Retirement planning is a complex endeavor, and many seniors explore various options to secure their financial well-being during their golden years. Reverse mortgages, also known as Home Equity Conversion Mortgages (HECMs), have gained popularity as one such option.

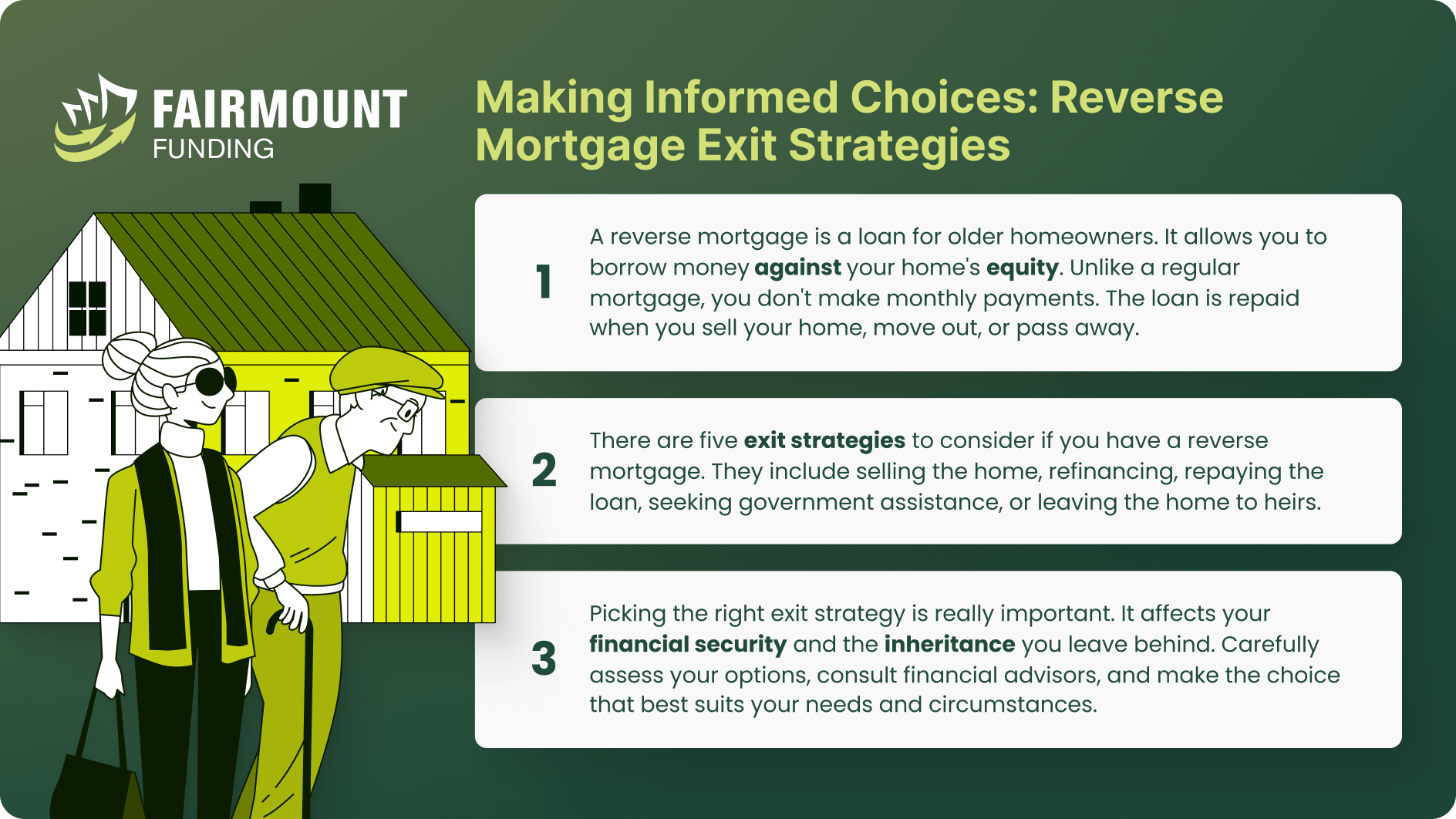

A reverse mortgage can be a helpful financial tool in retirement, offering potential benefits for certain individuals. However, it’s essential to recognize that this financial instrument is intricate and may not suit everyone’s needs. Even for those who have taken the time to understand the reverse mortgage loopholes, the process of disengaging from the loan can pose challenges that require careful consideration.

In this comprehensive guide, we will explore the complexities of reverse mortgages, providing insights into its mechanics, advantages, and drawbacks. We will also explore strategies for effectively managing a reverse mortgage, and when necessary, how to get out of a reverse mortgage with a clear understanding of the implications.

Understanding How a Reverse Mortgage Works

A reverse mortgage operates by utilizing the accumulated home equity to settle your existing mortgage. The remaining proceeds can be received as a lump sum, line of credit, or monthly payments from the lender. Unlike a traditional mortgage, it doesn’t necessitate immediate repayment. Instead, repayment occurs later. However, obligations include property taxes, homeowners insurance, and home maintenance.

To qualify for a reverse mortgage, you must be at least 62 years old, have sufficient home equity, and use the property as your primary residence. The most common type is the Home Equity Conversion Mortgage (HECM), backed by the Federal Housing Administration (FHA) for borrower protection. To secure a HECM, you’ll undergo a financial assessment, attend counseling to understand the loan terms, and recognize the eventual loan repayment requirement.

Property investors can potentially use reverse mortgages to their advantage by considering these strategies:

- Income Stream: Investors with substantial home equity can establish a reverse mortgage line of credit, which can serve as an emergency fund or a source of income during market downturns or when rental income is insufficient.

- Property Upkeep: Reverse mortgage funds can be used for property maintenance and improvements, helping investors maintain the value and marketability of their investment properties.

- Delaying Home Sale: Investors may utilize reverse mortgages to delay selling properties during unfavorable market conditions. This can allow them to hold onto investments until market conditions improve.

- Diversification: Accessing home equity through a reverse mortgage can provide capital for diversifying an investment portfolio, reducing reliance on a single property for wealth accumulation.

Can reverse mortgage loopholes be used as an exit strategy?

Reverse mortgages are governed by strict regulations and safeguards to protect borrowers and lenders. Under current reverse mortgage regulations, lenders are not permitted to assess whether borrowers possess adequate resources to cover property maintenance and tax payments. While federal rules ensure that borrowers are not obligated to repay more than the property’s value, this scenario implies that no equity would remain for distribution to the borrower’s family upon the borrower’s passing.

Using reverse mortgage loopholes is not an advisable exit strategy, and this can have serious legal and financial consequences. It’s essential to navigate reverse mortgages within the boundaries of the law and consider other legitimate exit strategies if needed. For this reason, some real estate investors may want to exit a reverse mortgage. Here are other common reasons you may want to exit from reverse mortgage:

- A transition to a nursing home or assisted living facility is on the horizon.

- You’re experiencing “buyer’s remorse.”

- The funds from your reverse mortgage fall short of covering homeowners insurance, property taxes, and maintenance costs.

- You’ve decided to leave your home to your heirs without requiring them to purchase it.

- You share the home with someone not on the loan, and their housing security is a concern if you move out or pass away.

- Your financial situation no longer necessitates the assistance of a reverse mortgage for income supplementation or home repairs.

Regardless of your motivation, it’s essential to understand that you have options. Taking the time to reflect on your reasons for wanting to exit this type of loan will help you make an informed choice about the best way to proceed.

5 Ways to Leverage Reverse Mortgage Loopholes

If you’ve acquired a reverse mortgage and no longer wish to retain it after careful consideration, can you get out of a reverse mortgage? Here are 5 methods to exit the loan, taking into account potential reverse mortgage loopholes.

Tip #1: Cancel the Transaction

If you’ve recently acquired a reverse mortgage and have had a change of heart, you may have a window of opportunity to cancel the transaction without any penalties, although it’s important to be aware of potential reverse mortgage loopholes. Typically, borrowers have a cooling-off period of at least three days after closing the loan to rescind the agreement. During this period, you can send a written notice to the lender expressing your intent to cancel, and any funds disbursed to you must be repaid promptly. This option allows you to undo the reverse mortgage transaction entirely.

Tip #2: Sell the Property

Selling the property is a common exit strategy for reverse mortgage borrowers. When you sell, the proceeds from the sale are used to repay the reverse mortgage balance, and any remaining equity is yours or can be passed on to your heirs. But what if your home value is less than your loan, how do you pay back a reverse mortgage? The good news is, reverse mortgages fall into the category of non-recourse loans. This means that the amount you owe on the loan will never exceed the value of your home. If you ever sell your home for less than the outstanding loan balance, FHA insurance steps in to bridge the gap.

Tip #3: Use Your Funds

When it comes to reverse mortgage payoff, you’ll be responsible for settling the borrowed amount along with any accrued interest. If you intend to continue residing in your home and have no plans to sell it, repaying the loan will necessitate out-of-pocket payments. This could involve using your savings for a lump-sum payment or establishing a structured payment plan, potentially requiring monthly installments and a revised budget to accommodate these payments.

Tip #4: Consider Refinancing

Refinancing your reverse mortgage is another possibility, especially if your financial circumstances have improved or interest rates have become more favorable. When you decide to refinance reverse mortgage, you can potentially secure a new loan with better terms, which may reduce costs and improve your overall financial outlook. It’s advisable to consult with a mortgage expert to fully explore this option.

Tip #5: Take Out a Loan

In some cases, borrowers consider taking out a traditional loan, including real estate investment loans, to repay the reverse mortgage. This can be a practical solution if you have access to credit and can manage the repayment terms effectively. However, it’s essential to carefully assess the terms and conditions of the new loan and consider how it aligns with your financial goals and capabilities. Ensure that you can comfortably meet the obligations of the new loan to avoid any adverse consequences.

Handling Reverse Mortgage Problems

Borrowers frequently have to find out how to get out of a reverse mortgage because they don’t completely understand how it operates or because they encounter unforeseen changes or needs. If you experience issues with your reverse mortgage, think about taking these actions:

- Talk to your lender. Open communication with your lender is vital when facing problems with your reverse mortgage. They can offer valuable insights and help you navigate your specific situation.

- Make partial payments. If you have the financial means, consider making partial payments on the loan to reduce the balance and interest accruing. This can help alleviate some of the financial pressure associated with the reverse mortgage.

- Review your long-term plans. Determine your primary objectives, such as whether your preference is to maintain long-term residence in the home or transfer the property to your heirs. Adjustments may be necessary to ensure your financial security.

- Speak with a reverse mortgage advisor. A reverse mortgage counselor or advisor can provide guidance on potential solutions and work with you to find a resolution like conducting a benefits assessment to see if you qualify for federal or state assistance programs.

- Consider the cost. Assess the overall cost of the reverse mortgage, including interest and fees. Remember that any decision you make will have associated expenses. Whether you choose to refinance your current loan with a conventional mortgage or opt for a new reverse mortgage, there will be closing costs involved.

Reverse Mortgage Loopholes FAQs

When do I have to pay for a reverse mortgage?

When a reverse mortgage reaches its repayment phase, which often happens after the borrower’s passing, Heirs can sell the home and use the proceeds to repay the loan, refinance it with a traditional mortgage, or buy the property themselves for either the loan amount or 95% of its appraised value, whichever is lower. They can also transfer the title to the lender and walk away from the loan, ending their obligations.

Would I need to justify my right to rescission?

No justifications are required when exercising your right to rescission. All that is necessary is for you to express your decision to follow an alternative course of action.

What makes a reverse mortgage bad?

A reverse mortgage can be considered “bad” for some individuals due to factors like high fees, interest costs, potential impact on inheritance, and the risk of losing the home if obligations aren’t met. But the most common reason people see it as “bad” is because the loan is not aligning well with their specific circumstances or because they’ve been misinformed. It’s essential to recognize that a reverse mortgage isn’t a one-size-fits-all solution, and there are cases where it may not be a suitable choice.

Maximize Your Financial Flexibility

Reverse mortgages offer valuable financial flexibility during retirement, enabling homeowners to access their home equity. However, as life circumstances change, repaying the loan may become the best choice, particularly when leaving the house as an inheritance for your children is a priority. While reverse mortgages are generally straightforward, it’s important to be aware of potential pitfalls and reverse mortgage loopholes. If you ever feel that you’ve rushed into a reverse mortgage, remember that your right of rescission exists for a reason. It grants you the freedom to reconsider your decision and make adjustments confidently to align with your evolving needs and financial goals.

KEY TAKEAWAYS

- Reverse mortgages enable homeowners aged 62+ to access home equity without monthly mortgage payments.

- The repayment phase of a reverse mortgage typically begins when the borrower passes away, moves out of the home, or when the home is sold.

- A reverse mortgage is typically repaid from the sale of the home.