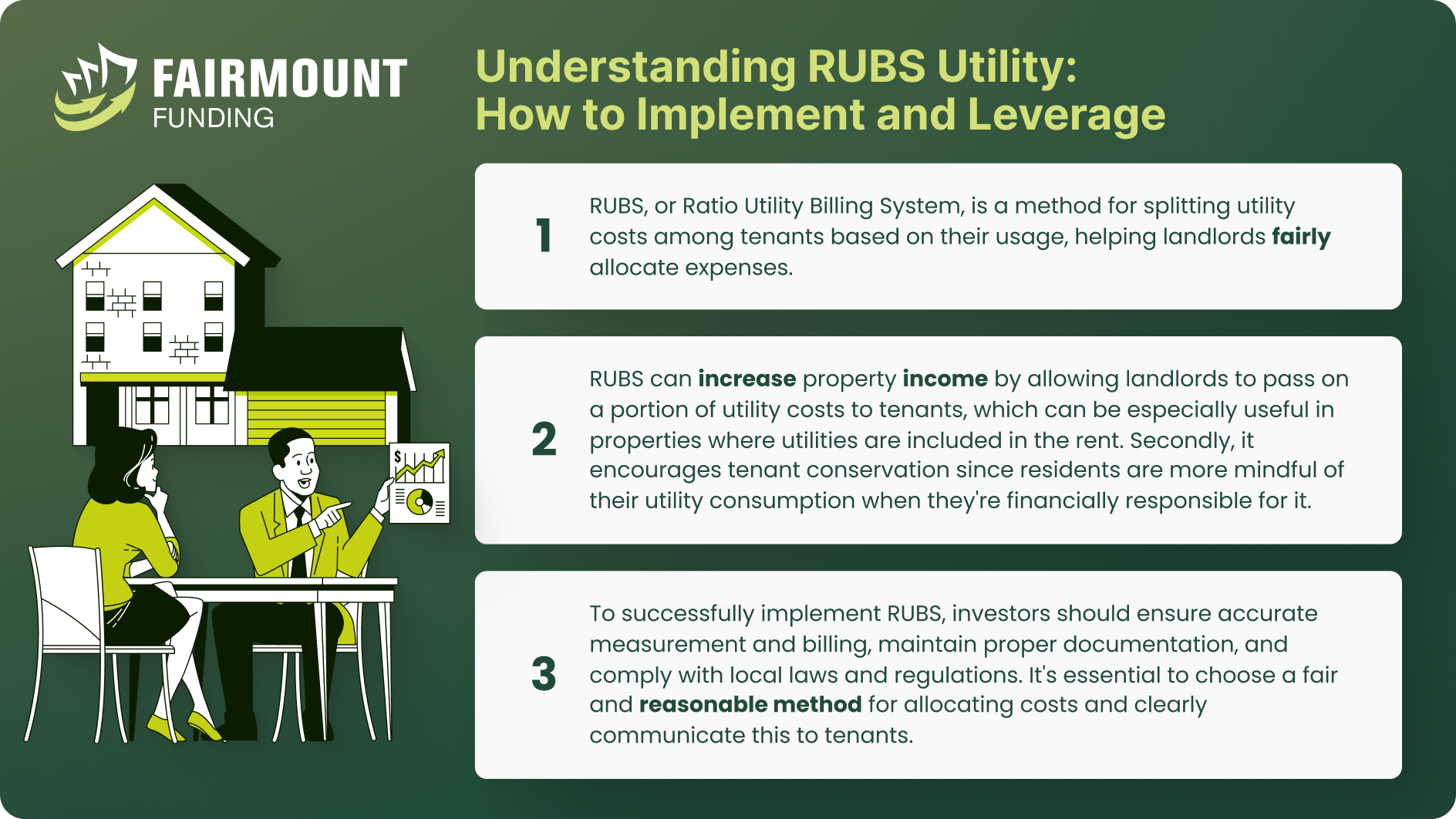

When it comes to real estate investing, success is all about maximizing returns while staying ahead of the competition. One strategy that’s been gaining traction is RUBS utility. RUBS in real estate stands for Ratio Utility Billing System. This allows property owners and managers to allocate utility expenses among tenants based on how much they actually use, instead of just taking it onto the monthly rent.

Why should real estate investors embrace RUBS utility? Let’s explore RUBS in-depth and see how savvy real estate investors can integrate it effectively into their investment strategies.

How can property investors benefit from RUBS income?

RUBS Income, short for Ratio Utility Billing System Income, refers to the revenue generated by property owners or managers through the implementation of a RUBS utility. RUBS is a method used in multifamily properties to fairly allocate utility costs among tenants based on their individual consumption. Here’s how it works:

- Property owners install utility meters or use a predetermined allocation formula to determine each tenant’s utility usage.

- Utility costs (such as water, gas, or electricity) are divided among tenants based on their usage percentages. This allocation is then added to each tenant’s monthly rent.

So, what is RUBS in real estate, and why does RUBS income matter? First off, it results in increased revenue, as property owners can recoup utility expenses that were traditionally included in the rent, significantly boosting the property’s cash flow. Plus, it allows property owners to offer more competitive base rental rates, attracting cost-conscious tenants and potentially reducing vacancy rates. This encourages tenant accountability by making them directly responsible for their utility consumption, often leading to reduced utility expenses for property owners. And here’s the kicker—the increased cash flow stemming from RUBS income can enhance the property’s overall value, making it a more appealing investment. It can contribute to improved profit margins by shifting utility expenses to tenants, thereby reducing the property’s operating costs.

Calculating RUBS Utility Income

When computing a multifamily property’s RUBS (Ratio Utility Billing System) income, several factors need to be carefully considered to ensure an accurate and fair allocation of utility costs among tenants. These factors include:

Number of Tenants per Unit: This method fairly splits utility costs among unit occupants, often used for water bills. It’s based on the premise that more people in a unit typically mean higher utility usage. Property management companies like it for its clarity and logic. However, adjustments can be tricky when occupant numbers change, such as when a couple has a baby. The challenge lies in accurately updating occupancy data in your property management software.

Square Footage: Some property management firms use square footage to calculate utility, often for gas. The idea is that larger units tend to consume more utilities due to increased heating and cooling needs. But it’s important to account for differences in unit design, as larger spaces may not necessarily have more water appliances or occupants, potentially leading to unfair allocations.

Bedrooms and Bathrooms: The number of bedrooms in a unit often correlates with the size of the living space and the number of occupants. Typically, units with more bedrooms accommodate larger households, which tend to have higher utility consumption. For instance, a three-bedroom apartment is likely to have more residents than a one-bedroom unit, resulting in greater water, electricity, and gas usage. Same goes with a larger number of bathrooms. Units with multiple bathrooms may have higher water usage due to additional toilets, sinks, and showers. This can significantly impact the allocation of water utility costs.

Legal Compliance: Be aware of local, state, and federal regulations governing utility billing practices. Compliance with laws and regulations, such as those related to tenant notification and utility billing disclosures, is essential to avoid legal issues. In several cities, RUBS may not be permitted due to concerns about its fairness, particularly when utility billing relies solely on square footage. Even in municipalities where RUBS is allowed, there are often specific regulations governing its implementation. To check whether RUBS is an option in your locality, reach out to your state’s public utility commission or your local National Apartment Association affiliate for guidance.

Utility Rate Variability: Consider whether utility rates are fixed or variable. Variable rates can fluctuate over time, impacting the accuracy of the allocation. Property owners may need to adjust the allocation formula periodically to account for rate changes. X-factors like different appliances should also be considered. Some units may come equipped with energy-efficient appliances like energy-star rated refrigerators, washers, or HVAC systems, while others may have older, less efficient models. These appliance differences can result in variations in utility consumption. Recognizing these disparities as an x-factor allows for a more precise allocation of utility costs, considering the impact of specific appliances on usage and efficiency. This ensures that tenants with different equipment profiles contribute fairly to utility expenses based on their actual consumption patterns.

Implementing RUBS Utility in Your Multifamily Property Investment

There are a few things that must be done to successfully adopt RUBS in your multifamily property. This includes:

- Utility Assessment: Begin by thoroughly assessing the property’s utility setup, including the type of utilities (water, gas, electricity), how they are measured (individual meters or master meters), and the infrastructure in place. Understanding the property’s utility configuration is essential for designing an effective RUBS program.

- Tenant Notification: Notify and educate your current residents about the upcoming transition to RUBS through lease addendums. These addendums should outline the new billing method, the allocation formula, and any changes in their lease agreements regarding utility costs. Clear communication is vital to minimize tenant confusion or resistance.

- Utility Billing Software: Invest in a comprehensive utility billing system or property management software that can handle the RUBS calculations, billing, and record-keeping efficiently. Upload detailed billing and unit information, including square footage, the number of bedrooms, and bathrooms, into this integrated system.

- Include Recent Master Utility Bills: Add recent master utility bills to your integrated system as a baseline for calculating the RUBS charges. This data will help establish a fair starting point for utility cost allocations.

- Trial Period: Initiate a trial period to test the RUBS system with a subset of tenants. This allows you to identify and address any issues or concerns before full implementation.

- Issuing Individual Utility Bills: Once a significant number of residents have enrolled in the RUBS program, the integrated system will generate individual utility bills for each tenant based on the established allocation formula. These bills should be clear and transparent, indicating the tenant’s share of utility costs.

- Tenant Payment to Utility Billing Company: In the RUBS system, tenants directly pay a utility billing company, not the landlord or property owner. This utility billing company will calculate the total utility expenses for the property, collect payments from tenants, and then reimburse the landlord or property management company.

- Tenant Support and Education: Provide ongoing support to tenants and address any questions or concerns they may have about the new billing method. Offer education and resources to help them understand their utility usage.

- Regular Auditing and Adjustments: Periodically review the RUBS program to ensure accuracy and fairness. Make adjustments to the allocation formula as needed, especially in response to changes in occupancy or utility rates.

- Record Keeping: Maintain thorough records of utility bills, calculations, and allocations for each unit. This documentation is crucial for transparency and addressing tenant inquiries or disputes.

Maximizing a Property’s RUBS Utility Income

RUBS utility offers property owners and investors an avenue to generate additional income while simultaneously enhancing their property. By implementing RUBS, property owners can allocate utility costs more equitably among tenants based on usage, effectively shifting the financial responsibility for utilities from the owner to the tenants. This approach not only increases the property’s cash flow but also improves its overall financial performance, which can be particularly beneficial for investors seeking higher returns.

Property owners can leverage their RUBS income to make valuable improvements to their multifamily properties. For instance, they can invest in energy-efficient upgrades, such as installing energy-efficient appliances, HVAC systems, or LED lighting, which not only reduce utility costs but also enhance the property’s marketability and sustainability. Moreover, RUBS income can be used to fund much-needed renovations and improvement or possibly help in getting a multifamily rehab loan, aimed at upgrading common areas, landscaping, or building exteriors to attract higher-paying tenants and increase property value.

RUBS Utility FAQs

Why should I use RUBS in my multifamily properties?

Using RUBS in your multifamily properties allows you to allocate utility costs more fairly among tenants based on their usage, which can increase property cash flow, attract cost-conscious tenants, and potentially improve overall profitability. It offers a transparent and equitable method for distributing utility expenses while encouraging tenant conservation.

Is it legal to implement RUBS?

The legality of implementing RUBS varies by location. It’s important to check local, state, and federal regulations and consult with legal counsel to ensure compliance with utility billing laws in your specific area.

What are the drawbacks of using RUBS?

The drawbacks of using RUBS can include potential tenant disputes, administrative complexities, and the need to stay compliant with local regulations. Additionally, it may not be suitable for properties with inconsistent utility consumption patterns.

Save Cost and Gain More with RUBS

No matter which specific RUBS utility method is selected, the advantages remain consistent. Property managers and owners can expect to recover a larger portion of utility costs, gain improved expense forecasting accuracy, and witness reduced utility consumption from tenants. RUBS serves as a practical solution that allows for precise allocation and recapture of utility expenses without the expense of meter installations. This method promotes fairness and transparency in utility billing, enhancing tenant relations and streamlining billing processes. Overall, RUBS presents a win-win scenario for both property owners and tenants, as it optimizes financial returns while encouraging more responsible utility usage.

KEY TAKEAWAYS

- RUBS utility provides property owners and investors with an opportunity to increase their revenue while simultaneously improving their property.

- RUBS Income is a smart strategy that enhances both revenue and the financial performance of multifamily properties

- Implementing RUBS in your multifamily properties enables you to distribute utility expenses equitably among tenants, aligning their costs with their actual usage.