House flipping, a popular form of real estate investment, involves purchasing a property, renovating it, and then swiftly reselling it for a profit. This dynamic venture requires a strategic blend of market insight, renovation skills, and financial know-how.

Aspiring flippers keen on understanding how to finance a fix and flip endeavor must navigate a landscape of funding options to ensure a successful project. Learning to finance a fix and flip effectively can make or break the entire venture.

The primary challenge lies in securing the necessary funds for both the purchase of the property and the subsequent renovations. That is why we will explore the various financing strategies available to budding real estate investors in this post.

How does house flipping work?

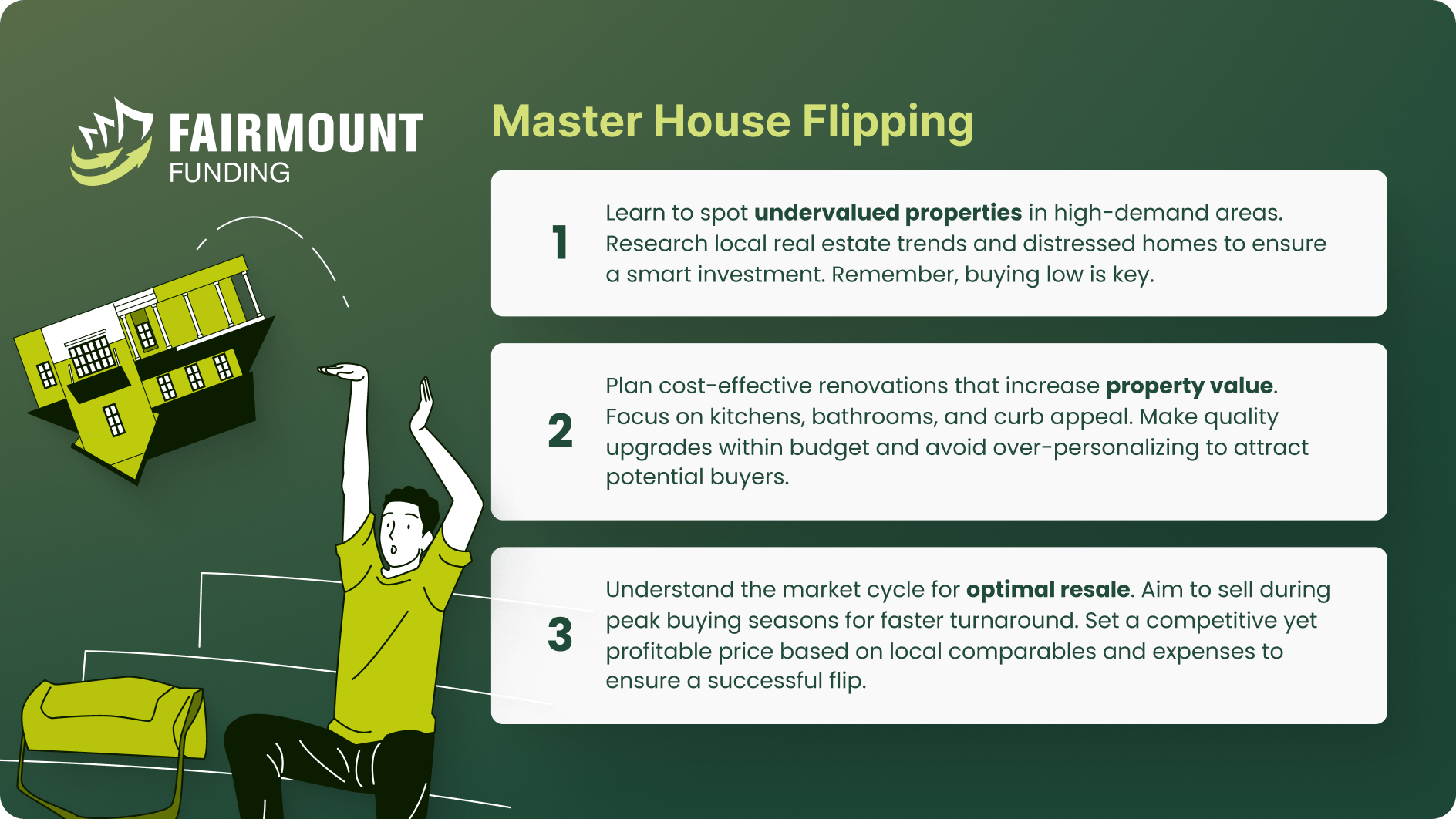

You may be asking, what is a house flipping? It is when an investor buys a distressed property, usually a house, to renovate and sell for a profit. A house flipper’s primary goal is to purchase a property at a relatively low price, increase its value through renovation and repairs, and sell it at a higher price. Ideally, the entire process should be done within a short period.

House flipping can be lucrative, but it also carries risks. Flippers must accurately estimate renovation costs, understand the local market, and be prepared for unexpected challenges. Moreover, successful house flipping requires combining real estate knowledge, renovation skills, financial management, and calculated risk-taking.

What makes flipping houses a good business?

Whether you are new to real estate investing or a seasoned property investor, house flipping is an excellent way to turn an asset into a profit. If you have the skills and are willing to put effort into it, flipping houses can be a good business. It will also allow you to enjoy the following benefits:

- Adaptable Strategy: House flipping offers flexibility regarding the types of properties investors can target and the strategies they employ. Investors can adapt their approach based on market conditions and personal preferences.

- Profit Potential: House flipping can yield substantial profits relatively quickly. By buying low-cost properties, making strategic renovations, and selling at a higher price, investors can generate significant returns on their initial investment.

- Diversification: House flipping can be a way to diversify an investment portfolio. Investors can achieve a balanced portfolio by incorporating short-term, higher-reward projects like flipping alongside longer-term investments like rentals.

- Quick Portfolio Growth: Successful flips can provide investors with additional capital to reinvest in more properties, leading to faster portfolio growth and increased wealth.

- Skill Development: Engaging in house flipping allows investors to develop an array of valuable skills, including property evaluation, negotiation, project management, budgeting, and renovation expertise. These skills can be applied to future investment endeavors.

How to Finance a Fix and Flip Business

There are various ways how to finance a fix and flip. Some options dubbed as “first-time fix and flip loans” are ideal for beginners, while some are applicable for real estate investors with solid credit scores or home equity.

- Personal Savings: Using your savings is a straightforward way to fund a house flipping project. This approach avoids debt and interest payments but requires sufficient capital.

- Traditional Bank Loans: Conventional mortgages or home equity loans from banks can fund your fix and flip project. However, these loans often have stringent credit requirements and a lengthy application process.

- Home Equity Line of Credit (HELOC): If you have a property with equity, you can consider using a HELOC, which allows you to borrow against the value of your home to fund your fix and flip project.

- Self-Directed Individual Retirement Account (IRA): Some IRAs allow you to invest in real estate, including fix and flip projects, which can provide tax advantages and help grow your retirement savings.

- Hard Money Loans: Hard money lenders provide fix and flip loans for real estate investments. These loans are based on the property’s value rather than your creditworthiness, making them more accessible for investors with less-than-perfect credit.

- Personal Loans: You might consider taking out a personal loan, although this option may come with higher interest rates and shorter repayment terms.

- Business Loans: If you have established a business entity for your fix and flip operations, you may be eligible for small business loans, lines of credit, or other financing options tailored for real estate investors.

- Private Investors: Partnering with private individuals or investment groups can provide the necessary capital. In exchange, investors may receive a share of the profits or interest on their investment.

- Crowdfunding: Online platforms allow you to raise funds from many investors for your fix and flip project. This can be a creative way to secure financing while spreading the risk among multiple backers.

Whether you choose hard money fix and flip loans or other financing options, thoroughly research each choice, assess the associated costs and risks, and consider seeking advice from financial professionals. You will need to have a clear understanding of your budget, the potential return on investment, and the timeline for your house flipping project to ensure you choose the most suitable funding method for your business.

Can someone new to house flipping get a fix and flip loan?

Securing a conventional loan for your house flipping project can be challenging for various reasons. To start, the income of a fix-and-flip investor tends to fluctuate, making it problematic to demonstrate a consistent capacity for covering mortgage payments. Furthermore, borrowers must have a track record of successfully managing such endeavors.

Additionally, conventional loans typically involve a lengthy closing process, often spanning 45 to 90 days. When aiming to finalize a deal swiftly, competitors armed with cash, private financing, or hard money loans usually take the lead due to their expedited closing capabilities.

For those searching for fix and flip loans for beginners, alternative options include private financing and hard money lending. Private financing entails securing a loan from an investor who acts akin to a bank, with interest paid on the borrowed amount over the loan’s duration. On the other hand, hard money lenders specialize in providing short-term loans tailored for house flipping. These lenders impose higher interest rates than traditional counterparts yet offer more lenient criteria and less administrative bureaucracy.

House Flipping FAQs

Can house flipping ruin my credit?

House flipping can impact your credit negatively if not managed carefully. Taking on excessive debt, encountering unexpected expenses, or experiencing difficulty selling a property could lead to financial strain and missed payments. Late payments or defaulting on loans can result in a decrease in your credit score, making it harder to secure future financing.

What skills do I need to become a successful house flipper?

To excel as a house flipper, several key skills are essential:

- A strong understanding of the real estate market, including local trends and property values, is necessary for identifying profitable opportunities.

- Renovation and construction knowledge is key to making cost-effective improvements.

- Project management skills help you oversee renovations and stay on schedule.

- Negotiation skills aid in purchasing properties at favorable prices and dealing with contractors.

- Financial literacy is important for budgeting, analyzing deals, and managing cash flow.

- Problem-solving skills help you navigate unexpected challenges during the flipping process.

What is a good ROI for a house flipping business?

A good return on investment (ROI) for a house flipping business can vary based on location, market conditions, and the extent of renovations. Generally, experienced flippers aim for an ROI of around 20-30%, which factors the purchase and renovation costs. This percentage ensures a healthy profit margin after all expenses are accounted for. However, conducting a thorough financial analysis and considering all costs involved is essential to determine a realistic target ROI for each specific project.

Start Your House Flipping Venture and be Part of the Real Estate Industry

House flipping presents a dynamic opportunity for aspiring and seasoned real estate investors. The intricate dance between property acquisition, strategic renovation, and timely resale demands a fusion of skills ranging from market acumen to project management.

It also helps that you know what are fix and flip loans. That is because these specialized loans are tailored to the unique demands of house flipping. It offers investors the capital needed to purchase properties and fund renovations and enables them to seize opportunities in a competitive market swiftly.

In your pursuit of house flipping success, it is paramount to conduct thorough research, develop a sound business plan, and assemble a reliable team of professionals. Navigating the intricacies of property valuation, renovation costs, and market trends will contribute to your ability to make informed decisions and achieve favorable returns.

KEY TAKEAWAYS

- House flipping is a popular investment strategy, wherein real estate investors buy a distressed property at a relatively low price, renovate it, and sell it at a higher price.

- There are various ways to finance a fix and flip. However, you must thoroughly research each choice, assess the associated costs and risks, and consider seeking advice from financial professionals.

- A beginner can get a fix and flip loan but not through conventional means. Instead, they can for private financing or borrowing from hard money lenders.