New construction home loans are pivotal for property developers and investors building from the ground up. This real estate loan provides the capital to turn architectural blueprints into tangible homes, offices, or commercial spaces.

New construction loans differ from traditional mortgages, as they are specifically tailored to address the unique financial needs associated with building new structures. As such, it can unlock opportunities for growth and innovation in the ever-evolving landscape of property development.

These advantages make hard money new construction loans valuable for real estate investors, especially those looking to embark on new construction projects. If you are still on the fence about taking a new construction loan, keep reading.

Reasons to Take New Construction Home Loans

New construction home loans provide property investors with a short-term, fixed-rate financing solution that offers flexibility and tax benefits. These advantages make them a valuable tool in real estate investment. These benefits provide compelling reasons for property investors to consider new home construction loans as a strategic financing option.

1. Short-term Loan

New construction loans are typically short-term loans, meaning they have a relatively brief repayment period than traditional ones. The short-term structure can be advantageous for property investors, enabling quicker investment turnaround times. Once the construction is complete and the property is sold or rented, investors can repay the loan and move on to the next project.

2. Fixed Interest Rate

Many new construction hard money loans come with fixed interest rates. This stability shields investors from interest rate fluctuations that can impact long-term financing. It provides predictability in budgeting and ensures that monthly payments remain consistent throughout construction, reducing financial uncertainty.

3. Multiple Draws

New construction loans often allow investors to draw funds multiple times during construction. This feature provides the flexibility to cover construction costs as they arise, ensuring that the project progresses smoothly. It eliminates the need for investors to have a significant upfront capital investment, which can benefit those working on larger projects.

4. Excellent Tax Benefits

New construction loans can offer attractive tax benefits to investors. The interest you pay is typically tax-deductible, leading to significant savings come tax season. These tax advantages can enhance the overall return on investment and make new construction projects even more financially appealing.

What are the new construction loan requirements?

You must meet several requirements when applying for new construction home loans. These requirements are essential for lenders to assess your eligibility and ensure the successful completion of the construction project.

- Detailed Construction Plans and Budget: Borrowers are typically required to provide comprehensive construction plans and budgets for the project. Your construction plan should outline the scope of work, materials to be used, and timelines. A well-thought-out budget helps lenders evaluate the feasibility of the project and its cost-effectiveness.

- Down Payment: Borrowers often need to make a significant down payment, typically ranging from 20% to 25% of the total project cost. This down payment serves as the borrower’s equity in the project and demonstrates their commitment to the investment.

- Proof of Income and Financial Stability: Lenders may request evidence of the borrower’s income and financial stability. This may include tax returns, bank statements, and employment verification. Demonstrating a stable financial situation is necessary to secure loan approval.

- Creditworthiness: Lenders will assess the borrower’s creditworthiness by reviewing their credit history and credit score. A good credit history demonstrates the borrower’s ability to manage debt responsibly, increasing their chances of approval for a home loan for new construction.

- Builder Qualifications: The qualifications and experience of the builder or contractor involved in the project are essential. Lenders may require information about the builder’s track record, certifications, and licensing to ensure they can complete the construction successfully.

- Appraisal and Inspection: Lenders will assess and inspect the property to determine its current and projected value. Doing so sets the loan-to-value ratio and ensures the property’s value justifies the loan amount.

- Legal Documentation: Borrowers must provide legal documentation like permits, zoning approvals, and any necessary contracts or agreements related to the construction project.

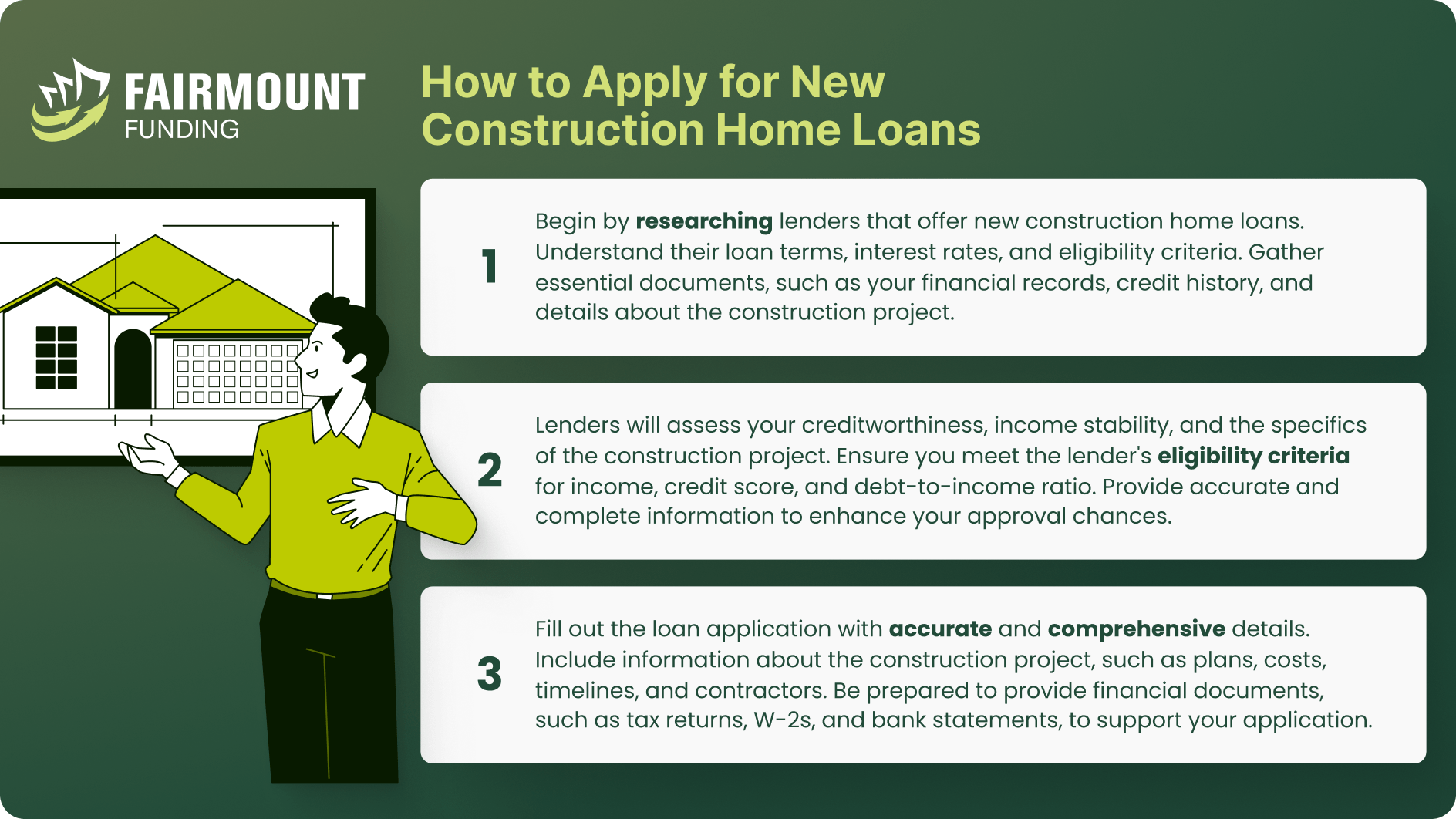

What Is The Process To Apply For A New Construction Home Loan?

Applying for new construction home loans involves well-defined steps to ensure a smooth and successful financing process. By following these steps, you can navigate applying for a construction loan effectively.

Step 1: Know How Much You Can Borrow

Before you start your construction project, you first need to know how much you can borrow. Utilize a new construction loan calculator that divides by each phase of the construction to estimate the loan amount you are eligible for, based on your financial situation and the project’s estimated cost. This step will help you establish a realistic budget and set expectations.

Step 2: Choose a Licensed Builder

Selecting a licensed and reputable builder is a fundamental step in the construction loan process. Lenders often require borrowers to work with experienced and qualified builders to minimize project risks. Your chosen builder must provide credentials, project plans, and cost estimates for the lender’s assessment.

Step 3: Look for an Experienced Lender

Before starting, you’ll want to partner with the right lender. Consider working with a real estate hard money lender or a financial institution experienced in new construction loans. They can provide valuable guidance and tailor the loan to your specific needs.

Step 4: Ensure You Have All the Paperwork

Gather the documentation required for your loan application. This typically includes financial statements, tax returns, building plans, construction schedules, and any other relevant paperwork. Being organized and prepared will expedite the approval process.

Step 5: Get Homeowners Insurance

Even during the construction phase, it is essential to secure homeowners insurance. This insurance covers risks associated with the property under construction and protects against unforeseen events such as fire, theft, or accidents. Having insurance in place demonstrates your commitment to safeguarding the investment.

Step 6: Begin the Approval Process

Once you have all the documentation, you can start the approval process with your chosen lender. The lender will review your financials, construction plans, and builder qualifications. If everything meets their criteria, they will approve the loan.

After approval, the lender will work with you to finalize the loan terms. This includes construction loan interest rates, repayment schedules, and draw schedules for disbursing funds during construction.

New Home Construction Loan Interest Rates

New construction loan rates are typically higher than conventional mortgage interest rates. These rates vary depending on the lender and the specific loan terms, but they often fall into one of two categories:

- Interest-Only Payments: During construction, borrowers often make interest-only payments based on the amount the lender disburses. These payments cover the cost of borrowing the funds needed for construction but do not reduce the loan principal.

- Variable Interest Rates: Construction loan rates often vary. This means that the interest rate can fluctuate over time, potentially causing variations in monthly payments.

There are various reasons new construction home loans come with higher interest rates. For one, lenders perceive construction loans as riskier due to the uncertainty associated with construction. Delays or changes in project scope can increase the risk for lenders.

Another reason is that it is a short-term loan lasting between 12 and 24 months. The shorter lending period can contribute to higher interest rates as lenders seek to offset the shorter duration with increased interest income.

On average, new construction loan rates can be 1% to 2% higher than the ongoing rates of 30-year fixed-rate mortgages. However, shopping around and comparing offers from different lenders is essential to secure the best possible rate for your specific project and financial situation.

New Construction Home Loan FAQs

1. How does a construction loan differ from traditional mortgages?

A construction loan differs from traditional mortgages in several ways. For one, a construction loan helps finance a property’s construction or renovation. Conventional mortgages, on the other hand, are used to purchase an already-built home.

During the construction phase, borrowers typically make interest-only payments on the funds disbursed by the lender. This differs from traditional mortgages, where borrowers make initial principal and interest payments.

After the construction is complete, a construction loan is typically converted into a permanent mortgage or paid off with a new mortgage. Traditional mortgages do not have this conversion process.

2. What credit score do I need when applying for new construction home loans?

The credit score required for a new construction home loan varies depending on the lender. You may need to maintain a minimum credit score of 680 to be eligible for a construction loan with favorable terms. However, some lenders, such as Fairmount Funding, may accept lower credit scores based on the case.

It is essential to note that you are likely to get a construction loan with low interest rates if you have a higher credit score. That is because your creditworthiness helps lenders assess whether it will be risky to give you a loan.

3. What can I do if my construction project takes longer than expected?

If your construction project takes longer than initially anticipated, there are several steps you can take:

- Communicate with Your Builder: Maintain open communication with your builder or contractor. Discuss the reasons for delays and work together to develop a realistic timeline for completion.

- Review Your Loan Agreement: Examine your construction loan agreement to understand its terms and conditions regarding construction timelines. Some loans may have provisions for extensions in case of delays.

- Consider Loan Extensions: If necessary, contact your lender to discuss extending the loan term to accommodate the delays. Be prepared to provide a valid explanation for the delay and demonstrate your commitment to completing the project.

- Budget for Extra Costs: Extended construction timelines can lead to increased costs for loan interest, property taxes, and insurance. Be prepared for these additional expenses and adjust your budget accordingly.

Turn Your Visions Into Reality With New Construction Home Loans

New construction home loans are a valuable resource in the world of real estate investment. That is because they offer the financial support needed to transform blueprints into brick and mortar.

While these loans come with unique terms and requirements, they provide a gateway to ambitious projects that can yield substantial returns. Understanding the intricacies of new construction loans and using them strategically is the key to success. As you embark on real estate development, remember that this financing solution offers flexibility. Doing so allows you to draw funds as needed during construction.

However, it is essential to be prepared with a solid plan. This includes the proper documentation and a reliable team of professionals. With careful planning and the right financial partner, these loans can pave the way for successful construction projects and long-term prosperity in the real estate market.

KEY TAKEAWAYS

- New construction home loans provide the capital to turn architectural blueprints into tangible homes, offices, or commercial spaces.

- This gives property investors with a short-term, fixed-rate financing solution that offers flexibility and tax benefits, making new construction loans a valuable tool in real estate investment.

- New construction loan rates are typically higher than conventional mortgage interest rates depending on the lender and the specific loan terms.