Investing in real estate can help you build long-lasting wealth and potentially perform better than investing in the stock market if you do it right. Like any investment, there’s a risk – you might lose everything. If you buy property in an area where prices are going down, nobody wants to rent, or not many properties are being sold, you could get stuck with a property you don’t want.

But unlike stocks and bonds, real estate investing is something you can touch and use, no matter what’s happening in the market. Even if the market goes really bad, you still own a piece of property that’s not going anywhere. This gives a lot of investors a sense of security that they can’t get from other types of investments that might seem more uncertain.

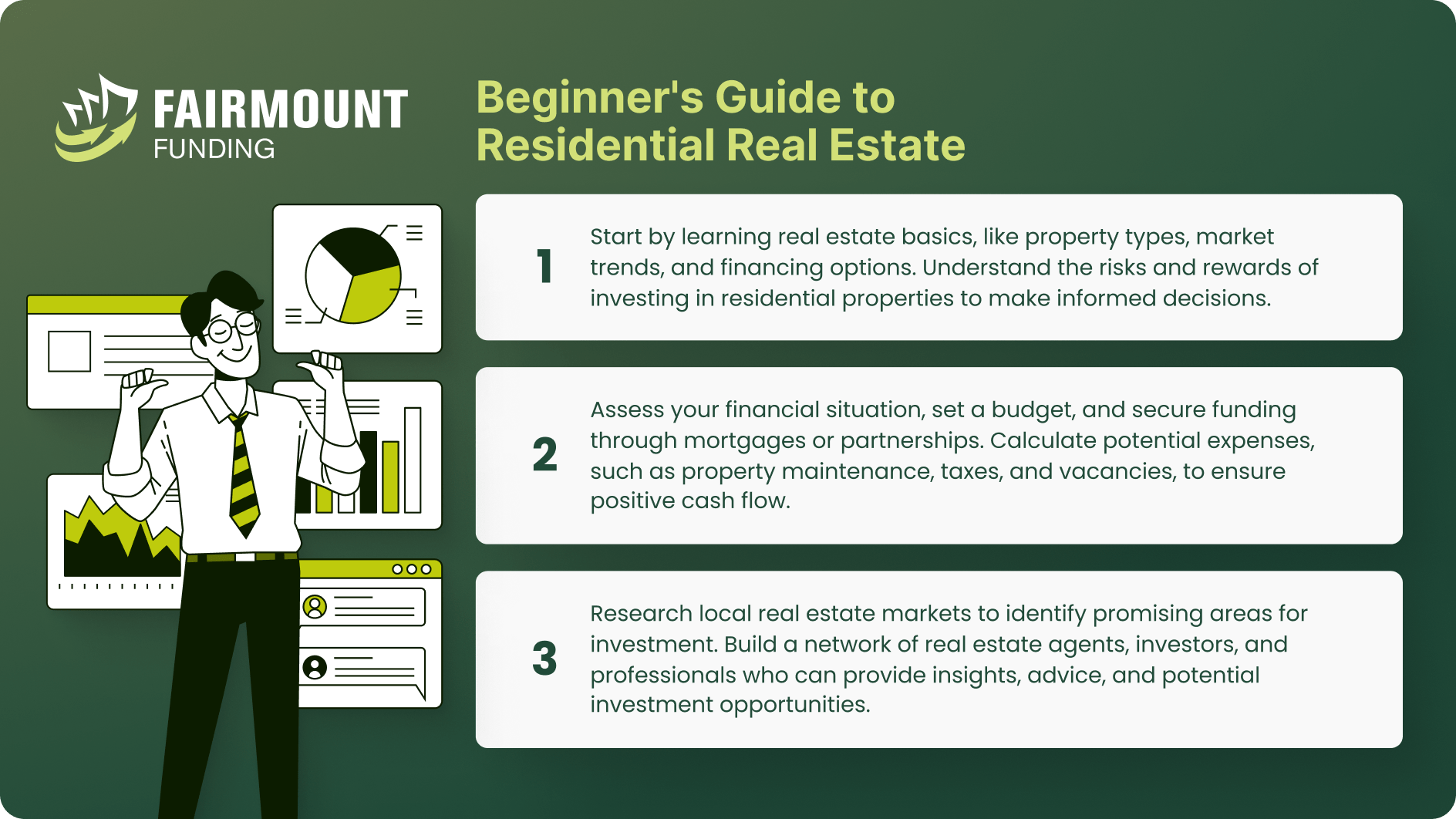

The reality is, real estate investing isn’t very exciting most of the time, but it can help balance out riskier investments like stocks. So, how can you start investing in real estate the right way? Here’s what you should know before you begin.

What Is Residential Real Estate Investing?

Real estate investing involves purchasing, owning, managing, or selling properties with the intention of generating income, capital appreciation, or both. It includes a wide range of property types, including residential homes, commercial buildings, apartments, land, and more. Investors may make money through rental income, property value appreciation over time, or a combination of both. In this article, we will concentrate on residential real estate investment which are housing investments primarily designed for people to live in, such as houses, apartments, condominiums, and townhouses.

Real estate investing offers several benefits influenced by your willingness to take on risk, the amount of your investment, and the real estate investment strategies you employ. Here are some of the advantages of residential real estate investing:

- Generate cash flow: Cash flow in this context refers to the surplus money left over after deducting all expenses associated with owning and managing a property from the rental income it generates. This positive cash flow can provide a steady stream of income, contributing to financial stability and helping to cover costs such as mortgage payments, property maintenance, taxes, insurance, and property management fees.

- Value appreciation: Real estate values typically appreciate over the years, so if you make a smart investment, you can make money when you sell it later. Also, the rent you can charge for the property often goes up over time, which means you could make more money each month.

- Equity and wealth: As you gradually pay off a property’s mortgage, you’re building up equity, which is like a valuable piece of your total assets. With this equity, you can get the ability to buy more properties. This can help you earn more money and grow your wealth over time.

- Tax breaks and deductions: Numerous tax benefits and deductions are available to real estate investors, which can result in financial savings during tax season. The reasonable expenses associated with owning, running, and managing a property are often deductible.

- Portfolio diversification: The risk of a total loss is reduced with a diverse portfolio. When you invest in different real estate markets or different types of properties, you’re creating a well-rounded set of assets. This can lead to a steadier investment and potentially better returns considering the risk involved.

Getting Started With Real Estate Investing

While many associate real estate investing with purchasing small rental properties, there’s a wide range of entry points into this market. Each avenue carries its own set of benefits and risks, offering distinct investment opportunities.

Owning Rental Properties

Some people start in real estate by buying a couple of small houses or a duplex. It’s like being a landlord – you find renters, fix things if they break, and deal with problems. At first, you might do all this yourself since there might not be much profit to hire help. It’s a bit like a business we’re familiar with because we’ve rented places ourselves. But remember, you’ll also need to make sure tenants follow the rules and take care of the property, even if unexpected issues pop up, like a broken pipe in the middle of the night.

When it comes to buying these rental properties, rental loans can help you acquire real estate for rental purposes. Let’s say you want to buy a duplex for $200,000. You might have some savings but not enough to cover the full price. Applying for a rental loan provides you the funds needed to purchase the rental property. This allows you to invest in real estate without needing all the money upfront. The rental income you receive from tenants can then help you pay off the loan while potentially earning a profit.

House Flipping

By now, most people have heard about property flipping – buying a house, renovating it, and selling it to someone else. However, what you see on TV doesn’t tell the whole story. Successfully flipping a residential property involves more than just the glamorized parts. You’ll need a significant amount of money to cover not only the materials and labor for renovations but also a reliable construction crew or subcontractors. Plus, you’ll have to pass various inspections before you can even put the property on the market.

One way to fund your property-flipping venture is through a fix and flip loan from private money lenders for residential real estate. This is a specialized type of loan designed specifically for real estate investors who want to purchase a property, renovate it, and then sell it for a profit. Fix and flip loans take into account the potential value of the property after renovations, making it possible for first-time flippers to secure funding based on the property’s future worth rather than just their own financial history. This can provide a more accessible way to enter the property flipping market and build a successful real estate investment business.

Real Estate Investing Groups (REIGs)

Real estate investment groups (REIGs) offer an attractive option for those who want to own rental property without the complexities of managing it themselves. Joining a REIG requires having enough money set aside and access to financing. In a typical setup, a company buys or constructs apartment blocks or condos and invites investors to purchase them, essentially becoming part of the group.

Each investor can own one or multiple self-contained living spaces, while the managing company oversees all units. They handle maintenance, find tenants, and advertise vacancies. In return for managing these tasks, the company takes a portion of the monthly rent.

Real Estate Investment Trusts (REITs)

Real estate investment trusts (REITs) are like investment funds for real estate that you can buy shares of on the stock market. Unlike private real estate projects, REITs are traded publicly, offering liquidity similar to stocks. However, selling quickly might not give you the best value.

REITs free you from property management, but it’s important to assess their leadership and financial management. Look for low debt, substantial ownership, and a clear long-term plan for their properties. REITs are quite transparent, sharing a lot of information about their income and expenses. This makes them a good choice for beginners who want a mix of residential real estate investing strategies or if you want to add some real estate to other investments that you have.

Land Speculation

Land speculation occurs when you buy a plot of land with the plan to sell it later, either as a whole or in sections. In certain regions, you can own land but sell off rights to things like water or minerals to other entities like mining or energy companies.

While land speculation is usually a short-term real estate strategy, a knowledgeable investor who understands the needs of specific industries like agriculture, energy, or real estate development can reap substantial profits by selecting the right land at the right price and time.

How to choose a residential real estate investment strategy?

Once you’ve determined that real estate investing is for you, the journey typically begins with a common question: ” How do you select the perfect investment property for your situation?” Here are a few factors to think about when deciding on the right property to invest in.

- Location: The property’s location plays a key role in its potential for growth and rental demand. Look for properties situated in areas with strong economic prospects, good amenities, low crime rates, and convenient access to transportation.

- Cumulative Gain: Consider the total return on investment, which includes both rental income and property value appreciation over time. A higher total return implies a more profitable investment.

- Market Trends: Analyze the current and future real estate market trends in the area. Consider whether property values are appreciating or depreciating, the level of demand for rentals, and the overall stability of the local real estate market.

- Rental Income Potential: Assess the potential rental income the property can generate. Research local rental rates and compare them to your expenses like mortgage payments, taxes, insurance, and maintenance costs.

- Property Type: Choose a property type that aligns with your investment strategy. Options include single-family homes, multi-family homes, and more.Each type carries its own set of pros and cons.

- Affordable Housing Properties: Consider the feasibility of investing in affordable housing investment. This can cater to a broader tenant base and may lead to steady rental demand, often supported by government initiatives like section 8 for housing.

How To Fund Your Project With Private Money Lenders For Residential Real Estate

When it comes to getting money for real estate projects, dealing with traditional lenders and their rules can be overwhelming. But teaming up with private money lenders is a much simpler way to go. They offer an easier path to financing by looking more at the property you want to buy than just your credit score.

Private money lenders are usually individuals or small groups who are ready to give you money for your real estate plans. They check out how good the property is and how you plan to make money from it.

If you work with private money lenders, you can skip the long and strict process that regular banks or credit unions make you go through. This will of course help you to get money quickly and smoothly, so you can jump on more investment opportunities quickly and catch time-sensitive deals in real estate.

Risks in Real Estate Investing

Any investment including real estate carries a level of uncertainty because it might not turn out the way you expect. For real estate investing, you need a good amount of money to buy and take care of the property. You also need time and skills to manage the place and deal with renters if you’re renting it out, whether it’s a long-term rental or a property you want to fix up and sell. Some real estate investors choose to hire someone to handle these tasks, but that comes with a cost, which can delay when you start making a profit and getting back the money you put in initially. Take note, real estate investing doesn’t deliver instant financial returns, so it might take several years before you see a profit or recover your initial investment.

Finding people to rent out your property during tough economic times is another risk of real estate investing. This means that you’d have to pay for the property’s maintenance and any mortgage payments you might owe to the bank for buying the property.

Real Estate Investing FAQs

Is my primary residence a real estate investment?

Usually, your primary home isn’t seen as a real estate investment because it’s where you live. However, you can still make money if you sell your home for more than what you paid. If that happens, you might need to pay taxes on the money you make.

How can real estate investments hedge inflation?

Owning real estate can act as a shield against inflation in a few ways. To start, property values might surge beyond the inflation rate, resulting in capital gains. Additionally, rents for investment properties can be adjusted upwards to match inflation. Lastly, properties funded by fixed-rate loans will witness a decrease in the portion of monthly mortgage payments over time, relatively speaking.

How can I be financially prepared for residential real estate investing?

Real estate needs a substantial financial commitment, requiring upfront cash for a down payment, partnership share, or full property purchase. You will also want to have a separate fund for potential repairs, distinct from your regular emergency savings. Before delving into real estate, it’s wise to set up an emergency fund, clear consumer debt, and set up automated retirement savings.

Real Estate Investment for Every Investor

No matter your investment style, there’s a real estate opportunity tailored to meet your needs. Seeking a hands-on approach? Consider being a landlord or flipping. Prefer a more passive approach? REITs might align perfectly with your goals.

However, as with any investment, ensure a thorough grasp of the terms before committing funds. Real estate investing demands a long-term perspective, urging careful consideration and informed choices.

When exploring your options, don’t overlook the potential benefits of private money lenders. With Fairmount Funding, we can offer a smoother and more flexible financing path, often looking beyond credit scores to focus on the property’s value and your investment strategy. This is particularly valuable for seizing time-sensitive opportunities and expanding your real estate portfolio.

KEY TAKEAWAYS

- Real estate investors utilize properties as a tool for making money using various real estate investing strategies or methods.

- Real estate investing brings benefits like passive income, steady cash flow, tax perks, diversification, and leveraging opportunities.

- Real estate investment doesn’t provide immediate financial rewards, which means it could be years before you start making a profit or getting back the money you put in initially.