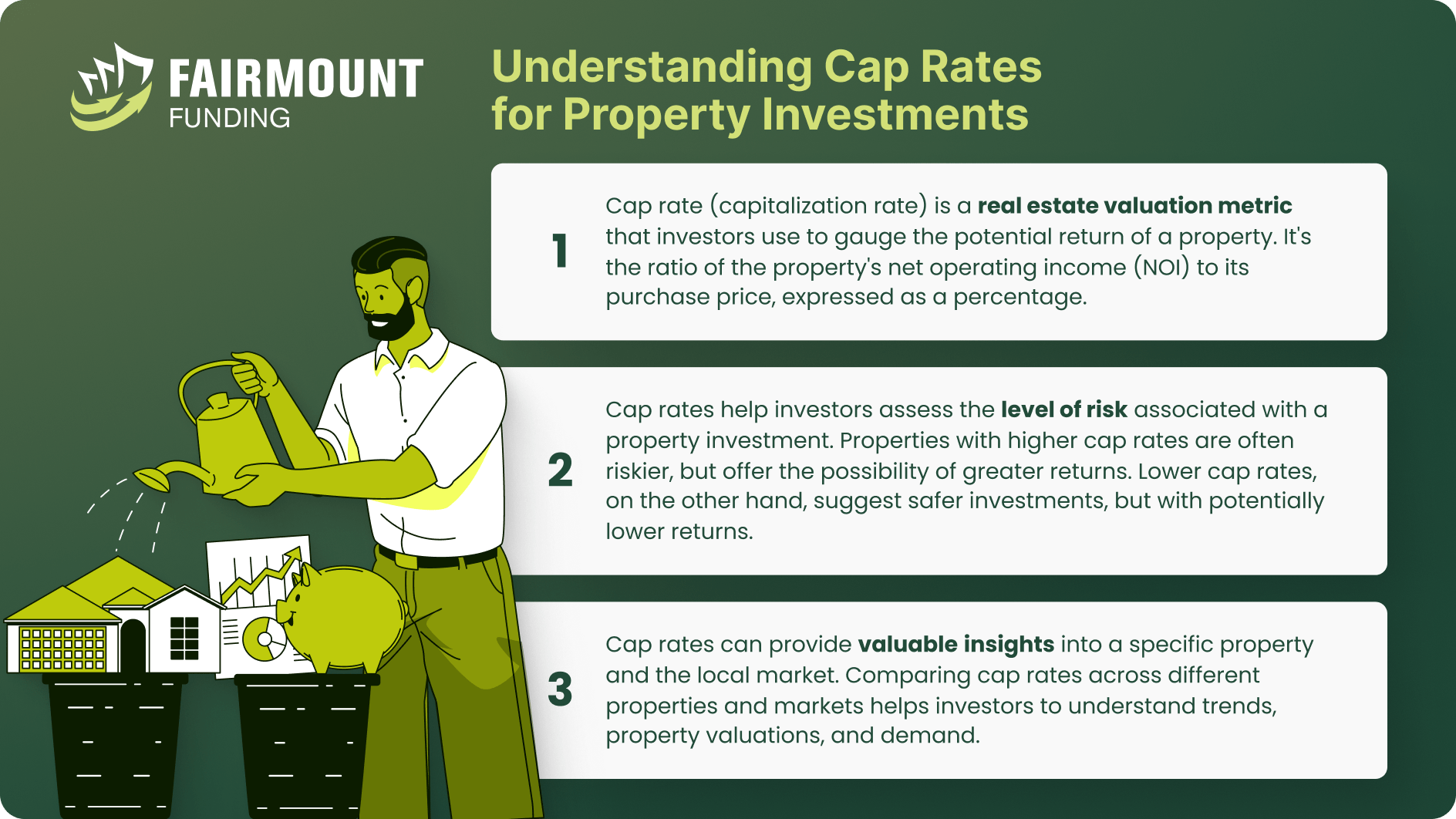

In the real estate industry, choices can make or break fortunes. With a lot of options, each with its own price and potential rental earnings, investors face the challenge of figuring out which property will give the best return for their money. This is where cap rate steps in.

Cap rate helps investors figure out how much money they can make from a property compared to how much they’re investing, no matter how expensive or cheap the property is. With this, investors can make smarter choices and properties that fit their investment strategy like a glove. Let’s dive into how exactly the cap rate works and how it’s a game-changer for real estate investors.

How can capitalization rate help property investors?

“Cap rate” stands for capitalization rate, and it’s a common metric used in real estate investment to evaluate the potential return on an investment property. Cap rate helps investors compare the potential return of different investment properties regardless of their purchase price. A higher cap rate generally implies a potentially higher return on investment, but it’s essential to consider other factors like location, market trends, property condition, and potential for appreciation.

It’s worth noting that cap rates are used primarily for quick initial assessments and comparisons. They do not take into account factors like financing costs, potential changes in property value, or individual investor preferences and strategies. As a result, cap rate should be used in conjunction with other financial analyses when making investment decisions.

Computing a Property Investment’s Cap Rate

The cap rate is expressed as a percentage and is calculated by dividing the property’s Net Operating Income (NOI) by its current market value or purchase price.

Mathematically, the cap rate formula real estate is:

Cap Rate = (Net Operating Income / Property Value) * 100

Here’s a breakdown of the components:

- Net Operating Income (NOI): This is the income generated by the property after subtracting all operating expenses (such as property taxes, insurance, maintenance costs, property management fees, etc.) from the total income generated by the property (rental income, leasing fees, etc.).

- Property Value: This is the market value of the property, often referred to as the purchase price or the appraised value.

- Expressed as Percentage: The last stage involves transforming the outcome of your division into a percentage by multiplying the outcome by 100.

Click here for our Cap Rate Calculator for real estate investors.

Interpreting a cap rate in terms of recovering the investment involves understanding how the cap rate relates to potential returns and the timeframe for recouping your initial investment. A lower or higher cap rate can indicate different scenarios for recovering your investment:

- Lower Cap Rate (Higher Price, Lower Return): A property with a lower cap rate typically has a higher purchase price relative to its net operating income (NOI). This could mean that the property is considered more desirable or has lower risk factors. However, a lower cap rate also implies a slower rate of return on your investment. It might take a longer time to recoup your initial investment through the property’s rental income.

- Higher Cap Rate (Lower Price, Potentially Higher Return): A property with a higher cap rate usually has a lower purchase price in relation to its NOI. This might indicate a riskier or less attractive property. However, a higher cap rate suggests a potentially faster rate of return on your investment. You could recoup your initial investment more quickly through the property’s rental income.

In essence, cap rate is used to quickly evaluate and compare investment opportunities based on current property values and incomes. For financial analyses to estimate the future value of an investment property at the end of a specified holding period, investors use the terminal cap rate. This incorporates assumptions about income growth and market conditions.

What are the market factors that affect cap rate in real estate?

Numerous elements can exert influence on the cap rate. Below are some of the factors that can affect cap rates:

- Location: The property’s location plays a significant role in determining its cap rate. Properties in desirable, high-demand areas often command lower cap rates due to their potential for stable and appreciating rental income. On the other hand, properties in less sought-after locations might have higher cap rates to attract investors despite potential risks.

- Real Estate Market Size: In larger markets with a higher population and greater economic activity, cap rates tend to be lower as investors are willing to accept lower returns for more stable investments. In contrast, in smaller markets, the demand might be more limited, which could lead to higher cap rates as investors seek higher returns to compensate for the perceived risk of potentially fluctuating returns.

- Asset Stability and Risk Perception: Investors often associate stable property values with lower investment risk. When a property’s value is expected to remain stable or increase, investors might be willing to accept lower returns on their investment, leading to lower cap rates. This is because they perceive the investment as having less risk of significant loss in value.

- Capital Liquidity and Initial Investment: The amount of capital an investor injects into a property represents their initial financial commitment. If an investor invests more capital upfront to improve the property, increase rental rates, or decrease operating expenses, the NOI might rise. As a result, the cap rate could be lower, indicating a potentially lower return on investment but a more stable and improved property.

- Property Type: Cap rate real estate differs among different types of assets. Multifamily and industrial structures typically exhibit the lowest cap rates. Moreover, economic indicators hold varying significance depending on the asset class. For instance, personal income significantly affects multifamily and retail properties, whereas durable and nondurable goods spending takes on particular importance for industrial properties.

While the cap rate is a valuable metric for assessing the potential return on a real estate investment, it’s important to acknowledge its limitations. One significant limitation lies in its simplicity. Cap rates provide a quick snapshot of an investment’s income potential, but they don’t account for several other factors that can impact the investment’s overall performance. For instance, cap rates do not consider the effects of financing, mortgage interest rates, or the time value of money. This means that two properties with the same cap rate might have vastly different financing arrangements, resulting in divergent net cash flows for investors.

Another limitation is that it does not incorporate potential changes in property value over time. They assume a static property value, which might not hold true in a dynamic real estate market. Properties with higher appreciation potential might initially appear less attractive based solely on their cap rates, leading to missed opportunities. So, while cap rates offer a starting point for evaluating investments, they should be used in conjunction with more comprehensive financial analyses.

Multifamily Cap Rates In 2023

According to CBRE, the opening quarter of 2023 brought about notable shifts in the real estate landscape. The multifamily sector, in particular, witnessed significant changes in multifamily cap rates. The average initial cap rate for multifamily properties experienced a 23 basis point uptick, reaching a level of 4.72%. This comes on the heels of a sequence of consecutive quarterly increases—39, 36, and 38 basis points—marking a departure from this trend. Notably, this change coincides with the Federal Reserve’s initiation of a new round of interest rate hikes. Looking ahead to the second quarter of 2023, the average prime initial cap rate for multifamily properties saw a modest increase of just 1 basis point, settling at 4.73%. Simultaneously, exit cap rates saw a reduction of 5 basis points. Interestingly, the analysis also noted that underwriting expectations for annual rent growth over the upcoming three years remained steady at 2.9% during the second quarter.

Impact Of Loan Interest Rates On Your Cap Rate

The interplay between cap rates and interest rates is a significant aspect of real estate investing. Generally, when interest rates rise, borrowing costs increase, potentially reducing demand for real estate and leading to higher cap rates. Conversely, lower interest rates can lead to lower financing costs, potentially resulting in lower cap rates. However, it’s important to note that the relationship between interest rates and cap rates is not always linear or immediate. The impact of interest rates on cap rates is a complex interplay that underscores the interconnectedness of financial markets and real estate investments. Investors must consider these complexities when assessing the impact of interest rates on cap rates and making strategic investment decisions.

Cap Rates FAQs

Is cap rate the same as return on investment?

While return on investment and cap rate are related, these two metrics are not the same and serve different purposes in investment analysis. Return on investment provides insight into the potential earnings an investment might yield within a defined timeframe. On the other hand, the capitalization rate offers a current or expected representation of the actual return on an investment.

What is a good cap rate?

A “good” cap rate varies based on factors like location, property type, and investor goals. Generally, cap rates around 4% to 10% are common, with lower rates in stable, desirable areas and higher rates in riskier or less sought-after locations. You’ll want to consider market conditions and individual investment strategies when determining a suitable cap rate.

When is the best time to use cap rate?

The cap rate is best used during initial property evaluations to quickly compare investment opportunities. It helps investors assess potential returns and risks without delving into complex financial details. However, it should be supplemented with more comprehensive analyses for making well-informed investment decisions.

Cap Rate Illuminates Profitability In Real Estate Investment

While cap rate doesn’t include all of the factors for a comprehensive financial analysis, it remains an indispensable initial tool that offers valuable insights. It might be simple, but it is like a fast lane to understanding how much money a property could make. Beyond its mere mathematical essence, the cap rate holds the key to unlocking a deeper understanding of the profitability embedded within a property. As a savvy investor, you know that comparing properties is more than a numbers game—it’s about seizing opportunities that align with your financial goals.

KEY TAKEAWAYS

- Cap rate is used to evaluate the potential return on an investment property.

- The cap rate is determined by dividing the net operating income of a property by its present market value.

- While cap rates provide an initial foundation for investment evaluation, they should be combined with in-depth financial analyses for a more thorough decision-making process.