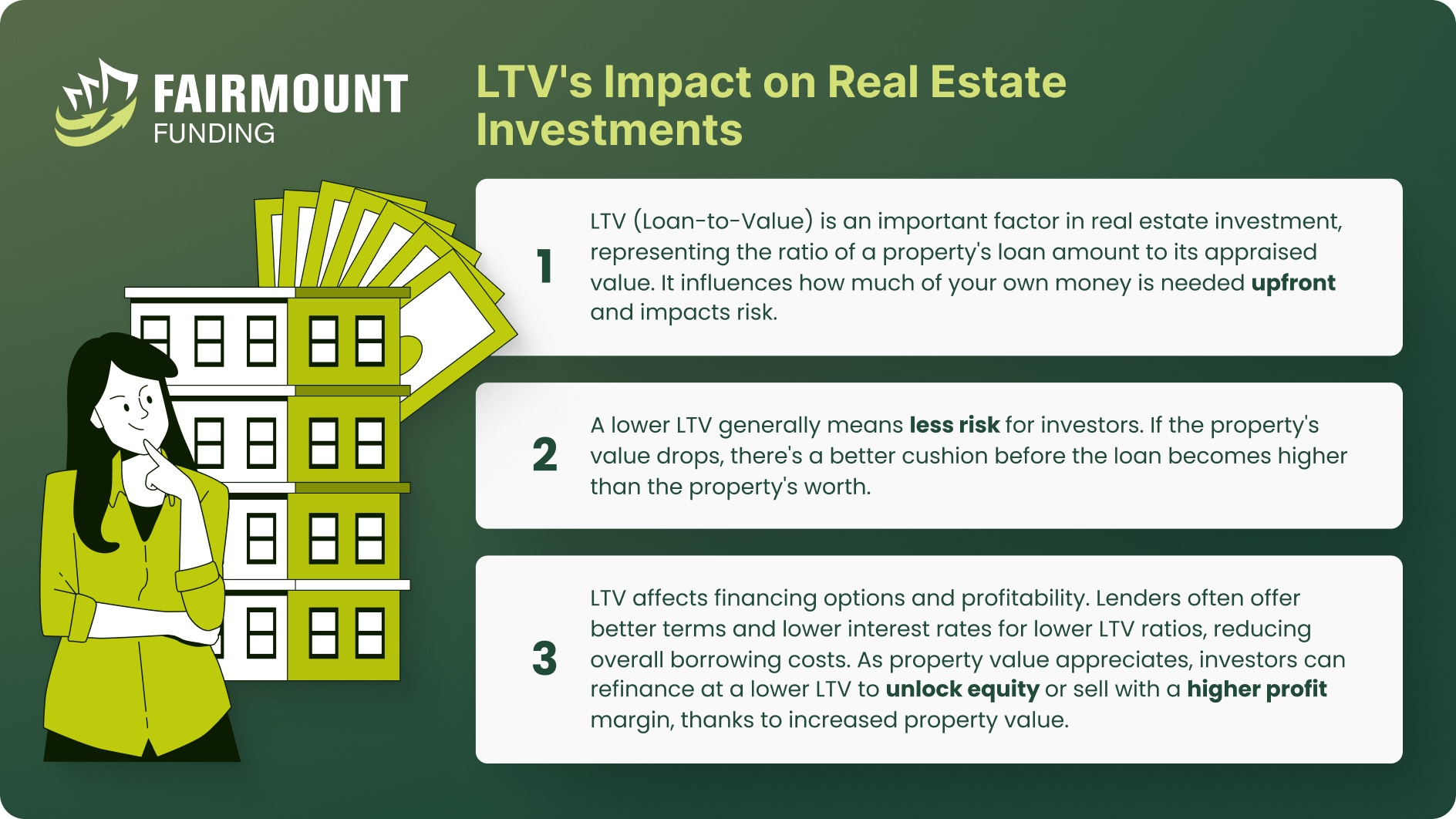

Whether you’re a seasoned pro or just diving into the real estate game, you’ve probably run into the whole loan-getting process. And guess what? There’s this nifty thing called the “loan-to-value ratio” or LTV that’s kind of a big deal. Basically, it tells you how much money you’re borrowing compared to how much your property’s worth. No matter if you’re a real estate guru or just getting started, familiarizing yourself with this ratio can be a game-changer. It helps you see where you stand financially and reveals the secret language of lenders, enabling you to navigate the financing process with confidence. Continue reading to explore loan-to-value ratios further and discover how this knowledge can benefit you.

What is the loan-to-value ratio?

The loan-to-value ratio is a straightforward calculation that assesses the extent of financing employed to acquire an asset in relation to the asset’s value. It provides a glimpse into the equity that a borrower holds in the property they’ve obtained – the residual value remaining if they were to sell the property and repay the loan. Essentially, LTV is the inverse of a borrower’s initial down payment. Let’s say a homebuyer decides to put down 20% of the property’s purchase price as a down payment. In this case, their loan-to-value ratio (LTV) would be 80%, as it represents the portion of the property’s value covered by the loan, with the down payment covering the remaining 20%.

The loan-to-value (LTV) ratio is a key factor in mortgage, home equity loans, and lines of credit applications. When your LTV ratio is at or below 80%, you’re likely to secure the most favorable interest rates. If your LTV ratio is higher, you may still be approved, but you’ll likely face higher interest rates. Additionally, LTV ratios exceeding 80% often necessitate the purchase of private mortgage insurance (PMI), which adds extra costs, typically ranging from 0.5% to 1% annually. PMI payments continue until your LTV reaches 80% or lower, which can occur as you pay down the loan or your home appreciates in value.

Lower LTV ratios not only increase your chances of loan approval but also often eliminate the need for PMI. Although it’s not a legal requirement, most lenders adhere to the 80% LTV guideline. So, how is the loan-to-value ratio typically used? It serves as a key determinant of your borrowing costs, influencing both interest rates and the need for PMI, ultimately impacting your overall loan affordability.

Using the LTV Formula

To determine how to calculate LTV ratio, simply take the amount borrowed for an asset and divide it by the appraised value of the property under consideration.

LTV Ratio = (Loan Amount / Property Value) x 100

Here are the key components:

Loan Amount: This is the total amount of money borrowed to purchase or refinance the property. It includes the principal loan amount and any additional fees or costs rolled into the loan.

Property Value: This represents the current market value of the real estate asset. Property value can change over time due to factors like market fluctuations, property improvements, or renovations.

Interpreting the LTV result:

- Below 80% LTV: An LTV ratio below 80% is generally considered favorable. It indicates that the investor has a significant equity stake in the property, which can lead to more favorable loan terms, lower interest rates, and reduced risk.

- Between 80% and 95% LTV: An LTV ratio in this range is considered moderate and can still be acceptable. However, borrowers may face stricter lending criteria, potentially higher interest rates, and the requirement for private mortgage insurance (PMI) to mitigate the lender’s risk.

- Above 95% LTV: An LTV ratio exceeding 95% is typically seen as high risk by lenders. Borrowers with such high LTVs may encounter challenges securing financing, higher interest rates, and a greater likelihood of needing PMI.

To simplify the calculation process, property investors can use an LTV calculator. Such tools provide a quick and accurate way to determine an investment property’s LTV, allowing investors to make informed decisions about their real estate investments.

LTC vs LTV

Loan-to-Cost (LTC) and Loan-to-Value (LTV) are both important metrics in real estate financing, but they serve distinct purposes:

Focus: LTV assesses the loan amount in relation to the property’s current market value. LTC, on the other hand, measures the loan amount in relation to the total cost of acquiring or developing a property, including construction and acquisition costs.

Use: LTV is primarily used to evaluate the risk associated with a property’s current market value. It helps lenders gauge the borrower’s equity stake and risk exposure. LTC is commonly used in construction and development financing to evaluate the risk associated with the entire project’s cost. It helps lenders assess the feasibility of the project.

Example: If a property is worth $200,000, and the loan is $160,000, the LTV is 80%.

If a construction project costs $1 million, and the loan is $800,000, the LTC is 80%.

While both LTC and LTV ratios are essential in real estate financing, they serve different purposes. LTV assesses the risk in relation to the property’s current market value, while LTC is concerned with the risk in relation to the total cost of acquisition or development. Understanding differences between loan to cost vs loan to value is super important to both property investors and developers alike when seeking financing for various real estate projects.

How does the LTV ratio impact your real estate investment loan?

Understanding what LTV is in real estate is important because it directly impacts your ability to secure a home loan and manage your existing ones. To secure a home loan, aiming for a 20% down payment (resulting in an 80% LTV) is generally wise. Going over 80% may risk loan approval and require mortgage insurance. For existing homeowners, an LTV exceeding lender limits might affect loan terms. While most home loans aren’t callable, some HELOCs are, and if your HELOC term ends, your lender may not extend it. Additionally, balloon mortgages can pose challenges when refinancing the balloon payment at the end of the term.

Reducing Your Investment Property’s LTV

Lowering your Loan-to-Value (LTV) ratio can be advantageous for improving your financial situation and securing better loan terms. Here are some strategies to help you lower your LTV:

- Increase Down Payment: Start with a larger down payment when buying a property.

- Pay Down Mortgage: Make extra payments to reduce your mortgage balance.

- Enhance Property Value: Improve your property to increase its appraised value.

- Refinance at Lower Rates: Refinancing can lower your LTV with a better rate.

- Reduce Other Debts: Pay off other debts to free up funds for your mortgage.

- Avoid Additional Loans: Don’t take out more loans against your property.

- Monitor Property Value: Stay aware of your property’s market value.

Loan-to-Value Ratio FAQs

Does LTV affect how much I can borrow?

Yes, the LTV (Loan-to-Value) ratio significantly impacts how much you can borrow. A higher LTV often results in a smaller loan amount, while a lower LTV allows for a larger borrowing capacity or a maximum loan to value ratio.

What is a good LTV?

An ideal loan-to-value (LTV) ratio often falls at 75% or lower. Most lenders prioritize borrowers with LTV ratios of 80% or less, ensuring easier mortgage approvals and a broader range of mortgage choices. Nevertheless, once your LTV climbs beyond 85%, your options for mortgage loans tend to decrease.

What is the drawback of using LTV?

One limitation of the data provided by the LTV is that it solely considers the homeowner’s primary mortgage and does not factor in other financial obligations, such as secondary mortgages or home equity loans, in its calculations.

Build your Wealth Brick by Brick with LTV

The LTV ratio can impact your financial situation in various ways, but it’s not the sole determinant for lenders. To make informed decisions, investors and homeowners should grasp the broader spectrum of factors lenders consider and be mindful of their specific LTV ratio. Different types of financing have distinct requirements, so paying attention to your unique circumstances is essential. Utilizing a reliable LTV calculator can provide valuable insights. Keep in mind that your LTV ratio is just one facet of your overall financial profile, but it’s a critical one for real estate success.

KEY TAKEAWAYS

- The loan to value ratio represents the proportion of a loan in relation to the property’s worth.

- LTV serves as one of the criteria lenders consider in their decision to approve or deny a loan.

- A good rule of thumb: Keep your loan-to-value (LTV) ratio below 80%. Going over 80% can lead to higher costs, require private mortgage insurance, or even loan denial. LTVs exceeding 95% are typically not accepted.