If you’re a business owner or property investor exploring options to refinance an existing mortgage to take advantage of lower interest rates, you may have encountered the term yield maintenance. Just like any other investment term, it may be unfamiliar at first, but understanding what is yield maintenance is important to ensure you make the most informed decision for your business’s financial future.

To understand this term better, let’s first breakdown what yield maintenance is. Then we can go through how to calculate yield maintenance for your property, as well as how it works and some of the most common questions that investors have for it.

What is yield maintenance?

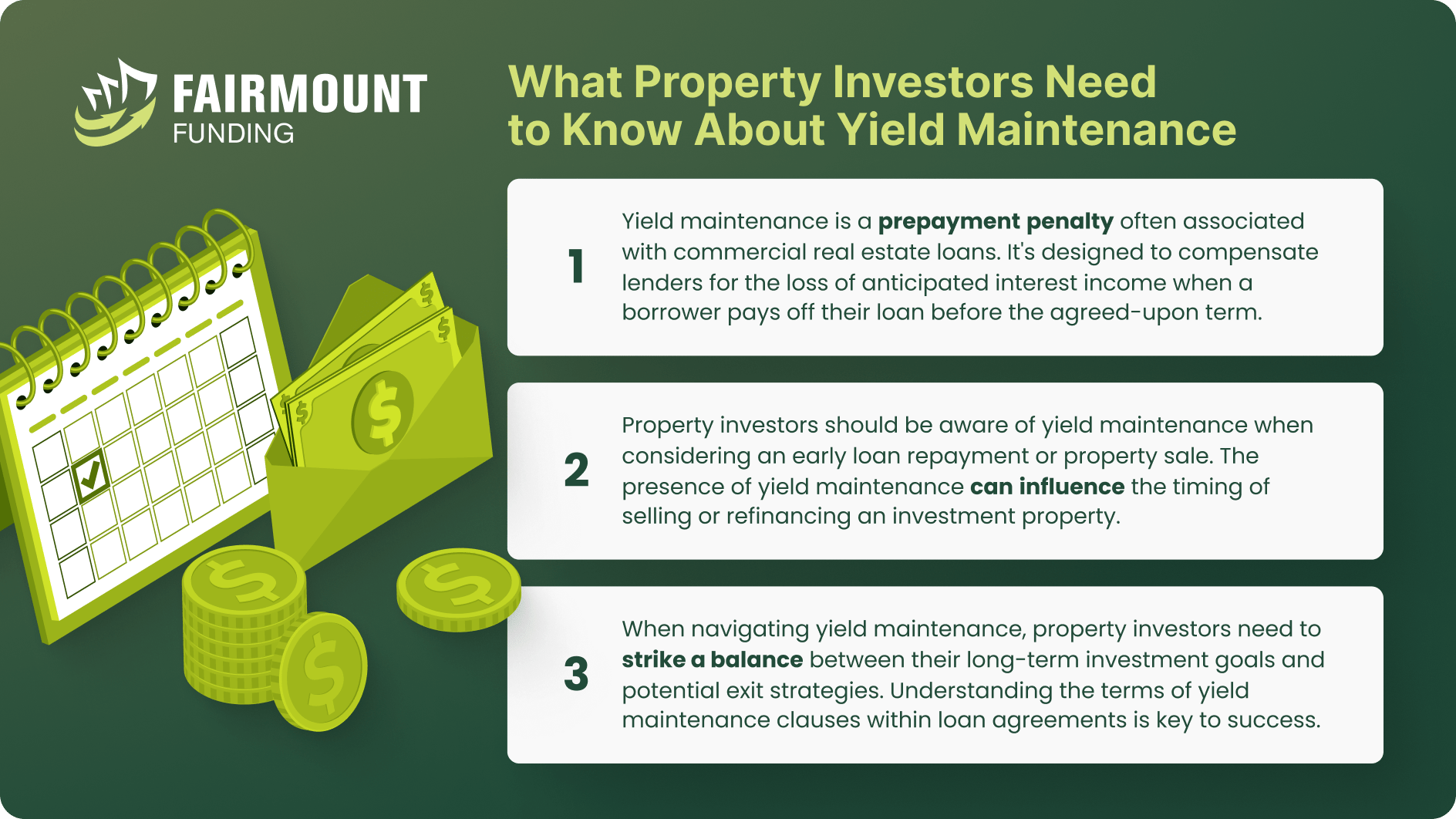

Yield maintenance is a financial provision most commonly found in commercial real estate loans. It is used to compensate lenders for the interest income they would have earned over the remaining life of the loan if the borrower decides to prepay the loan before its maturity date. This provision ensures that lenders receive a predetermined yield or return on their investment, often tied to the current market interest rates.

Property investors and real estate money lenders use yield maintenance as a metric for several purposes:

- Risk Mitigation: Lenders use yield maintenance to protect themselves against the risk of early loan prepayments. By including this provision, they can anticipate and account for potential changes in interest rates, ensuring they achieve their desired yield.

- Pricing Loans: The presence of this provision can influence the interest rate offered to borrowers. Borrowers with a lower risk of prepayment may receive more favorable rates.

- Investment Analysis: Yield maintenance is to be considered when evaluating potential investments. Understanding the implications of yield maintenance can help investors assess the cost of refinancing or selling a property before the loan’s maturity date.

- Refinancing Decisions: Borrowers analyze yield maintenance when deciding whether to refinance existing loans. They weigh the costs of yield maintenance against potential savings from lower interest rates to make informed financial decisions.

How to Calculate Yield Maintenance

To calculate Yield Maintenance, you can use a formula that considers several components. This formula helps property investors and real estate money lenders understand the financial implications of loan prepayment and whether it’s economically advantageous for both parties. Here’s a breakdown of the yield maintenance formula components and their significance:

Yield Maintenance = (PV of Remaining Payments) – (Loan Balance) / (Remaining Term) x (Yield Maintenance Rate)

- PV of Remaining Payments: This represents the present value of all remaining mortgage payments. It accounts for the interest and principal payments that the lender would have received if the loan were to continue as scheduled.

- Loan Balance:This is the outstanding balance on the loan, which the borrower wants to prepay.

- Remaining Term: This indicates the number of months or years left until the loan’s original maturity date.

- Yield Maintenance Rate: This is a predetermined rate agreed upon in the loan agreement. It’s the rate that ensures the lender receives the same yield as if the borrower made all the scheduled payments. This rate is often based on the current market interest rates at the time of prepayment.

What Yield Maintenance Tells Property Investors and Real Estate Money Lenders

Property Investors: Property investors can use the calculated Yield Maintenance amount to assess the cost of prepaying a loan and how it impacts the overall return on their investment. It helps them make informed decisions about whether it’s financially advantageous to refinance or sell a property before the loan’s maturity.

Real Estate Money Lenders: For lenders, the calculated Yield Maintenance amount serves as a tool to ensure they receive their expected yield on the investment. It also helps them determine the financial impact of loan prepayment on their portfolio. Lenders can use this information to set appropriate prepayment penalties, assess the credit risk of borrowers, and make pricing decisions on future loans.

To simplify the process, you can use our yield maintenance calculator here.

What are the benefits of using yield maintenance?

Yield maintenance benefits borrowers when anticipating rising interest rates, allowing them to repay loans at a discounted present value, especially when no minimum prepayment fee is specified. Additionally, the inclusion of a yield maintenance clause frequently suggests that the loan can be assumed, a highly attractive option for borrowers.

In commercial financing, yield maintenance clauses are common for loans exceeding $1 million, protecting lenders against revenue loss and enhancing loan marketability for securitization. This also assures predefined returns to debt securities purchasers.

For apartment loans, yield maintenance reduces capital requirements, involving a one-time penalty payment, leaving capital available for property improvements or acquisitions. It’s also straightforward- once calculations are approved by the lender, that’s it. This makes it an efficient prepayment option.

When deciding if yield maintenance is right for you, think about the interest rate trends, whether the loan can be taken over by someone else, and how it benefits both you and the lender. It’s great for borrowers when rates are going up because it lets them pay off the loan at a discount. For big commercial loans, it’s a common choice and helps lenders protect their income. Plus, it guarantees a certain return to investors who buy the bundled debt.

Limitations of Using Yield Maintenance

The most significant drawback of yield maintenance happens if this option is applied in a declining interest rate environment. For instance, if a borrower intends to refinance at a lower interest rate, the expense associated with yield maintenance may surpass the benefits of continuing with the existing loan payments. In such cases, the penalty incurred could be significantly more expensive compared to several alternative prepayment penalty options.

Other alternatives from yield maintenance includes defeasance, step-down prepayment penalties, and flat prepayment penalties. Defeasance involves replacing an existing loan with a new one and settling the existing loan using a portfolio of U.S. Treasury securities. A step-down prepayment penalty diminishes over time, whereas a flat prepayment penalty remains constant irrespective of the timing of the loan prepayment.

Yield Maintenance FAQs

How does yield maintenance differ from defeasance?

When it comes to releasing the underlying real estate asset, there are two distinct approaches between yield maintenance vs defeasance. Yield maintenance involves the direct prepayment of the loan, while defeasance entails a unique process of substituting collateral and transferring the loan obligation to a successor borrower. These methods differ both legally and economically, providing borrowers with alternative strategies to unencumbered their assets.

When is the best time to use yield maintenance?

The best time to use yield maintenance in real estate financing is when you anticipate rising interest rates. In such a scenario, yield maintenance allows borrowers to prepay their loans at a present value discount, potentially saving on interest costs. It’s also a valuable option when the loan is assumable, as it can make the property more attractive to potential buyers. However, it’s important to carefully evaluate your specific financial situation, investment goals, and the terms of your loan agreement to determine if yield maintenance aligns with your needs and plans.

How can I avoid a prepayment penalty?

There are several approaches to achieve this. First, you might secure a loan without any prepayment penalty, which is more common for loans under $1 million. Alternatively, you can have a buyer take over the mortgage when selling the property. Another option is to refrain from prepaying the loan altogether. Moreover, certain loans include clauses permitting the sale of a property after a designated period without incurring a prepayment penalty. However, it’s essential to note that the penalty might still apply if you intend to refinance the loan instead.

Yield Maintenance and What it Means to You as an Investor

Yield maintenance may initially appear daunting, but its suitability for borrowers hinges on your real estate payment strategy and future plans. If your intention is to sell the property or refinance it early in the loan term, taking a loan with a yield maintenance prepayment penalty may not be the best choice, unless the returns outweigh the early exit cost. Conversely, if you plan to hold the asset and continue with fixed debt financing until the loan’s maturity date, the yield maintenance prepayment won’t impact you.

It’s important to note that the yield maintenance period specifies when this penalty applies. For instance, if you have a 10-year loan with a yield maintenance prepayment period of 7 years, you’re exempt from potential prepayment penalties after the first 7 years of the loan. If you’re confident that you won’t prepay during those initial 7 years and anticipate selling the property at present value in years 8, 9, or 10, then the yield maintenance clause should not deter you. Although yield maintenance can entail significant costs, it doesn’t necessarily have negative implications. In certain situations, it can be advantageous to prepay a loan to seize the benefits of a lower interest rate.

KEY TAKEAWAYS

- Yield maintenance is a prepayment penalty mechanism that ensures lenders attain an equivalent yield from a loan prepayment as they would from the originally scheduled monthly payments.

- Calculating yield maintenance premiums involves employing a defined formula that factors in the present value of remaining mortgage payments, the interest rate, and the treasury yield.

- Yield maintenance serves the purpose of recompensing investors or lenders for the interest income they would otherwise have earned in the future when a borrower repays a loan ahead of schedule.