For aspiring and seasoned real estate investors, the allure of self-storage facilities for sale has captured the attention of those seeking to diversify and expand their portfolios. One reason is that 38% of Americans use self-storage units. The primary reasons include downsizing, relocating, or needing more space at home.

This explains why self-storage facilities have emerged as a compelling asset class, offering a unique combination of passive income and long-term value. With the rising demand for storage solutions, investing in self-storage offers a solid chance to tap into a resilient market with a consistent revenue stream.

If you want to venture into a dynamic market with financial stability and growth potential, exploring self-storage for sale might be your next strategic move. This guide will give you an overview of what a self-storage facility is, why self-storage investing can be a good idea, and how you can get started.

What Is a Self-storage Facility?

A self-storage facility is a commercial property that provides rental spaces to individuals and businesses to store their belongings, inventory, equipment, or other items. These facilities consist of storage units of different sizes, which tenants can rent on a short-term or long-term basis.

Storage facilities offer a secure and convenient solution for people who need extra space to store items that no longer fit in their homes or workplaces. This can include furniture pieces, vehicles, or office equipment. Additionally, these facilities typically provide various amenities and security features like climate-controlled units, 24/7 access, and surveillance cameras to attract tenants.

As mentioned, self-storage facilities for sale have become increasingly popular due to urbanization, downsizing, and the growth of e-commerce. That is why they have become an appealing investment option for real estate investors seeking to capitalize on the consistent demand for storage space.

Advantages of Investing in Self-storage Facilities for Sale

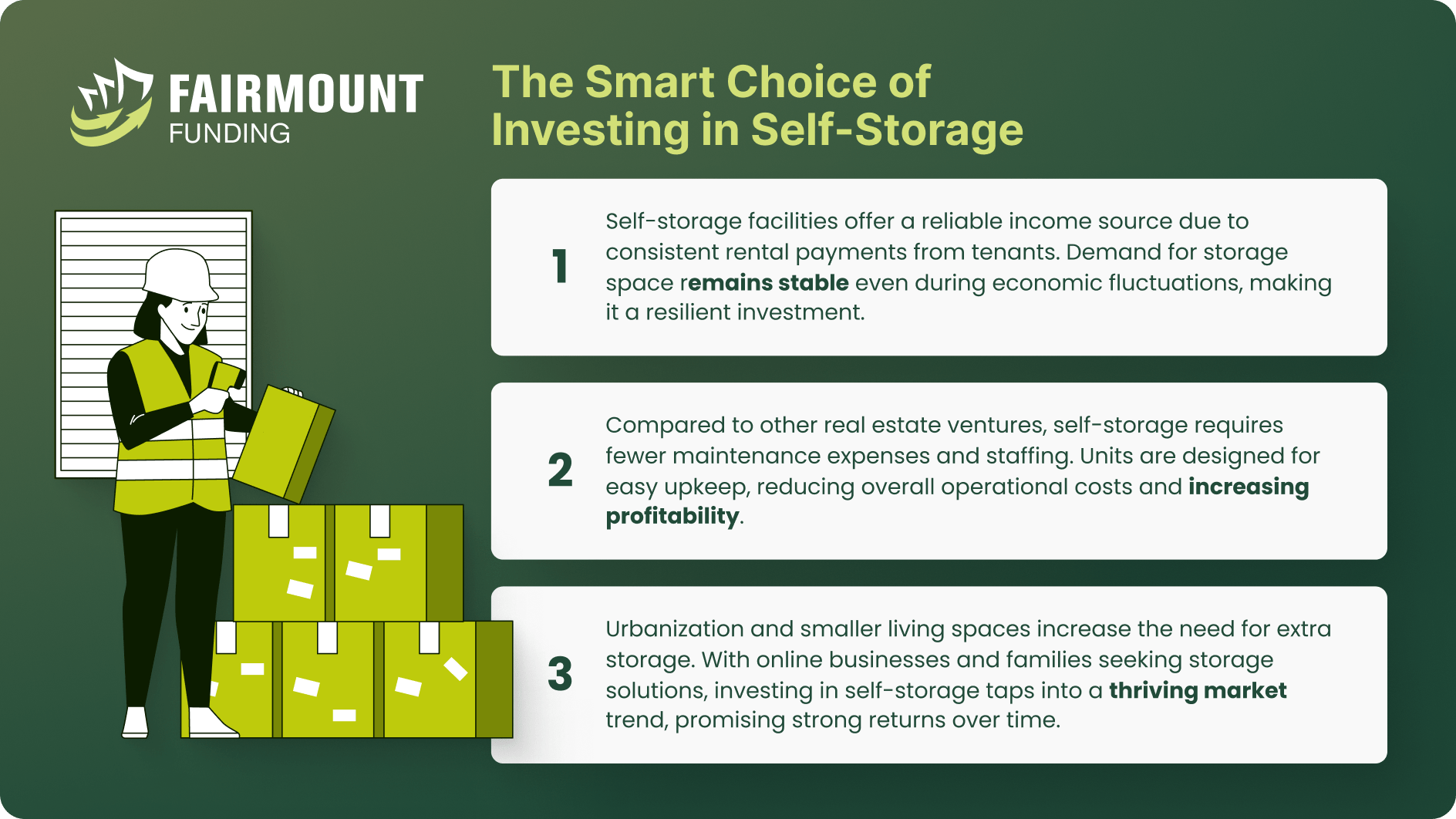

Investing in self-storage facilities for sale offers a host of advantages. The following benefits make self-storage compelling for those seeking a stable and potentially lucrative investment opportunity.

Flexible Business Model

Self-storage facilities offer a flexible business model, enabling investors to adapt to changing market conditions and tenant needs. Their varying unit size let investors cater to a diverse clientele, including individuals, small businesses, and enterprises. Additionally, the short-term nature of most leases provides the flexibility to adjust rental rates and terms to align with market trends and maximize returns.

Minimum Risk

Compared to other real estate ventures, self-storage investments carry relatively lower risk. The essential nature of storage space means that even during economic downturns, people and businesses still require storage solutions. This inherent demand minimizes the risk of prolonged vacancies or significant revenue fluctuations. Additionally, the expense of tenant turnover is generally lower than other types of real estate, as you can quickly prepare your storage facilities for new occupants.

Growing Market Demand

The self-storage market is expected to grow to $72.15 billion by 2028. One of the contributing factors is the increasing need for storage facilities due to urbanization, increased mobility, changing lifestyles, and the rise of e-commerce.

As living spaces decrease in size and business inventory expands, the need for accessible storage options remains constant. This sustained demand ensures investors a stable and reliable income stream, making self-storage facilities a recession-resistant investment choice.

Low Maintenance

Self-storage facilities often require less maintenance compared to other types of commercial properties. The design of these facilities prioritizes durability and functionality, with features like concrete floors and metal construction that require minimal upkeep. Additionally, tenants are responsible for maintaining their storage units, reducing the landlord’s maintenance obligations.

Resilient Asset

Self-storage investments have proven to be remarkably resilient during economic fluctuations. These facilities perform well in both economic booms and downturns, making them a haven for investors seeking stability. The ability to generate consistent cash flow even in uncertain times adds to the allure of self-storage facilities as a solid addition to a diversified investment portfolio.

Self-storage Investing Strategies

Investing in self-storage facilities for sale presents a practical opportunity for diversifying your portfolio and establishing a reliable stream of passive income. Nevertheless, many aspiring real estate investors must learn to invest effectively in self-storage to achieve a favorable return on investment (ROI). That is why we came up with a short list of how you can get started with self-storage investing:

- Invest in a Real Estate Investment Trust (REIT): Investing in a self-storage REIT can be an excellent option for investors seeking a more hands-off approach. REITs own, operate, or finance income-generating real estate properties, including self-storage. By investing in a self-storage REIT, you can gain exposure to the industry without the direct responsibility of managing properties. REITs offer the benefit of liquidity since they are traded on stock exchanges, letting you buy and sell shares quickly.

- Buy an Existing Self-Storage Facility: Purchasing an existing self-storage facility provides a quicker path to generating revenue. This option allows you to enter an established operation with existing tenants, rental income, and operational systems. However, you must conduct thorough due diligence to assess the facility’s location, occupancy rates, financial performance, and condition before you secure a self-storage facility loan or shell out your money to purchase it.

- Build a Self-Storage Facility: If you have the resources and are inclined to take a more proactive role in the business, building a self-storage facility from the ground up can be rewarding. This approach offers greater control over the facility’s design, features, and location. However, it requires self-storage financing, extensive planning, zoning approvals, construction management, and a more extended timeframe before generating income.

- Invest in a Self-Storage Syndicate: A self-storage syndicate involves pooling resources with other investors to collectively purchase or develop a self-storage property. This option allows you to share the financial burden, risks, and responsibilities while tapping into the expertise of others. Syndicates are particularly useful for those who want to invest in complex facilities without individually taking on the entire burden.

What should I consider before buying self-storage facilities for sale?

Before purchasing a self-storage facility, you must consider several key factors to ensure a successful investment. These include:

- Location: The self-storage facility’s location is paramount. Choose an area with high population density, limited competition, and convenient accessibility for potential tenants. Proximity to residential neighborhoods, commercial centers, and major thoroughfares can significantly impact occupancy rates.

- Market Demand: Research the local market thoroughly to gauge the demand for self-storage facilities for sale. A strong demand ensures consistent occupancy and rental income.

- Property Condition: Assess the condition of the facility. Inspect the buildings, units, security features, and overall infrastructure. Renovation costs can impact your budget, so accurately evaluate any necessary repairs or upgrades.

- Financial Performance: Review the financial records of the facility. Examine historical and projected income, expenses, occupancy rates, and cash flow. A clear understanding of the financial performance helps determine the facility’s potential profitability.

- Regulations and Zoning: Check local zoning regulations and permitting requirements. Ensure that the facility complies with all legal and regulatory standards. Zoning laws can dictate where self-storage facilities are allowed to operate.

- Management and Operations: Consider whether you will manage the facility or hire a professional management company. Effective operations are a must for tenant satisfaction and maximizing income.

- Financing: Explore your financing options and secure the necessary funds for the purchase. Working with reputable self-storage lenders is recommended because they can help you identify the type of loan that would suit your needs. They can also aid you in understanding the terms of your self-storage loans, their interest rates, and repayment schedules.

Self-storage Facilities for Sale FAQs

What makes self-storage facilities a good investment?

Self-storage facilities are considered a lucrative investment for several reasons. Firstly, they offer a steady and often recession-resistant income stream due to their consistent demand.

As urbanization and downsizing trends continue, people and businesses require additional storage space. This demand helps maintain high occupancy rates, ensuring a reliable source of rental income.

Additionally, self-storage facilities’ relatively low operational costs contribute to their profitability. It also offers the flexibility to adjust rental rates and lease terms depending on market conditions, enhancing the potential for higher returns.

Is owning a self-storage facility profitable?

Yes, owning a self-storage facility can be very profitable. Self-storage businesses often generate a consistent cash flow due to the stable demand for storage solutions. While profitability can vary depending on location, market demand, facility size, and management efficiency, successful self-storage investments can provide attractive returns. However, like any investment, conducting thorough research, due diligence, and financial planning is essential before entering the self-storage market.

What is the typical profit margin for self-storage businesses?

The profit margin in the self-storage business can vary widely based on different factors. Nonetheless, self-storage facilities often boast favorable profit margins due to their relatively low operating costs and consistent demand.

As a general guideline, self-storage facilities aim for net operating income (NOI) margins of around 40-60%. After deducting all operating expenses, the NOI should be about 40-60% of the total income generated by the facility. Effective management practices, efficient marketing, and optimizing occupancy rates will significantly allow you to achieve and maintain these margins.

The Self-storage Market is Here to Stay

The growing demand and technological innovations entail that self-storage is here to stay. Hence, it makes sense to invest in it. However, it is imperative to conduct thorough research, assess your financial capacity, evaluate the local market demand, and understand the level of involvement you are willing to commit.

Investing in self-storage facilities for sale requires careful consideration and due diligence. Each step is pivotal to a successful investment endeavor. So, whether you are a newcomer to real estate investment or a seasoned player looking to expand your foothold, storage investment offers a compelling arena to explore.

KEY TAKEAWAYS

- A self-storage facility is a commercial property that individuals and businesses can rent to store items that no longer fit their home or workplace.

- The rising need for storage makes self-storage facilities for sale a compelling property investment.

- However, investing in self-storage facilities requires careful consideration and due diligence.