It’s no secret that 90% of millionaires acquired their wealth through real estate investing. And the reason behind this is simple: Wealthy people prefer investing in real estate because it’s a safe, easy, and profitable choice. However, as property prices reach record highs, fewer individuals have the necessary funds to begin investing. Because of this, transactional funding becomes exactly what you need, especially when time is of the essence and you need fast access to cash to close a deal.

While there are many other ways to make money, real estate is always a dependable option. All you really need to do is buy a property and wait for it to increase in value. Of course, factors like where you buy and market conditions matter, but you don’t have to spend years studying complex strategies.

So, when it comes to transactional funding, all it takes is a fantastic deal, a motivated buyer, and transactional lenders in the mix.

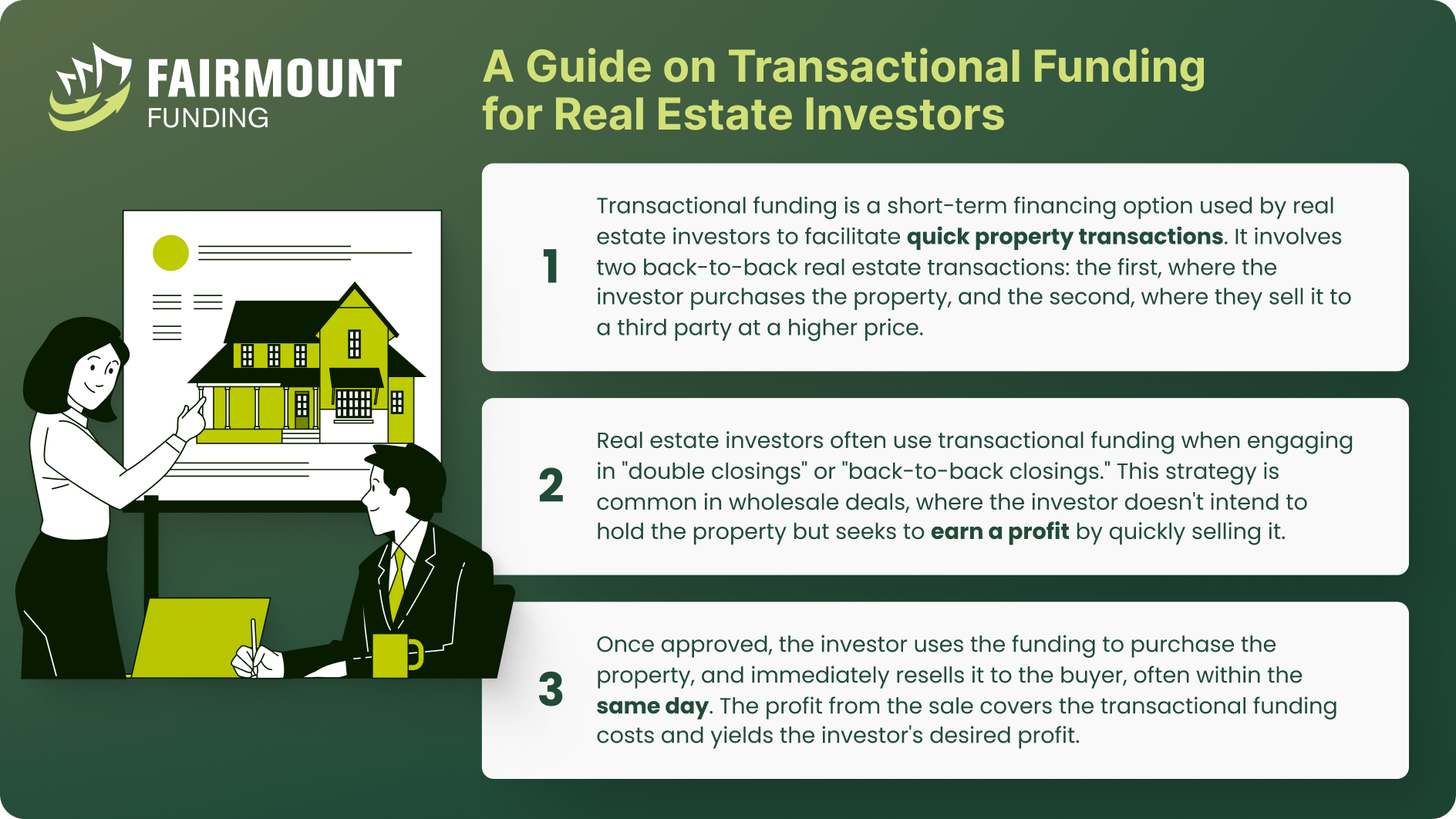

What is transactional funding?

Transactional funding, sometimes called an ABC transaction, same-day, or flash funding, is a speedy method that investors use to make money without risking their own cash. Here’s how it works: Investors borrow a short-term loan, typically from a private lender, for a brief period. They then use this borrowed money to purchase something valuable like a house or property. Their goal is to sell this asset quickly to another buyer for a profit. Once the sale is completed, they promptly repay the loan, often within just a few days.

Given their extraordinarily short-term nature, transactional funding for real estate is most suitable when a buyer intends to finalize a purchase and subsequently resell the same property (in a separate transaction) for a profit within a few days, at most.

What is extended transactional funding?

Extended transactional funding is a variation of normal transactional funding that allows investors more time to complete their real estate transactions and can be especially useful for real estate wholesalers. Unlike regular transactional funding, which typically involves very short-term loans for quick property flips, extended transactional funding provides a longer borrowing window, sometimes up to several months. This extended timeframe can be beneficial when dealing with more complex real estate deals that require additional time for renovations, marketing, or finding a buyer. Essentially, extended transactional funding offers greater flexibility and a more extended repayment period compared to the quick-turnaround nature of traditional transactional funding.

Transactional funding comes in varying time frames to accommodate different real estate investment needs.

30 day transactional funding

Often used in wholesaling deals, where investors quickly assign contracts to other buyers. This short-term funding option is ideal for fast-paced real estate transactions and requires repayment within 30 days.

90 day transactional funding

Suitable for deals that require a little extra time for tasks like renovations or marketing. This option extends the repayment window, accommodating a wider range of real estate investment strategies.

6 month transactional funding

Investors opt for this option when they need to hold properties for a longer period while maximizing their profit potential. With a repayment period spanning six months, it is primarily used for more complex real estate ventures such as extensive renovations or development projects.

Pros and Cons of Transactional Funding

Transactional funding is a valuable strategy embraced by investors for its speed and flexibility. However, it comes with inherent risks tied to taking on debt. Investors must weigh these pros and cons to determine if it suits their needs.

Advantages of Transactional Funding

- Full Property Coverage: Investors and wholesalers can secure 100% of the property’s purchase cost, minimizing their risk.

- Effortless Approval: The approval process is straightforward, often without the need for credit checks or income verification.

- Swift Access to Funds: Transactional funding offers rapid access to funds, sometimes within hours, enabling investors to seize time-sensitive real estate opportunities.

Disadvantages of Transactional Funding

- Closing Costs: Expect closing costs, which are typically deducted from your profits at both deal closings.

- Short-Term Commitment: Transactional funding typically involves short-term loans, necessitating a quick turnaround with your end buyer.

- Rapid Repayment: Payments are usually due within weeks, sometimes even within 48 hours, so be prepared for quick repayment. Additionally, the success of the deal depends on your end buyer’s financing qualification.

Using Transactional Funding for Real Estate

Transactional funding is a powerful tool in the real estate world, particularly for investors and wholesalers seeking to make quick, profitable deals without significant upfront capital. It allows them to acquire and sell properties quickly, often within a short timeframe.

Transactional Funding for Real Estate Wholesaling

Transactional funding proves invaluable in wholesale property trading. It allows investors to secure the necessary funds for purchasing a property from the seller and subsequently reselling it for a profit in a separate transaction. This approach offers greater flexibility and serves as an alternative to assigning contracts, which may not be permissible in certain locations. Due to its advantages and rapidity, transactional funding holds significant utility for real estate wholesalers.

Requirements vary per lender. But in general, you’ll need a motivated seller, proof that you represent a business entity such as an LLC, and an end buyer who is ready to close the deal immediately to be eligible for transactional funding.

Transactional Funding for House Flipping

It’s no surprise that transactional funding plays a vital role for house flippers and rehabbers. It not only enhances their flexibility but also allows them to seize more opportunities. Thanks to its swift deployment, investors can access deals they might otherwise lose to competitors. By securing and using funds faster than those relying on traditional financing, investors can make offers more promptly. In this way, house flippers can swiftly acquire wholesale properties, resell them to end buyers without significant renovations, and maximize their profits.

Finding the Best Transactional Funding Lenders

Finding the right transactional funding lenders including real estate hard money lenders are essential for real estate investors and wholesalers looking to capitalize on lucrative opportunities. These lenders provide the essential capital needed for fast property acquisitions and profitable resales. Here are some of the ways you can find transactional lenders:

Search Online

Google remains a reliable resource for this purpose. If you’re looking for transactional funding lenders in your area, simply enter ” ‘Your City Name’ + ‘Transactional Funding’ ” into the search bar on Google. This will generate a list of search results where you can easily find and contact local transactional funding lenders.

Get Referrals

Start by reaching out to your network to inquire if they are aware of any transactional funding lenders. If they are not, the next course of action is to ask if they know of any traditional, private, or hard money lenders. Once you establish contact with these lenders, you can then inquire whether they offer transactional funding services or if they can refer you to someone who does.

Attend Local REIA Meetings

REIA (Real Estate Investors Association Meetings) are gatherings within your local real estate investing community, offering valuable networking opportunities and business expansion. By participating in these meetings, you can connect with various lenders and financiers eager to provide capital for real estate ventures.

Transactional Funding FAQs

What properties are eligible for transactional funding?

You can use transactional funding on a house, which is why it’s used by wholesalers and home flippers. This could include Single-family houses, Multifamily properties, Condos, Lots and land, Bank-owned homes (REOs), Fire damaged properties, Hurricane damaged homes, MLS listings, Wholesale properties, Foreclosures, and Auction properties. It can also be used for earnest money deposit and commercial real estate properties.

What are some of the alternatives for transactional funding?

Alternative to transactional funding includes hard money loans, Private money loans, JV partners, and bank loans.

What are the tax implications of transactional funding to property wholesalers?

For real estate wholesalers, the tax considerations related to transactional funding are straightforward. If you acquire a property through a hard money lender and subsequently sell it at a profit, you’ll be subject to capital gains taxes. However, if a property purchased with a private lender goes into foreclosure without being sold or refinanced beforehand, the IRS categorizes it as an “ordinary loss,” exempting it from capital gains taxes.

Fuel Your Real Estate Success with Transactional Funding

To be a successful real estate investor and wholesaler, it’s smart to build relationships with different lenders. This way, you’re ready for various financing needs, like transactional funding. When you know transactional lenders, you have a quick way to get money when you need it.

So, if you come across deals that can’t be easily assigned, you can still close them quickly using transactional funding. In real estate, there’s always some risk, but it’s a calculated risk to make a profit. When the potential profit outweighs the risks and costs, using transactional funding is a smart decision to help your real estate business grow.

KEY TAKEAWAYS

- Transactional funding is a quick strategy that investors employ to generate income without putting their own money at risk.

- Transactional funding is the ideal solution, especially when time is critical and you require quick access to funds for closing a deal.

- With transactional funding, all you need is a great deal, a motivated buyer, and transactional lenders on your side.