If you want to secure your financial future, there are different ways to invest your money. Some people invest in stocks or mutual funds, which can be good if you start early and do it carefully. But there’s another way to invest called real estate investing for beginners, which is like buying and owning properties.

Real estate can be a bit tricky when you’re just starting, but it’s a hands-on way to make money. So, you might have heard stories of people getting rich by owning and selling properties or even starting with no money and becoming millionaires.

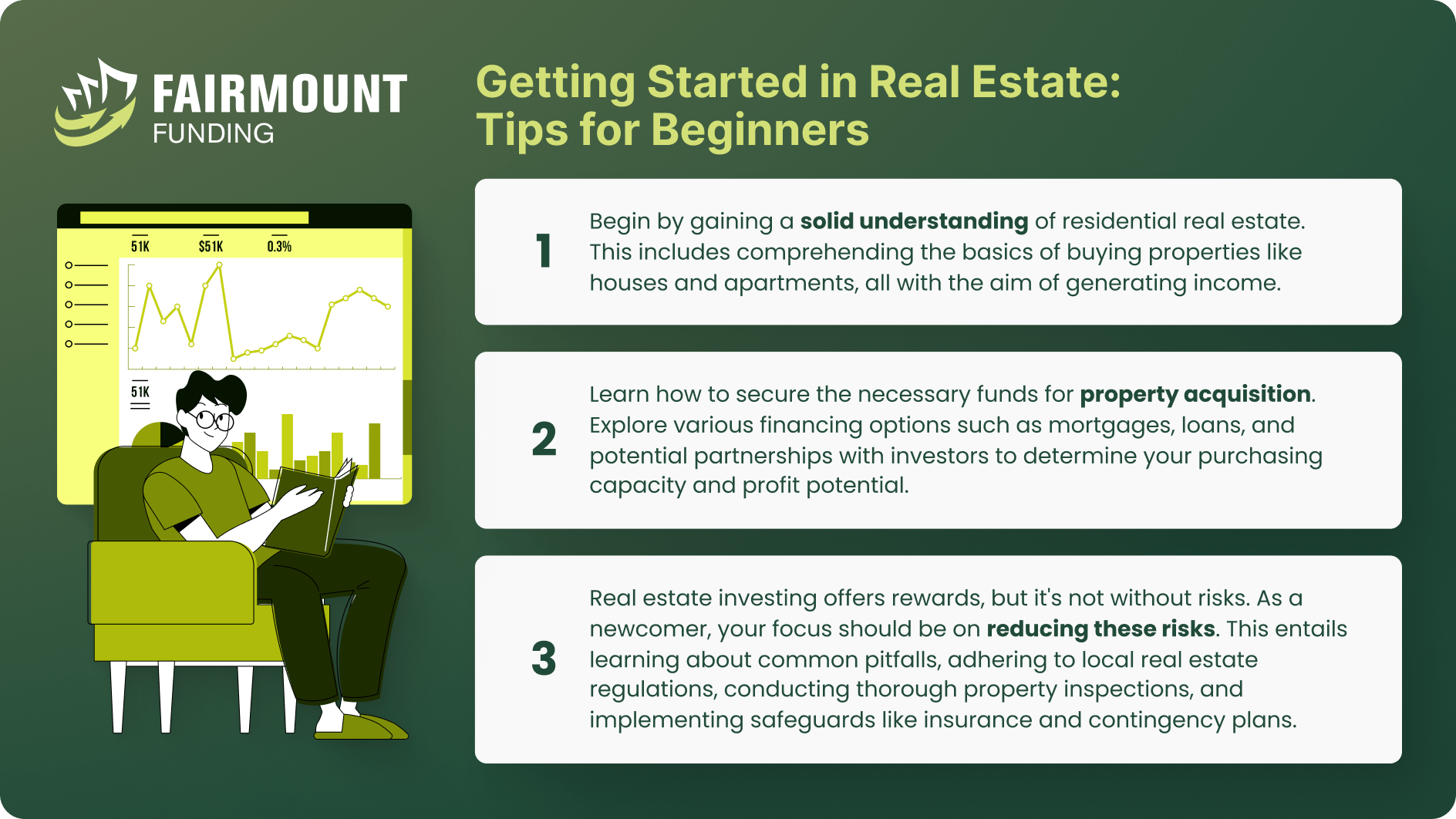

Let’s talk about some important things to know about real estate investing for beginners.

Is it a good idea to invest in residential real estate properties?

Real estate has a solid track record for wealth building, and many millionaires still endorse it for various reasons. It comes in different forms, such as residential, commercial properties, and real estate stocks. Here’s why adding real estate to your investments makes sense.

● Real estate diversifies your investments

Adding real estate to your investment mix is a smart move for diversification. Spreading your investments across different markets safeguards you against potential risks. The economy is complex, with various components, and it’s possible for one to falter while others prosper.

● Your assets will grow in value

Real estate investment for beginners offers ownership of a tangible asset that can gain value. Real estate values typically appreciate, and a wise investment can yield a profit upon sale. People will always have a need for a place to live and as long as properties are well-maintained and located in attractive areas, it tends to remain valuable over time.

● It’s a flexible choice for new investors

Owning real estate offers a high degree of flexibility in how you manage your investment. You have the freedom to choose between renting out your property for a steady income, selling it to capitalize on potential gains, or exploring various other options such as subdivision or rezoning to align with changing economic circumstances. This adaptability ensures that your investment remains useful and responsive to evolving market conditions.

● Many tax advantages and deductions

Real estate investors can tap into numerous tax benefits, deducting ownership and operational costs. They can also spread the depreciation of their investment property over many years, reducing their taxable income. Moreover, the possibility of deferring capital gains taxes using a 1031 exchange adds to the tax advantages of real estate investments.

● You build your wealth and equity

As you steadily reduce the mortgage on a property, you’re steadily building equity, which represents a substantial asset contributing to your overall net worth. This growing equity grants you a powerful financial leverage that can be used to acquire additional properties. By doing so, you can not only diversify your real estate portfolio but also increase your potential for generating greater cash flow and accumulating even more wealth over time.

Factors to Consider in Real Estate Investing for Beginners

There are several key factors to consider when it comes to real estate investing for beginners. Here are some things to consider on how to invest in real estate:

Location

The location of a property is often the most critical factor. Properties in desirable, growing areas tend to appreciate more and provide better rental income potential. Residential property values are significantly influenced by their proximity to amenities, green areas, scenic vistas, and the overall status of the neighborhood. On the other hand, commercial property valuations are closely tied to their proximity to markets, warehouses, transportation hubs, highways, and tax-exempt zones.

Property Type: New or Existing

Newly constructed properties often come with appealing price points, the opportunity for customization, and modern amenities, providing a fresh start for homeowners. However, they can also entail potential risks such as construction delays, unexpected cost increases, and uncertainties associated with a developing neighborhood.

In contrast, existing properties offer the convenience of immediate occupancy, quicker access to established amenities, and often lower overall costs. However, the condition of the property, including any needed repairs or renovations, affects its value and potential for rental income.

Property Value

Property valuation is a critical factor in real estate investing. Investors rely on accurate valuations to determine the market worth of a property, impacting choices such as buying, selling, or holding. This valuation not only influences options for real estate finance but also guides investment strategies, ensuring that investors can optimize returns and effectively manage their real estate portfolios.

Investment Purpose and Horizon

Matching the investment purpose with the investment horizon is essential. For example, investors seeking immediate income or regular cash flows might choose rental properties. The goal here is to secure consistent rental income to cover expenses and potentially generate profits. While those planning for retirement may focus on long-term property appreciation. This often involves investing in areas with potential for growth and development.

Overall Real Estate Market

Real estate investors must stay informed about the overall market conditions, conduct thorough market research when finding investment property for sale, and adapt their strategies based on the prevailing trends. Just like with other investments, it’s smart to buy when prices are low and sell when they’re high. Real estate markets can go up and down, so keep an eye on trends. Also, watch out for mortgage rates – lower rates can save you money on your loans.

Types of Real Estate Investments for Beginners

The choice of property type is important when deciding how to invest money in real estate for beginners as it fundamentally shapes your investment strategy and the potential returns you can expect. Each property type comes with its own set of opportunities and challenges. Here’s a closer look at how each property type influences your investment:

- Residential Properties. Investing in residential properties, such as single-family homes, multi-family units, or apartment complexes, often provides a reliable source of income. It’s important to note that there are numerous strategies and varying levels of competition specially for real estate investing for beginners, therefore, selecting the right exit strategy and market is a key step for success in residential real estate. Popular approaches include renovating properties, short-term wholesaling, and long-term rental income, with the added benefit of tax breaks.

- Rental Properties. Rental properties are often considered a safe and straightforward investment and real estate loans like single rental loans can help finance this type of investments specially for beginners. Monthly rent provides a consistent income stream, making it an attractive option, especially in a rising interest rate environment. While it offers guaranteed income, be prepared for regular maintenance and occasional tenant issues, which can affect profits. Choosing a growth-oriented location can maximize your potential for profit when selling the property.

- House Flipping. House flipping offers a unique approach to real estate investing, particularly suitable for beginners. Unlike long-term property management, it’s a temporary venture. Flipping involves purchasing properties in need of renovation, enhancing their value through repairs, and reselling them at a profit. The goal is a quick turnaround, but market conditions may affect the timing of the sale.

- Commercial Properties. To increase your chances of success in real estate investing, consider commercial properties like offices, retail spaces, industrial units, multi-family housing, or hospitality projects. These investments offer potential for higher cash flow, longer leases, and lower vacancy rates. Renting to businesses often results in smoother transactions and on-time rent payments due to their concern for their image and space.

- REITs. REITs are companies that own commercial properties like shops, hotels, and offices. You can invest in them by buying their shares on the stock exchange. They distribute a large portion of their income to shareholders, providing dividends and portfolio diversification. REIT shares offer flexible liquidity, allowing you to sell them on the stock exchange when needed.

Where can I find properties ideal for real estate investing for beginners?

Sometimes, investors get stuck figuring out how to actually find a property after deciding on the type. So, as you learn about different property types, make sure you also know where and how to locate them. Here are some useful options for investors.

MLS Listings and For Sale by Owners

Many investors find properties on the MLS or through FSBO listings. Yet, hidden opportunities frequently slip by, lacking effective marketing or being overpriced. To access the MLS, partner with a real estate agent or attend local networking events. When seeking FSBO properties, working with agents who have insights into these listings or driving through target areas to spot property sale signs can be helpful. Patience and a multi-pronged approach are key when searching for your next investment deal.

Off-Market Properties

In competitive markets, off-market properties offer an advantage. These properties are not listed on the MLS but can be found with the right search approach. To discover off-market properties, explore resources like public records, real estate auctions, wholesalers, networking events, and contractors. Wholesalers often have insights into recently renovated, leased properties at attractive prices, some with existing property management. Foreclosure listings remain relevant, so monitor newspapers and public records. Finding off-market properties requires extra effort but is worthwhile.

Real Estate Investing for Beginners FAQs

What is the best type of real estate investment?

The best type of real estate investment depends on your circumstances, goals, market, and strategy. Location matters, with different markets favoring various property types. Consider your involvement level, risk tolerance, and profitability goals. Some investors succeed in multiple property types, so flexibility is key.

What is indirect real estate investment?

Indirect real estate investment means you don’t directly own properties. Instead, you invest with others in a pool managed by a company that owns and operates properties or holds a portfolio of mortgages.

What do I need to know before buying my first investment property?

Like all investments, it’s imperative to conduct thorough research, consult experts, and diligently evaluate the risks and potential gains before making investment choices.

Assess your finances and secure financing if necessary like single rental loans . Consider down payments, maintenance costs, and potential vacancies. Research the local real estate market, including property prices, trends, and potential growth areas and choose the right property type based on your goals. Take note that Location is critical so consider factors like neighborhood, proximity to amenities, and rental demand.

Build your Wealth with Confidence

Real estate investment offers wealth-building potential but demands knowledge, patience, and careful consideration. This guide covers key aspects of real estate investing for beginners , from fundamentals to property types and finding the right investments. Different property types can yield profits, but the ‘best’ one varies based on many factors. Thus, it’s wise to explore various options.

While there’s no one-size-fits-all approach, the tips and strategies here empower beginners to navigate the market confidently and make informed choices. As with any investment, thorough research, professional advice, and risk assessment are vital.

Real estate investing can provide long-term passive income and financial freedom. Success requires commitment to learning and action. With this guide’s insights, newcomers can begin building a prosperous real estate investment portfolio.

KEY TAKEAWAYS

- Real estate investment holds the promise of wealth accumulation but requires expertise, patience, and thoughtful deliberation.

- Real estate can seem challenging for beginners, yet it’s a hands-on path to earning income.

- Real estate includes different types like residential and commercial properties, as well as real estate stocks.