Taking a reverse mortgage on investment property offers a unique avenue for real estate owners to tap into the equity of their assets. Hence, they have additional sources of income they can use during retirement or challenging financial times. But does it differ from renting out a house with a mortgage?

A reverse mortgage on an investment property allows homeowners to turn a portion of their real estate’s equity into cash without selling it or making monthly mortgage payments. On the other hand, renting out a house with a mortgage involves the more conventional practice of owning a property with a standard mortgage while earning rental income from tenants.

If you choose the former, consider whether you are eligible for this financing solution. Keep on reading to learn more about how you can take a reverse mortgage on your investment property.

What is a reverse mortgage?

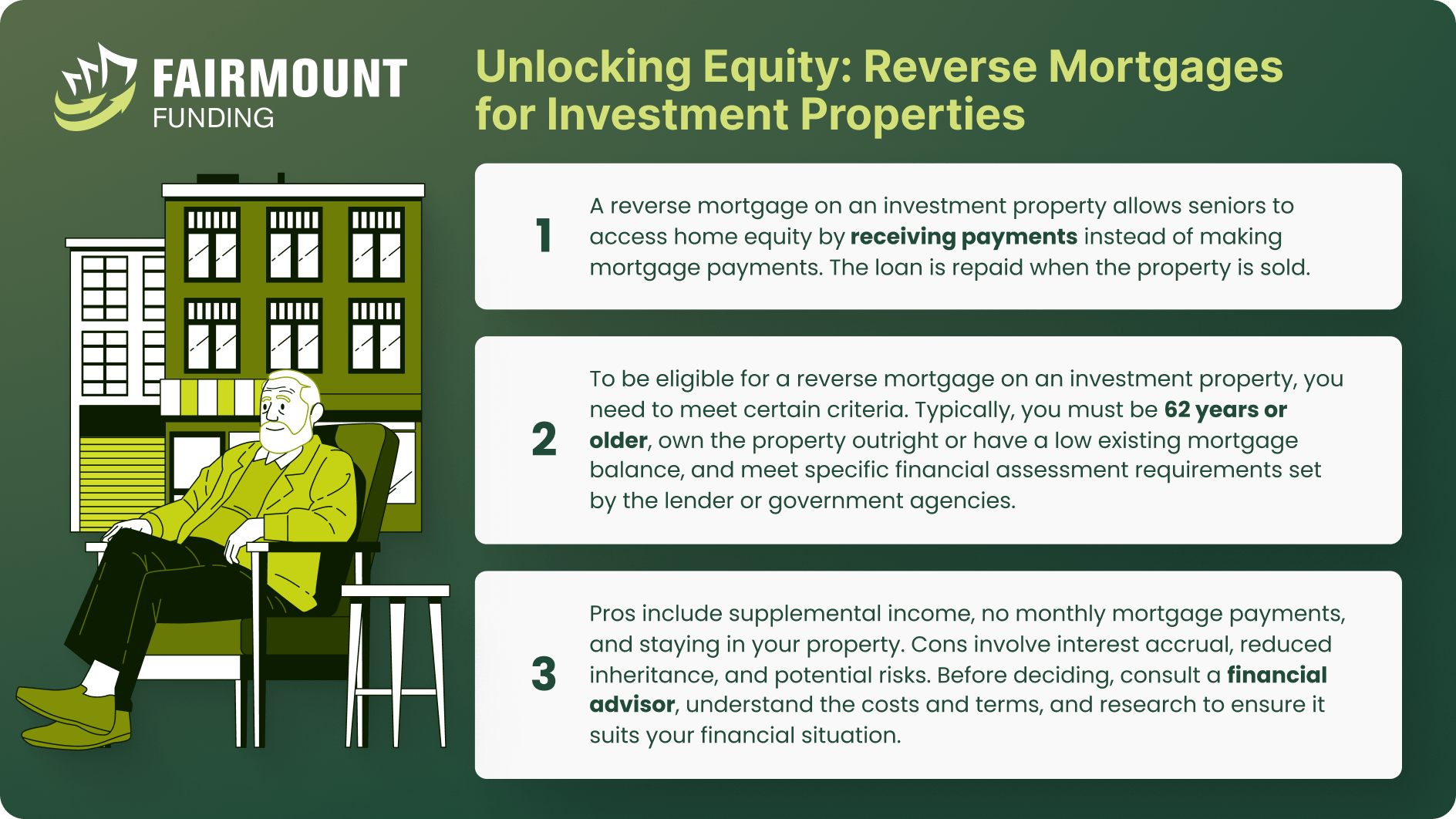

A reverse mortgage is a financial arrangement designed for homeowners, typically those at least 62 years old. This financing solution allows them to convert a portion of their home’s equity into cash without selling the property or making monthly mortgage payments.

Instead of the homeowner paying the lender, it is the reverse. This can provide supplemental income during retirement or address financial needs without forcing the homeowner to move out of their home.

How Reverse Mortgage Works

Reverse mortgages allow homeowners to access the home equity they built over the years. You can access this equity in various ways, including a lump sum, monthly payments, or a line of credit. The homeowner only needs to repay the loan once the property is sold, the homeowner moves out, or they pass away. At that point, the loan is typically repaid from the home sale. If the proceeds from the sale exceed the loan balance, the excess goes to the homeowner or their heirs.

Reverse Mortgage Eligibility

There are criteria that homeowners must meet so they can qualify for a reverse mortgage. These are the following:

- Age: Generally, the youngest homeowner on the title must be at least 62 years old.

- Homeownership: You must own the property, or you can pay your mortgage balance using the proceeds from the reverse mortgage.

- Residence: The property must be your primary residence, and you must live there for most of the year.

- Financial Assessment: Lenders may conduct a financial assessment to ensure you can meet ongoing expenses like property taxes and insurance.

It is essential to consider its implications and costs and whether a reverse mortgage on investment property is possible. That is because it can impact your estate and future inheritance of your heirs. We recommend consulting with a financial advisor or counselor before entering into a reverse mortgage agreement.

Different Types of Reverse Mortgages

A reverse mortgage has slight similarities with a home equity loan or home equity line of credit. However, you are not required to have an income or good credit to qualify. That said, you can choose to receive the proceeds of your reverse mortgage in one of four ways:

- Lump Sum: A lump sum reverse mortgage provides homeowners a single, large payment upfront. This is helpful for borrowers with immediate financial needs or who want to settle an existing mortgage and other debts. The drawback is that reverse mortgage interest rates begin accruing on the entire loan amount as soon as it is disbursed, which can lead to a substantial loan balance over time. Hence, it is worth considering whether a lump sum is a good reverse mortgage on investment property.

- Annuity or Equal Monthly Payments: Homeowners receive equal monthly payments from the lender for as long as they continue to live in the home with this option. Annuity payments provide a stable and predictable source of income, which can be beneficial for covering living costs or healthcare. These payments typically last as long as the homeowner resides in the home.

- Term Payments: Term payments are similar to annuity payments, although they have a fixed duration of 5, 10, or 20 years. Homeowners receive monthly payments for the chosen term. This option may be suitable for specific financial goals over a set period, like funding a child’s education or paying off debts.

- Line of Credit: This works like HELOC. Homeowners can access a predetermined credit limit but can choose when and how much to withdraw. The unused portion of the credit line can grow over time, making it a flexible option for managing expenses. Interest accrues only on the withdrawn amount, potentially saving homeowners money in the long run.

Can you get a reverse mortgage on investment property?

In general, obtaining a reverse mortgage on investment property is impossible. Reverse mortgages are typically designed for primary residences, where the homeowner lives most of the year.

Per the primary residence mortgage rules, these loans are meant to tap into the equity of your primary home and provide a source of income without requiring monthly mortgage payments. As such, rental or investment properties do not meet the primary residence requirement for a reverse mortgage.

There are also nuances you should keep in mind:

- Second Homes: Homeowners may obtain a reverse mortgage on a second home if it meets the lender’s criteria. However, they must still use the property as their primary residence for most of the year. This option is not designed for rental or investment properties.

- Renting Out a House with a Reverse Mortgage: Deciding to rent out a primary residence with a reverse mortgage can trigger the loan’s due and payable status. The loan balance becomes due when the homeowner no longer lives in the home as their primary residence. If a homeowner wishes to keep a property as an investment and continue receiving reverse mortgage occupancy benefits, they would need to pay off the balance or refinance it through another financial arrangement.

Borrowers can explore alternative financing options to fund an investment property’s acquisition. This can include traditional mortgages, home equity loans, and lines of credit on their primary residence, personal savings, or real estate investment loans.

Each financing option has its eligibility requirements, terms, and conditions. That is why it is essential for potential investors to carefully evaluate their financial situation and choose the method that aligns best with their investment goals and risk tolerance.

How much can you borrow?

How much you can take from your reverse mortgage depends on your initial principal limit. This is based on your age, the loan’s interest rate, and your property’s appraised value.

For instance, you have a $300,000 house and an initial principal limit of $200,000. The difference of $100,000 accounts for the interest accumulating on the reverse mortgage over the years. Assuming you own your home free and clear, using part of the reverse mortgage proceeds to pay off your first mortgage may be unnecessary.

This qualifies you to access the maximum of 60% of the initial principal limit, which is $200,000, during the first year of the reverse mortgage. However, you must use part of your home equity to pay for the loan’s expenses, like mortgage premiums and interest.

Reverse Mortgage on Investment Property FAQs

When is it a good idea to get a reverse mortgage loan?

Getting a reverse mortgage is a good idea if you are a senior homeowner looking to supplement your retirement income, cover healthcare expenses, or improve your overall financial stability. It can also be beneficial if you want to age in place and access the equity in your home without selling it.

Hence, a reverse mortgage on investment property is not viable. Instead, you can use it if you do not plan to leave your primary residence. That is because this type of loan is typically designed for those who intend to stay in their homes.

How much equity do I need for a reverse mortgage?

The amount of equity you need when you calculate reverse mortgage can vary. That is because lenders must consider your age, the appraised value of your home, current interest rates, and the specific reverse mortgage program you choose.

Typically, the older you are, the more equity you can access. Nevertheless, it is safe to assume that you will need significant equity in your home.

What do I need to get a reverse mortgage?

To qualify for a reverse mortgage, you or the youngest homeowner on the title must be 62 years old or older. You must be the homeowner or have a low mortgage balance that the reverse mortgage proceeds can pay off. Lastly, the home must be your primary residence, and you must live there for most of the year.

Some lenders may conduct a financial assessment to ensure you meet ongoing expenses like property taxes and insurance. You will also go through mandatory reverse mortgage counseling, which involves meeting with a HUD-approved counselor to discuss the implications and responsibilities of a reverse mortgage. The counselor will help you understand the loan terms and ensure it aligns with your financial goals.

Reverse Mortgage: Who is it For?

In conclusion, a reverse mortgage does not cater to investment properties. These financial instruments are primarily designed for homeowners aged 62 and older who wish to access the equity in their primary residences without making monthly mortgage payments.

Suppose you are a real estate investor seeking to unlock the equity in an investment property. In that case, home equity loans, traditional mortgages, or lines of credit may be more suitable.

A reverse mortgage on investment property may not be viable. However, real estate investors can explore other strategies to fund their investment endeavors. Careful financial planning, sound investment decisions, and a diversified portfolio can help you achieve your investment goals and build wealth over time.

KEY TAKEAWAYS

- A reverse mortgage allows homeowners to turn a portion of their real estate’s equity into cash without selling it or making monthly mortgage payments.

- Obtaining a reverse mortgage on investment property is impossible since it is designed for primary residences, where the homeowner lives most of the year.

- You can explore alternative financing options, such as real estate investment loans, to fund an investment property acquisition.