Houses that have been abandoned or not maintained properly deteriorate over time. And because of this condition, investors can typically buy the property at a discounted price. These are usually the properties that are acquired by fix and flip investors.

Time is key with this kind of investment, and getting quick loans to fund renovations is a must. The primary goal is to sell the property as quickly as possible, for as much profit as possible. This is where fix and flip loans can help secure that.

One of the benefits of fix and flip loans is to provide fast access to capital, allowing investors to act quickly when a profitable property becomes available. Keep reading to know more about the many benefits of fix and flip loans and what they can provide.

What makes house flipping a good business?

House flipping has gained widespread popularity, largely due to the proliferation of HGTV’s reality shows featuring individuals engaged in property renovations and resales. However, the term “fix and flip” may still be unfamiliar to some. So, what does it entail, and what makes it a good business?

The term “Fix and Flip” refers to a real estate investment strategy where an individual or a group of investors purchases a property, renovates (thereby “fixing” it) to increase its value and appeal, and then sells it (to “flip”) for a profit. The process typically involves buying properties that are distressed, run-down, or in need of significant repairs at a price below their market value. After acquiring the property, the investors will invest in necessary repairs and improvements to enhance its condition and attractiveness to potential buyers.

Fix and flip is a dynamic and active form of real estate investing, as it requires hands-on management of the renovation process and a keen understanding of the local real estate market. It is popular among real estate investors for several compelling reasons:

- It offers significant profits by buying distressed properties at discounted prices and reselling them at higher market values within a short time frame.

- It has a relatively short investment horizon compared to a long-term buy-and-hold strategy.

- It provides investors with the opportunity to gain valuable insights and expertise in the local real estate market.

- It can serve as a complementary strategy to diversify an investor’s real estate portfolio.

- It satisfies creative expressions as it allows investors to design and construct their vision in transforming distressed properties into desirable homes.

- It is appealing in markets with high demand for housing and limited inventory.

- It provides an opportunity to unlock the hidden potential of a property by identifying valuable renovations or improvements that other buyers might overlook.

What are the benefits of fix and flip loans?

Having sufficient funding ensures that the renovation process proceeds smoothly and according to plan. Fix and flip loans serve as the primary source of capital to acquire distressed properties, cover renovation expenses, and carry out the entire flipping process.

Here’s how fix and flip funding can help investors:

Flexible Loan Terms

Fix and flip loans offer significant advantages to new investors, primarily due to their flexibility. Unlike loans from traditional credit unions or banks, fix and flip loans from fix and flip lenders are more lenient in their regulations and processes. Applying for a loan with a credit union or bank often involves adhering to strict guidelines and lengthy approval timelines. However, fix and flip loans come with more adaptable terms and fewer attached stipulations, making them a preferable choice for investors seeking a smoother and quicker funding process.

Streamlined Approval Process

Traditional mortgage loans may involve lengthy approval procedures, which can delay an investor’s ability to act quickly on a potential flip. Another one of the benefits of fix and flip loans is that it often has a faster and more straightforward approval process. This enables investors to advance promptly with their investment plans.

Leveraged After-Repair Value

The fix-and-flip value is the total cost of acquiring the property and covering the repairs, but that’s not the main focus for investors. Instead, they mostly pursue the after-repair value (ARV), which represents the estimated market value of the property after all the repairs are finished. The difference between the ARV and the fix-and-flip value is the expected profit that investors are aiming to achieve.

With fix and flip financing, investors can secure funding based on the projected ARV of the property rather than its current value. This means that they can borrow a percentage of the property’s expected post-renovation value, allowing them to access more substantial financing and potentially take on larger and more profitable flipping projects.

Lenient Property Eligibility

There are a range of properties and projects that fix and flip loans can cover, such as properties that are non-owner occupied, attached or detached SFR, 2-4 unit properties, townhomes, and condos. Fix and flip lenders don’t diminish the likelihood of funding a loan request based on the type or condition of a property. Unlike traditional bank loans, fix and flip loans offer more lenient terms and conditions for property funding.

Profit Optimization

Profit optimization is another one of the significant benefits of a fix and flip loans. Since investors can access readily available capital, they can secure properties at a discounted price before other potential buyers can make an offer. This also gives them the ability to undertake timely and comprehensive renovations.

The accelerated renovation process, made possible by a fix and flip loan, helps investors minimize holding costs, such as mortgage payments, property taxes, and utilities. Reducing these carrying costs allows investors to sell the property more quickly, thereby avoiding prolonged market exposure and potential price fluctuations.

With this benefit of fix and flip loans, investors can increase their chances of realizing higher profits from their house flipping projects.

Zero Prepayment Fees

Traditional lenders, such as banks and credit unions, often include prepayment penalties in their loan agreements. These penalties are designed to deter borrowers from paying off the loan before the agreed-upon maturity date. This is to ensure that lenders can earn the expected interest income over the loan’s entire term.

For house flippers, they aim to complete their projects the soonest time possible and pay off the loan once the property is sold to avoid unnecessary interest expenses. The absence of prepayment penalties is another one of the benefits of fix and flip loans that makes it more appealing to real estate investors pursuing short-term projects like house flipping. The ability to pay off the loan without any financial repercussions aligns perfectly with the nature of fix and flip projects, where the goal is to complete the investment swiftly and achieve a quick return on investment.

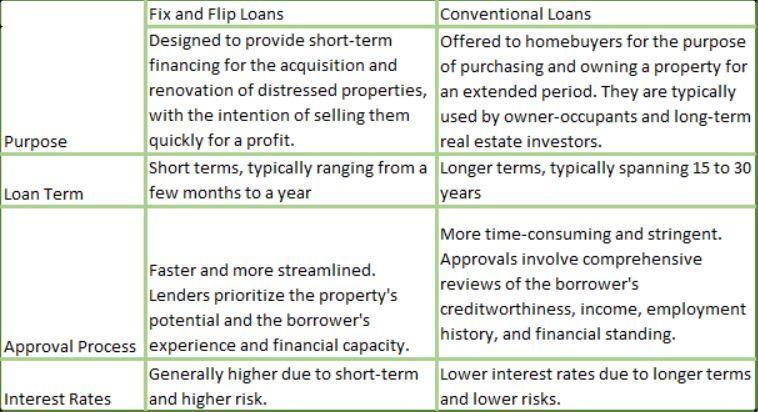

Fix and Flip Loans vs. Conventional Loans

Fix and flip loans and conventional loans are two distinct types of financing used in the real estate industry, each catering to different investment strategies and borrower needs. Here are the key differences between fix and flip loans and conventional loans.

Where to Find Fix and Flip Funding

Some of the common places to find fix and flip funding that cater specifically to real estate investors engaged in house flipping includes the following:

- Private Lenders: Also known as hard money lenders, are individuals or companies that offer short-term loans to real estate investors. They are often a popular choice for fix and flip financing due to their quick approval process and flexibility.

- Real Estate Crowdfunding Platforms: Crowdfunding systems enable various investors to pool their funds to support real estate initiatives, such as fix and flip businesses. These platforms provide access to a larger pool of investors and might offer attractive interest rates and terms.

- Real Estate Investment Groups: Often consist of experienced investors willing to finance fix and flip projects within the group. Networking with such groups can lead to potential funding opportunities.

- Online Lending Platforms: Online lending platforms that specifically cater to real estate investors let borrowers connect with lenders who specialize in fix and flip loans, streamlining the funding process.

- Private Individuals: Individual investors with a real estate interest may be willing to support fix and flip projects on occasion. These people could be friends, family members, or coworkers who see the potential in your project.

- Traditional Banks and Credit Unions: While traditional lenders do not normally offer fix and flip financing, some banks and credit unions may have specific loan packages for real estate investors that can be utilized for house flipping. These loans may come with stricter requirements and longer approval processes.

- Seller Financing: Sellers of distressed homes may be willing to provide financing to the buyer (investor) in some situations to assist the transaction. This can be a good option, especially if your other options are limited.

When looking for fix and flip funding, carefully research and compare the terms, interest rates, and requirements of each option to find the best fit for your specific project and financial needs.

Benefits of Fix and Flip Loans FAQs

What are the other costs to consider when flipping a property?

Beyond construction expenses, flipping a property can also incur additional costs including cost of holding, insurance payments and utilities, sales costs (closing costs, staging fees, and Realtor fees), contractors fee or your own sweat and equity.

What are the risks of house flipping business?

Potential financial losses due to unexpected renovation costs, market fluctuations, extended holding periods, and difficulty in finding buyers at desired prices are some of the major risks associated with a fix and flip business.

Are fix and flip loans a good option for beginner real estate investors?

Fix and flip loans can be a viable option for beginner real estate investors, but they come with certain considerations. It’s advisable to thoroughly research the local real estate market, understand renovation costs, and have a solid plan in place before considering fix and flip loans. Proper due diligence, knowledge, and support from experienced professionals can increase the chances of success for beginner real estate investors using fix and flip loans.

Fuel Your Flipping Success with Fix and Flip Loans!

If you want to start house flipping but lack sufficient funds, fix and flip loans can serve as a valuable resource to make it happen. They provide an accessible financing option, even if you don’t have substantial savings or a strong financial background.

There are several benefits to fix and flip loans that you can benefit from as we’ve discussed in here. However, it’s important to note that while fix and flip loans can be an excellent option for initiating your house flipping journey, they come with risks.

Before diving into the world of fix and flip loans, it’s essential to conduct thorough research, educate yourself about the market dynamics, and create a solid business plan. With this, you can increase your chances of a successful and profitable house flipping venture.

KEY TAKEAWAYS

- Fix and flip loans serve as a means of short-term financing for acquiring and renovating distressed properties, with the ultimate goal of promptly selling them for a profit.

- Fix and flip requires hands-on management during the renovation process and a profound grasp of the local real estate market.

- Fix and flip loans present attractive benefits, yet it is essential to be mindful of the associated risks.