For real estate investors, success isn’t solely dependent on finding the right properties; it’s also about comprehending the financial indicators that drive profitability. One of the most important metrics is Net Operating Income (NOI), often abbreviated as NOI.

So, why should NOI matter to investors? The answer is simple yet profound: NOI equips you with the knowledge needed to make more informed and strategic investment decisions, ultimately enhancing and optimizing your portfolio’s income.

In this article, we will break down the concept of real estate NOI. We’ll explain the meaning of net operating income, show you how to calculate it, and highlight why it matters for those investing in real estate..

NOI: Definition and Formula

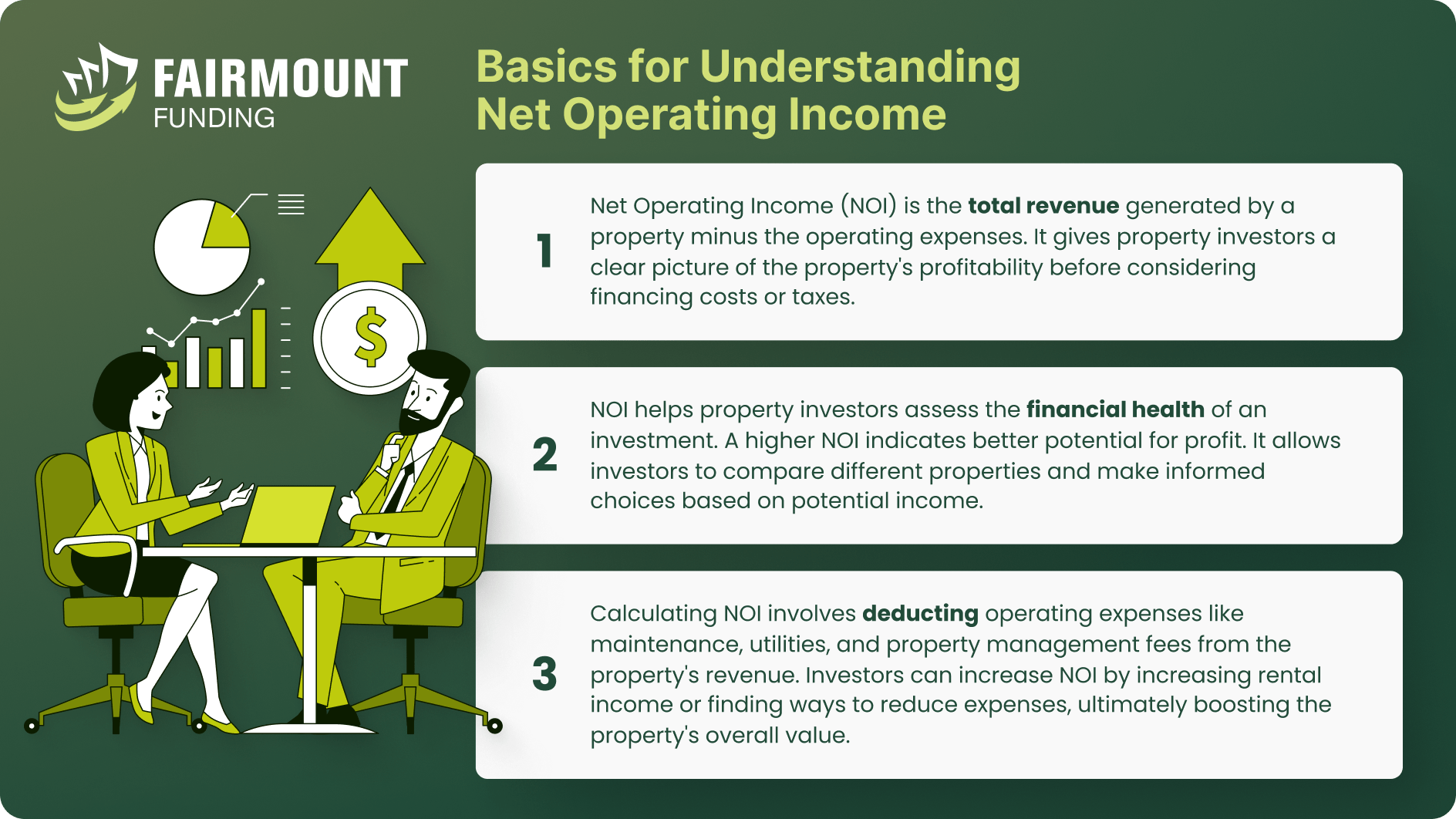

Net Operating Income (NOI) serves as a central calculation for assessing the profitability of income-generating real estate investments. It represents the total income generated by a property, subtracting all essential operational costs.

So, what is NOI in real estate? NOI is a pre-tax metric that features on a property’s income and cash flow statement, excluding loan interest and principal payments, capital expenses, depreciation, and amortization. In other industries, this metric is known as “EBIT,” or “earnings before interest and taxes.”

Real estate professionals use Net Operating Income as a valuation method to precisely determine the worth of their income-producing properties. To calculate NOI, one must deduct the property’s operating expenses from its income.

Net Operating Income Formula:

NOI = Total Revenue – Operating Expenses

Wherein:

Total Revenue: This includes all the income generated by the property, such as rental income, lease fees, parking fees, and any other sources of income related to the property like laundry machines or vending machines if any.

Operating Expenses: These are the costs associated with running and maintaining the property, such as property management fees, property taxes, insurance, maintenance and repairs, utilities, and other day-to-day operational expenses. It does not include mortgage payments or financing costs.

Here’s an example of how to calculate net operating income using the net operating income formula:

Rental Income: $10,000

Parking Fees: $ 2,000

Vending Machine: $ 3,000

Total Revenue: $15,000

Property Management Fees: $1,000

Property taxes: $2,000

Repair and maintenance: $3,000

Insurance: $1,428

Operating Expenses: $7428

Net Operating Income = $15,000 – $7428 = $7572

Using an NOI calculator can make it easy for property investors to compute their Net Operating Income. With this, property owners will have an insight into whether the income generated from renting a property outweighs the ownership and maintenance expenses.

Pros and Cons of Using Net Operating Income as a Metric

Net Operating Income (NOI) is a valuable metric for evaluating real estate investments, however, it has its own set of advantages and disadvantages. Let’s explore both the pros and cons of relying on NOI.

Advantages of Using NOI as a Metric

- Simplicity: NOI provides a straightforward way to assess a property’s income potential by focusing on its operational aspects, making it easy to calculate and understand.

- Income Assessment: It offers a clear view of a property’s ability to generate income and cover operational expenses, helping investors gauge the property’s financial viability.

- Risk Assessment for Lenders: NOI serves as a key metric for lenders when evaluating the risk associated with financing a property. Lenders can use NOI to gauge the property’s income-generating potential and its ability to cover debt service, which helps them make more informed lending decisions.

Disadvantages of Using NOI as a Metric

- Limited Perspective: NOI does not consider financing costs, loan terms, or the impact of leverage on returns. It provides an incomplete financial picture, as it focuses solely on operational aspects.

- Potential Calculation Errors: NOI calculations can be prone to errors, especially when investors overestimate rental revenues or underestimate operating expenses. Inaccurate figures can lead to a skewed perception of a property’s profitability and may result in poor investment decisions.

- Management-Dependent Variability: NOI can be inconsistent because it relies on how well the property is managed. Different management styles can lead to different income and expense figures, making NOI less reliable as a consistent measure.

Net Operating Income vs. Other Metrics

NOI vs. Gross Operating Income

NOI should not be confused with Gross Operating Income in real estate. Gross Operating Income represents the total possible income a property can generate, minus any income lost due to vacancies. Net Operating Income (NOI), on the other hand, is derived from Gross Operating Income after deducting all operating expenses.

NOI is a valuable tool for estimating the potential income from an investment property, but it’s important to note that it does not factor in certain costs like income taxes or mortgage amortization

NOI vs. Net Income

NOI focuses solely on the operational aspect by subtracting operating expenses from revenue, providing a clear picture of the core profitability of a business without considering non-operational factors like interest, taxes, and one-time expenses. In contrast, Net Income encompasses all expenses, both operating and non-operating, and reflects the overall profitability of a company, making it a more comprehensive indicator of a business’s financial health. While NOI is valuable for assessing operational efficiency, Net Income provides a broader perspective by including all costs and revenues associated with a business.

NOI vs. DSCR

Net Operating Income (NOI) gauges a property’s income from daily operations by deducting operational costs but excluding non-operational expenses like taxes and interest. It’s vital for assessing rental income potential and property valuation.

On the other hand, Net Income Multiplier (NIM) calculates property value by dividing its sale price by net income after subtracting all expenses, including financing and taxes. It aids in evaluating the overall return on real estate investments and comparing property values holistically.

NOI vs. Net Income Multiplier

Net Operating Income (NOI) measures a property’s operational profitability by subtracting operating expenses from revenue, focusing on day-to-day income generation. It evaluates rental income potential and influences property valuation.

Net Income Multiplier (NIM) estimates property value by dividing its sale price by net income after all expenses, including non-operating ones. It assesses overall real estate investment return and allows property value comparisons, considering financing and tax-related costs, offering a comprehensive financial perspective.

How Can NOI Help Property Investors?

While Net Operating Income has its limitations, it is still a simple and great way of providing investors with a clear picture of the property’s potential cash flow and operational profitability. It helps investors estimate the potential income a property can generate.

NOI also serves as a valuable tool for trend analysis, allowing you to gain insights into a property’s performance over time. By tracking changes in a property’s Net Operating Income, you can assess whether it’s thriving or facing declining profitability. For investors with multiple properties, NOI analysis compares the NOI of different properties. Investors can allocate resources to properties with the highest income potential or identify underperforming assets that may require improvement or divestment signaling the need for corrective actions or potential sale.

Moreover, NOI plays a pivotal role in various essential calculations. It forms the foundation for crucial metrics like the cap rate, which aids in estimating your anticipated return on investment, and the Debt Service Coverage Ratio (DSCR), a metric lenders employ to evaluate your capacity to meet debt obligations. Lenders also use NOI when evaluating loan applications. A strong NOI demonstrates the property’s ability to generate income and cover debt obligations, making it more appealing to lenders and potentially resulting in better financing terms for investors.

By understanding the property’s NOI, investors can project future rental income and assess whether it aligns with their income goals and investment strategies.

Net Operating Income FAQs

What are the operating expenses in owning a real estate property?

Real estate operating expenses include the full array of costs associated with property maintenance and business operations. These expenses comprise property taxes, insurance premiums, utility bills, and expenditures for ongoing property upkeep and repair. In essence, they encompass all facets of property management, including legal and accounting services, as well as contracted services like landscaping, cleaning, snow removal, and maintenance. It’s worth noting that some of these expenses may be seasonal or paid on an annual basis, which explains why Net Operating Income (NOI) is calculated on an annual basis to provide a comprehensive view of a property’s financial performance.

Does net operating income include mortgage?

Mortgage payments are not included from the net operating income (NOI) formula because they don’t fall under operating expenses. NOI considers total income minus operating costs, so mortgage payments are not part of the equation. Instead, NOI calculations account for the ongoing expenses required to manage the property.

What is not included in net operating income?

NOI excludes items that aren’t direct, annual expenses. This includes taxes, depreciation, tenant improvements (TI), capital expenditures, and debt, as these can vary widely and don’t reflect the property’s ongoing financial health. By excluding these factors, NOI enables a fair comparison of properties based on their income and outflow, irrespective of individual investor circumstances.

Is there an ideal NOI?

There is no specific ideal Net Operating Income (NOI) in absolute terms because NOI is not expressed as a percentage. Instead, it’s a numerical value representing a property’s operational profitability, considering its revenues and expenses. However, when comparing NOI to the property’s overall value as if it were purchased entirely in cash, a higher percentage of NOI to property price is generally considered better. This indicates that the property is generating a relatively higher income in proportion to its cost, which can be a positive indicator for investors.

Net Operating Income: The Cornerstone of Smart Real Estate Decision-Making

Net Operating Income (NOI) is a vital metric in real estate investment, offering more than just a glimpse of income after expenses. It’s a powerful tool enabling investors to gauge profitability, compare investments, shape property valuations, and influence loan decisions. Mastery of NOI, including factors like rental income, expenses, occupancy, effective management, and market dynamics, gives investors a competitive edge, enhancing property income and value. NOI’s role in calculating the cap rate, a key return-on-investment indicator, underscores its importance. Whether analyzing new opportunities, managing properties, or strategizing, NOI remains a dependable guide for real estate investors, providing essential insights and a robust foundation for success.

KEY TAKEAWAYS

- NOI provides you with valuable knowledge to make smarter and more strategic investment choices, ultimately paving the path to boost and maximize your portfolio’s earnings.

- To compute NOI, simply deduct all the property’s operating expenses from its total generated revenue.

- NOI can help property owners assess whether the income from renting a property justifies the costs of ownership and maintenance.