The allure of multifamily properties continues to soar as the real estate market evolves. Thus, they are becoming a popular choice among property investors seeking stable and long-term returns.

One of the advantages of investing in multifamily properties early is generating substantial cash flow. With multiple units bringing in rental income, investors can enjoy steady revenue streams that often outperform those derived from single-family homes. It also allows them to spread expenses across multiple units, reducing individual overhead costs.

This financial efficiency of owning a multifamily investment property can improve profitability and increase cash-on-cash returns. This post will discuss multifamily property investing and why you should consider it.

What is multifamily property investing?

Multifamily property investing refers to purchasing and owning residential properties that consist of multiple housing units. Multifamily residential properties can include apartment buildings, condominium complexes, townhouses, and duplexes.

The primary objective of multifamily property investing is to generate rental income from the tenants who lease the individual units. The property owner or investor becomes the landlord and is responsible for property management, collecting rent, and maintaining its upkeep.

The 4 Advantages of Investing in Multifamily Properties

Are multifamily properties a good investment? The answer is that yes, it can be a very worthwhile and lucrative venture.

Investing in multifamily properties allows investors to build wealth through real estate. However, achieving optimal results requires careful research, due diligence, and a well-thought-out strategy so you can enjoy the following benefits.

Steady Cash Flow

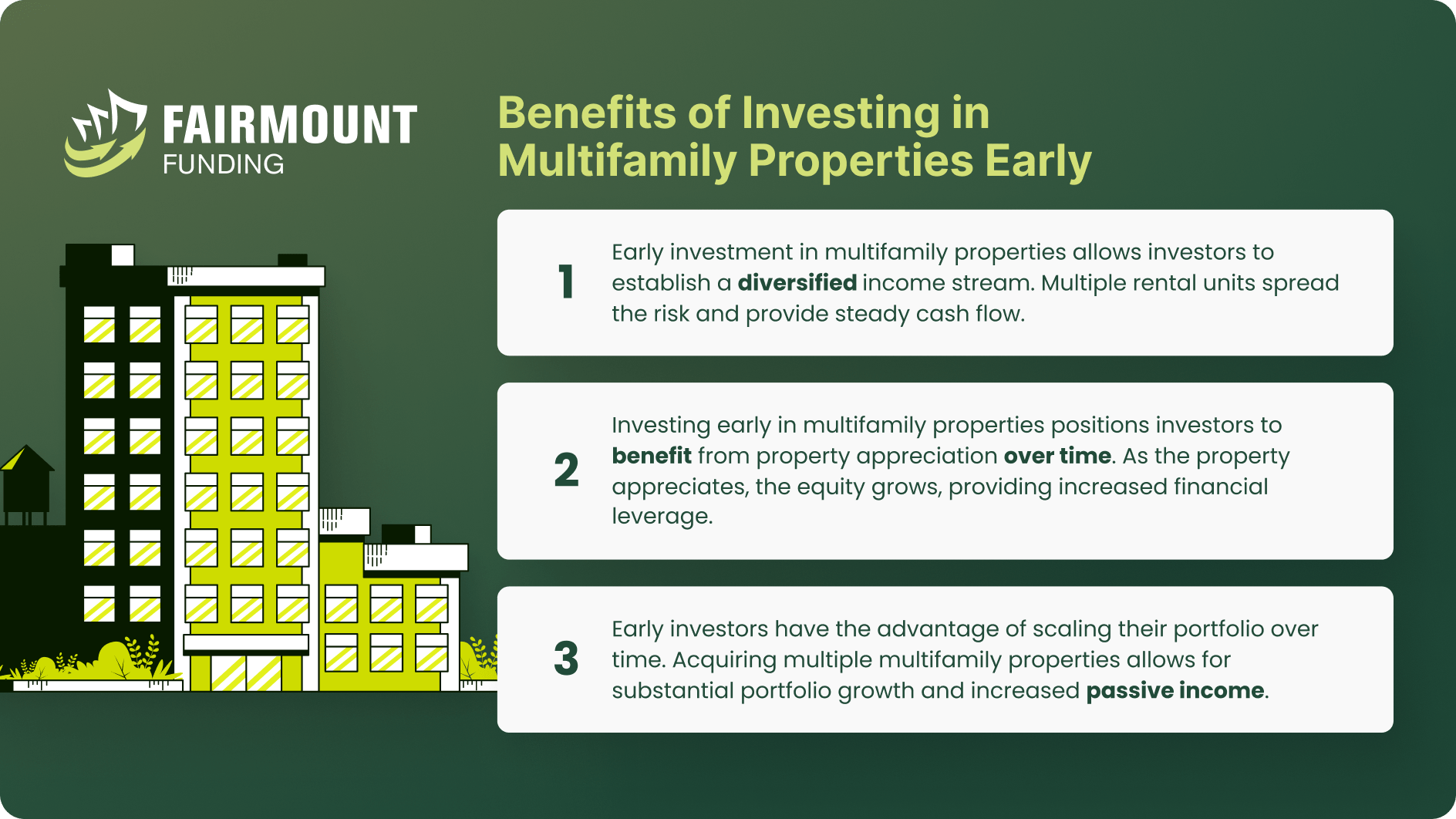

Multifamily properties generate multiple rental income streams from the various units within a property. This steady cash flow can provide a more predictable and stable income than single-family properties, where vacancies may lead to income gaps.

Moreover, owning a multifamily property diversifies the investment risk. Even if one or a few units are vacant, the other units continue to generate income, providing a buffer against potential losses.

Property Appreciation

Multifamily properties appreciate in value over time, especially if they are located in areas with increasing demand for housing. This can lead to increased equity and wealth for the investor.

Relatively, investors can actively increase the value of a multifamily property by making strategic renovations and improvements. Enhancing the property’s appeal can justify higher rents, leading to improved cash flow and higher overall property value.

Financing Opportunities

Multifamily properties generally have better access to financing options. One reason is that lenders that provide multifamily financing view multifamily properties as more stable and less risky. Thus, owning a multifamily property means you can quickly secure a loan for multifamily investment property with favorable terms.

Economies of Scale

Managing multiple units within a single property allows for cost efficiencies. That is because you can spread the cost of expenses for maintenance and repairs across the units. Doing so reduces the overall cost and increases your profit margins.

Moreover, rental income, property appreciation, and potential tax benefits can contribute significantly to an investor’s financial success. As such, investing in multifamily properties allows you to build long-term wealth.

How can I finance my multifamily investment property?

There are various financing options you can choose from when investing in multifamily properties, such as a multifamily rehab loan. However, you must first assess your financial situation, investment goals, and risk tolerance.

This is where using a multifamily mortgage calculator can be helpful. This tool provides an estimate of how much monthly mortgage you may need to pay. This way, you can determine whether you are spending more than what you can afford.

Types of Multifamily Investment Property Loans

Conducting thorough research on what multifamily investment property loans will suit you leads to an informed decision that aligns with your investment strategy. Below are the financing options you can choose from when investing in multifamily properties:

- Traditional Bank Loans. Many investors secure financing through conventional lenders like banks or credit unions. These institutions offer multifamily investment property loans that typically come with competitive interest rates and favorable terms, especially if you have a strong credit history and a solid financial profile.

- Government-Sponsored Loans. Agencies like the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) provide multifamily loans with lower down payment and more lenient qualification criteria. FHA loans are ideal for first-time investors, as they offer attractive terms for multifamily properties with a maximum of four units.

- Private Lenders. Private lenders can be an option for investors who cannot meet the strict requirements of banks and credit unions. However, these loans often come with higher interest rates and shorter loan terms.

- Multifamily Bridge Loans. Multifamily bridge loans are a short-term financing option that bridges the gap between purchasing a property and securing permanent financing. These loans can be helpful when an investor needs immediate capital to acquire a multifamily property and plans to refinance or sell it afterward.

- Seller Financing. There are instances when the property seller may be willing to provide financing to the buyer. This arrangement can offer flexibility in terms and qualification criteria, making it an attractive option for investors.

Multifamily Property Investing FAQs

Is multifamily property investing right for me?

Deciding whether multifamily property investing is suitable for you depends on various factors. This includes your investment strategy, financial goals, and risk tolerance.

Multifamily properties can bring in a steady income and provide tax benefits. However, they also require active management. If you prefer a more hands-off approach, other options like real estate investment trusts (REITs) may be more suitable.

What are the risks associated with multifamily property investing?

As with any investment, multifamily property investing comes with its share of risks:

- Vacancy and Cash Flow. The vacancy rate of rental properties increased from 5.8% to 6.4% during the last quarter of 2022 and the first quarter of 2023. If units remain vacant for extended periods or rental rates drop significantly, it can impact the property’s cash flow and your ability to cover expenses.

- Economic Factors. Real estate markets are susceptible to fluctuations, and property values may not always appreciate. Changes in the local or national economy, such as a downturn or recession, can also affect rental demand and property values.

- Property Maintenance. Repairs and maintenance costs can be substantial, especially with multiple units. Failing to maintain the property adequately can lead to decreased tenant satisfaction and property value.

- Financing Risks. If you took on debt to finance the investment, interest rate changes or inability to secure refinancing could pose risks.

- Regulatory and Legal Issues. Eviction laws, tenant disputes, and compliance with local regulations can present challenges for property owners.

How can I maximize my returns when investing in multifamily real estate?

To maximize ROI when investing in multifamily properties, it is vital to do your due diligence. That is because successful multifamily property investing requires careful planning, continuous monitoring, and adapting to changing market conditions. Consulting with experienced investors or real estate professionals lets you gain valuable insights into achieving your investment objectives.

Build Long-Term Wealth in Real Estate by Investing in Multifamily Properties

Investing in multifamily properties can be lucrative and rewarding for those seeking to build wealth through real estate. The advantages of multifamily property investing, like steady cash flow, economies of scale, and potential property appreciation make it an appealing option for seasoned and new property investors.

However, it can help if you also acknowledge the associated risks and challenges of investing in multifamily properties. Vacancies, property maintenance, market fluctuations, and regulatory issues can all impact the success of the investment. Fortunately, diligent research, careful planning, and effective property management can mitigate these risks and give you a strong return on investment.

KEY TAKEAWAYS

- One of the benefits of investing in multifamily properties includes having a steady income that can outperform those derived from single-family homes.

- However, changes in the local or national economy can impact rental demand and property values.

- This is where careful planning, continuous monitoring, and adapting to changing markets can come in handy.