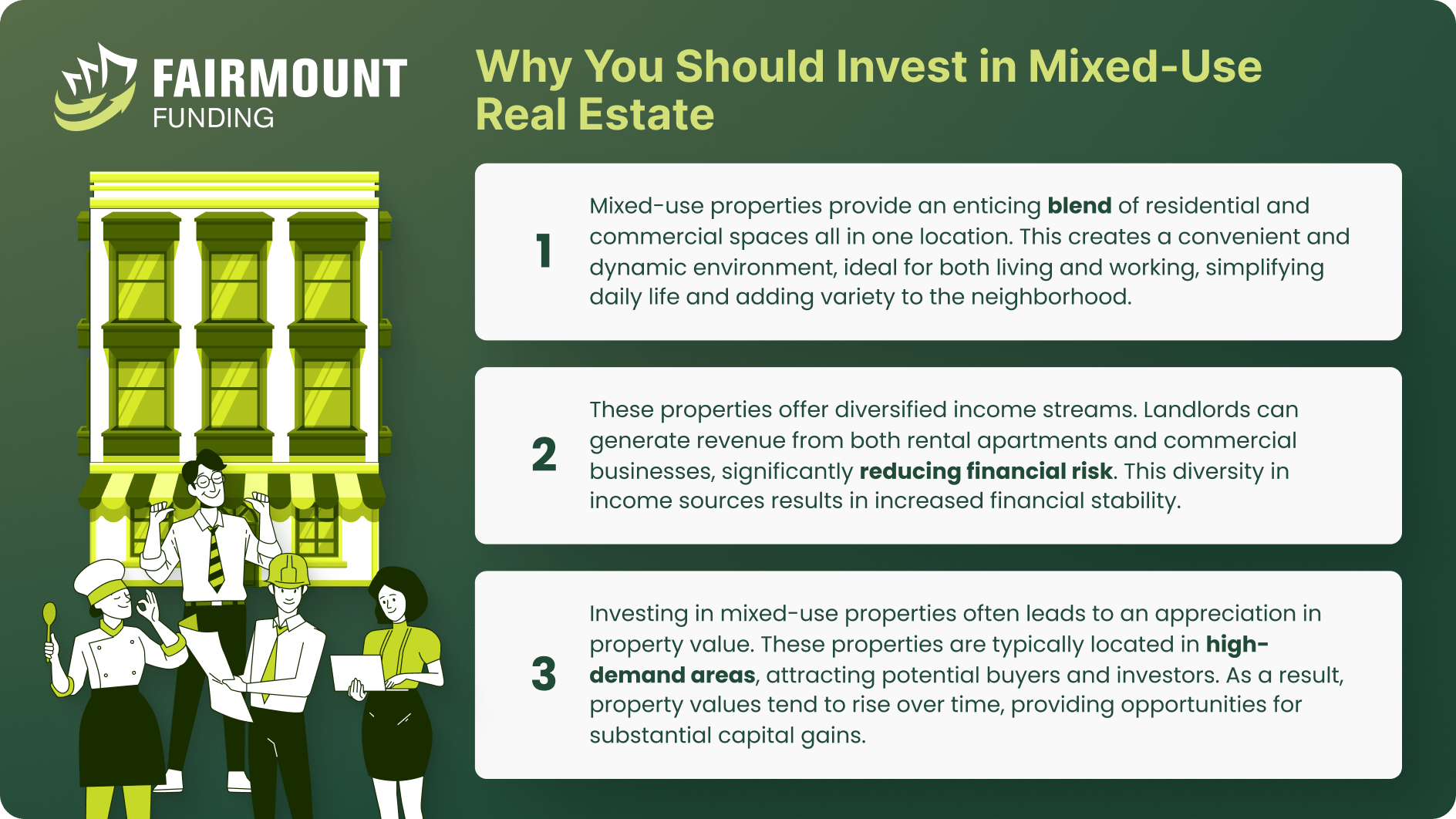

Investing in a mixed-use property offers opportunities to diversify your investment portfolios and maximize returns. A multi-use property combines different types of spaces, like residential, commercial, and sometimes even industrial, all within a single building or complex. This blend of uses can offer several advantages that make them an attractive investment option.

By having various components like apartments, offices, retail shops, or restaurants in one location, investors can reduce the risk associated with vacancies and market fluctuations. Mixed-use properties also benefit from increased foot traffic and synergy between the different types of tenants, which can lead to higher rental income and property appreciation.

It is also often situated in vibrant, urban areas, where demand for commercial and residential spaces tends to be high. This strategic location can contribute to your investment portfolio’s long-term growth potential and overall stability. Before investing, be sure you conduct due diligence, as it’s necessary to first have a foundation of basic knowledge on mixed-use property investing before committing to it.

What is a mixed-use property?

Also called a multi-use property, a mixed-use property combines multiple functions within a single building or complex. It typically integrates properties for residential, commercial, and sometimes industrial use. Mixed-use properties can host a diverse and vibrant environment where people can live, work, shop, and socialize in one cohesive location.

Consider buying a mixed-use property to expand your real estate investment portfolio. That is because there are various indicators showcasing growing demand for multi-use properties:

- Walkability: According to the 2023 Community & Transportation Preferences Survey, 79% of Americans prefer to live within walking distance of commercial establishments. Additionally, 78% would be willing to pay more to live in a walkable city. This indicates that living in mixed-use developments, wherein residential properties are just a block away from a mall, is becoming a popular housing option.

- Urban Revival: Millennials aged 35 – 44 choose to live in the suburbs, while those who are 25 – 34 years old are concentrated in urban areas. This is where mixed-used properties are often located, enabling real estate investors to foster sustainable and healthy communities.

- Continuous Demand for Apartments: The demand outlook suggests that the need for apartments will slow down from 2022 to 2035. However, several factors drive the constant need for apartments, especially in metropolitan areas. Approximately 266,000 apartment units are needed yearly to meet this demand.

- Built-in Customer Base for Retailers: A mixed-used property often has apartments above commercial space. This setup allows retailers to attract nearby residents, boosting foot traffic and creating a built-in customer base.

6 Benefits of Mixed-Use Property Investing

Investing in a mixed-use property offers many advantages. These benefits encompass various aspects of financial returns, tenant stability, and community development. Let’s delve into the key benefits of mixed-use property investing:

1. Charge Higher Rent

Mixed-use properties allow landlords to charge higher rents compared to single-use properties. This is because tenants in these developments benefit from the convenience of having multiple amenities and services nearby, making them willing to pay a premium for the added value.

2. Consistent Cash Flow

Mixed-use properties provide a more consistent and diversified cash flow. This includes rental income from residential, commercial, and retail tenants. This diversification helps mitigate the risk of relying on a single type of tenant.

3. Diverse Market of Tenants

Mixed-use developments attract a diverse market of tenants like businesses and professionals occupying commercial spaces and individuals and families living in residential units. This diversity helps maintain a stable tenant base, reducing the impact of economic downturns in any sector.

4. Proximity to Community Amenities

Mixed-use properties are often located near community amenities like parks, schools, public transportation, and entertainment. This convenient access enhances the property’s appeal to tenants and customers, ultimately increasing demand and property values.

5. Build Walkable Communities

Mixed-use developments pave the way for walkable communities, a trend gaining popularity for environmental and health benefits. These developments reduce the need for extensive car use, promoting a greener, more sustainable way of living that resonates with modern urban dwellers.

6. Lower Turnover

With the diverse amenities and services available within mixed-use developments, tenants often find staying more convenient and enjoyable. This leads to lower turnover rates, reducing the costs associated with vacancy and tenant turnover.

Investing in a Mixed-Use Property

Investing in a mixed-use property can be a lucrative endeavor for property investors. That is because it can provide rental income diversification and the potential for significant returns. However, it requires a strategic approach.

Property investors can navigate mixed-use properties’ unique challenges and opportunities by following these steps.

- Market Research and Location Analysis: Location is critical to the success of your investment. Conduct market research to identify areas with strong demand for mixed-use properties. Consider factors like population growth, employment opportunities, and amenities and services.

- Financial Preparation: Assess your financial readiness for mixed-use property investment. Calculate your budget, including the down payment, renovation, and ongoing expenses. Mixed-use properties often require a more significant upfront investment than single-use properties, so having your finances in order is essential.

- Secure Financing: Mixed-use properties may not qualify for traditional residential mortgages. Explore mixed-use loans and financing options tailored to these types of investments. Mixed-use property loans are designed to accommodate the unique characteristics of multi-use developments, considering residential and commercial components.

- Due Diligence: Do your due diligence on your preferred property. This includes evaluating the condition of the building, zoning regulations, and potential rental income. Verify the existing leases and assess the feasibility of attracting and retaining tenants.

- Property Management: Consider how you will manage the property. Mixed-use properties often involve dealing with different types of tenants, so it’s a good idea to have a reliable property management strategy. You may handle management in-house or hire a professional property management company.

- Diversify Tenant Mix: Aim for a diverse tenant mix that can contribute to a stable and consistent cash flow. This might involve attracting a mix of residential renters, commercial tenants, and retail businesses. Diversification helps reduce risk and dependency on a single tenant category.

- Legal and Regulatory Compliance: Always keep the local zoning laws and regulations governing mixed-use properties in mind. Ensure that your property complies with all zoning codes and permits. Consulting with legal experts familiar with mixed-use properties can be beneficial.

- Long-Term Strategy: Consider how to add value to your mixed-used property over time. This includes renovations, maintenance, or repositioning to meet changing market demands.

Factors to Consider in Mixed-Use Property Investing

Investing in mixed-use properties can be rewarding, although it requires considering various factors to ensure success. Here, we will delve into the key factors that property investors should weigh when investing in a mixed-use property:

- Efficient Property Design: Efficient property design is paramount in mixed-use developments. Investors should maximize space utility and ensure that residential, commercial, and retail components are well-integrated. This can enhance the overall functionality of the property and attract a diverse range of tenants.

- Prime Location: Location is a critical factor for the success of mixed-use properties. Opt for locations that offer easy access to public transportation and major highways. You can also search for areas with strong economic growth potential, like those near employment centers, schools, and amenities.

- Available Amenities: Mixed-use properties thrive when they boast an array of amenities that cater to the needs and desires of residential and commercial tenants. Consider amenities like fitness centers, communal gathering spaces, outdoor areas, and on-site retail options. These amenities can enhance the living and working experience, attracting and retaining tenants.

- Affordable Rent: You will want to strike the right balance between rental rates and affordability. Research the local rental market to ensure that your rental rates are competitive. Additionally, consider the overall cost of living in the area, as this can influence tenant demand and retention.

- Right Blend of Tenants: Achieving the right mix of tenants is essential. Aim for a diverse tenant blend to contribute to a stable and consistent cash flow. This might include residential renters, commercial tenants from various industries, and retail businesses that complement one another. A diverse tenant mix helps reduce risk and vacancies in any one sector.

Mixed-Use Property Investing FAQs

Is a mixed-use property the same as a mixed-commercial property?

A mixed-use property is different from a mixed-commercial property. A mixed-use property combines various functions like residential, commercial, and sometimes industrial uses within one complex.

On the other hand, a mixed commercial property typically involves a combination of commercial services. This includes retail stores, offices, or restaurants but may not include residential components.

What makes mixed-use property investing a good idea?

Mixed-use property investing can be a good idea because it can lead to multiple rental income streams and risk diversification. They are often located in vibrant, urban areas with a strong demand for residential and commercial spaces. This strategic location can contribute to your investment portfolio’s long-term growth potential and stability. Additionally, mixed-use properties support sustainable and walkable communities, aligning with modern lifestyle preferences and environmental goals.

What are the risks of investing in a mixed-use property?

Investing in mixed-use properties carries certain risks, including:

- Managing residential and commercial tenants can be more complex and time-consuming than single-use properties.

- The success of mixed-use properties hinges on how healthy the residential and commercial real estate markets are. Economic downturns can impact both sectors.

- Ensuring zoning regulation compliance can be challenging, and changes in zoning laws may affect property use.

- Attracting and retaining the right mix of tenants is key to success. A poor tenant mix or high vacancy rates in one sector can affect cash flow.

- Maintaining residential and commercial spaces may require higher upkeep costs and more extensive property management.

Mixed-Use Property Investing can be a Rewarding Venture

Investing in mixed-use properties can be a rewarding venture for real estate investors. These properties, which blend residential and commercial elements, offer the potential for diversification, higher rental income, and growth opportunities.

While managing a mixed-use property may require more effort and attention to detail, the benefits often outweigh the challenges. Moreover, it’s important to explore the available financing options, like mixed-use loans, that are tailored to this unique asset class. These loans can provide the financial flexibility to successfully acquire and develop mixed-use properties. Additionally, location, efficient property design, tenant mix, and a focus on amenities are vital factors that can significantly influence the success of your investment.

As with any real estate endeavor, conducting thorough due diligence, staying informed about local regulations, and developing a well-thought-out investment strategy are essential. By carefully considering these factors and embracing the opportunities presented by mixed-use properties, investors can tap into a dynamic market and contribute to creating vibrant, sustainable communities.

KEY TAKEAWAYS

- A mixed-used property typically integrates properties for residential, commercial, and sometimes industrial use.

- It can host a diverse and vibrant environment where people can live, work, shop, and socialize in one cohesive location.

- Mixed-use property loans are designed to accommodate the unique characteristics of multi-use developments.