investing in real estate more accessible.

Pros and Cons of Investing in Real Estate

It can be a rewarding venture to invest in real estate. However, real estate investing also comes with its pros and cons. Below are some of the main advantages and disadvantages of investing in real estate.

Advantages of Investing in Real Estate

- Potential for Appreciation. Real estate properties can appreciate over time, which can lead to substantial returns on investment. As the property value increases, so does your equity.

- Cash Flow and Passive Income. Rental properties can generate regular cash flow through rental income. Once you cover expenses like mortgage, taxes, and maintenance, the surplus becomes passive income, providing financial stability.

- Leverage. Real estate investments often involve leveraging borrowed money, such as mortgages, to purchase properties. This amplifies your purchasing power and potential returns as you control a more valuable asset with a smaller initial investment.

- Tax Benefits. Real estate investors can take advantage of different tax deductions, including mortgage interest, property taxes, depreciation, and operating expenses.

- Hedge Against Inflation. Real estate investments can act as a protection against inflation. That is because rental income and property values tend to rise with inflation. This can help preserve your purchasing power.

Disadvantages of Investing in Real Estate

- Illiquidity. Liquidating a real estate property can be challenging compared to other investments. Selling a property can take time, and you may need help to access your capital quickly in case of emergencies.

- Maintenance and Expenses. Properties require ongoing maintenance and may incur unexpected expenses, cutting into your cash flow and profitability.

- Market Risk. Economic factors, market conditions, or changes in the local area can impact a property’s value. A decline in the real estate market could lead to decreased property values and potential financial losses.

- Financing Risks. Using leverage can magnify returns, but it also increases risk. If property values decline or rental income drops, it may become challenging to meet mortgage obligations.

- Regulatory and Legal Challenges. Real estate investments are subject to regulations and legal issues, such as zoning restrictions, tenant rights, and landlord responsibilities.

Best Places to Invest in Real Estate

The average cost of buying a house in the United States is at least $300,000. Meanwhile, a house for sale tends to stay on the market for ten days before it gets sold.

That said, the country has a moderate seller’s real estate market. This means property investors may still face a bidding war when buying a house despite the increasing inventory. Hence, investors need to crunch the number to identify the best places to invest in real estate.

The rule of thumb is to look for areas with a high return on investment for your properties. Before you invest in real estate, ensure that the location has the following:

- High rental occupancy. Assess the vacancy rate in the area to ensure a healthy demand for rental properties.

- Favorable rental income compared to mortgage payments. Aim to cover a significant portion of your mortgage through rental income.

- Low tenant default rate. Choose areas where tenants are reliable and have a good track record of paying rent in a timely fashion.

Other factors you should consider are its growth, stability or decline, and whether you seek short-term capital gains or long-term buy-and-hold opportunities. Market timing is crucial, especially in cities with excellent rental income potential but limited available properties. Acting swiftly and wisely is essential to secure deals that meet your investment criteria.

Invest in Real Estate FAQs

How can I make money in real estate investing?

Knowing how to invest in real estate is worthwhile because it can bring in recurring income. Here are several ways to make money in real estate investing:

- Market appreciation. Over time, properties can increase in value due to market appreciation. Buying in an area with growth potential can lead to significant returns when you sell.

- Rental income. Owning rental properties can generate regular cash flow through rental income, providing a steady stream of passive earnings.

- Short-term rentals. Platforms like Airbnb offer opportunities to earn higher returns by renting out properties for short periods.

- Fix and flip. Some investors purchase distressed properties at a lower price, renovate them, and sell them at a higher price for a profit.

- REITs. Investing in REITs enables you to be a shareholder in real estate properties and earn dividends from their profits.

Is it a good idea to invest in real estate with little to no money?

Investing in real estate with little to no money can be possible, but it comes with risks and challenges. Some strategies include wholesaling, lease options, seller financing, or forming partnerships. While these methods may require less upfront capital, they still involve potential risks and may require strong negotiation skills.

Additionally, it is essential to thoroughly understand the specific strategy you choose and be prepared for the time and effort it may take to find suitable deals. Always conduct due diligence, seek professional advice, and carefully assess the risks before pursuing real estate investment with minimal funds.

What is the BRRRR method?

The BRRRR method stands for the following:

- Buy. Acquire a property below market value, often a distressed or undervalued property.

- Rehab. Renovate and improve the property to increase its value and make it suitable for rental.

- Rent. Place tenants in the property and start generating rental income.

- Refinance. Once the property is stabilized and has increased in value, refinance it to pull out the initial investment or a significant portion of it.

- Repeat. Use the funds from the refinance to reinvest in another property, repeating the process and building a portfolio over time.

The BRRRR method is a popular way on how to create wealth investing in real estate. That is because it allows investors to recycle their initial capital and acquire multiple properties without continuously relying on new funds. Nonetheless, it is essential to be strategic when selecting properties and estimating renovation costs accurately. This is to ensure a positive cash flow after refinancing to make this method successful.

Invest in Real Estate and Start Building Your Wealth

It may seem daunting to invest in real estate without money. However, it is possible with the right knowledge and creativity.

Embracing alternative strategies like wholesaling, seller financing, or real estate partnerships allows you to kickstart your property investment journey, even with limited funds. However, it requires careful consideration, thorough research, and a well-thought-out strategy.

By leveraging the available options, aspiring investors can take confident steps toward building wealth in real estate.

KEY TAKEAWAYS

- With thorough planning and knowing the right strategies, it is possible to invest in real estate with little to no money.

- It can be a rewarding venture to invest in real estate, although it also has its limitations.

- It is advisable to make real estate investment in places with high rental occupancy, favorable rental income, and low tenant default rate.